Featured

- Get link

- X

- Other Apps

Carbon Credit Investment Funds

Anzeige In Wachstumsunternehmen direkte Investments tätigen. The fund is structured as a Portfolio Investment Entity which offers exposure to the price of carbon credits which are bought from the Emissions Trading Scheme in New Zealand.

Innovation Fund Climate Action

Innovation Fund Climate Action

Salt Investment Funds Limited is the issuer of the Carbon Fund.

Carbon credit investment funds. Personal carbon credit trading may not have reached the big time yet but business carbon credit trading is big business. We invest in companies that are developing blockchain technology to enable a more efficient and transparent global market for carbon credits. Our fund invests in companies that use blockchain or distributed ledger technology DLT to verify carbon offsets sequestered carbon or energy generated by renewable resources.

The Global Carbon Fund. Purchase a Trial subscription for 1 for 4 weeks You will be billed 68 per month after the trial ends. The Carbon Fund is New Zealands first NZX-listed investment fund designed to trade in carbon credits.

The Smart Money Is Investing In Carbon Credits. The World Banks carbon finance initiatives have supported activities in 65 countries and have made 2 billion in Emission Reduction payments since the first carbon fund Prototype Carbon Fund was launched in 1999. However CERs are sold by special carbon funds established by large financial institutions.

Carbon pricing can be combined with offset credits. Such schemes have been adopted by. Using a value-driven model to set a price for carbon credits can truly account for the full environmental social and economic impacts of a specific projectthat is both in emissions reductions plus.

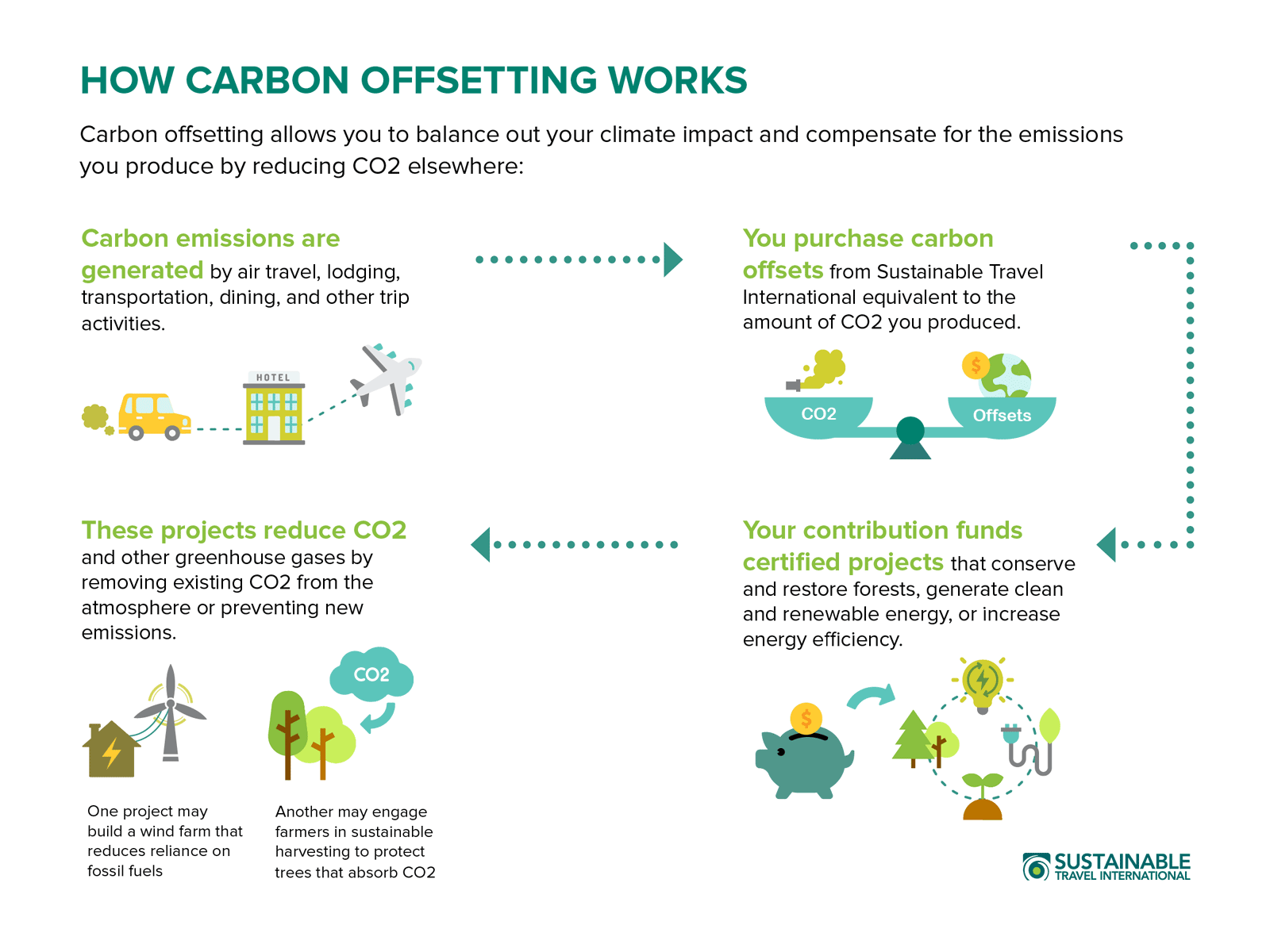

A carbon credit is a permit that allows the company that holds it to emit a certain amount of carbon dioxide or other greenhouse gases. Through projects developed by the Paradigm Project organizations are able to invest in carbon credits generated by verified emission reductions from rural households reduced burning of. The idea is to pay for emission reductions elsewhere rather than invest in the country of operation.

What Is a Carbon Credit. One way for investors to play the trend is the new KFA Global Carbon exchange-traded fund KRBN which began trading in July. The largest Carbon Credits ETF is the KraneShares Global Carbon ETF KRBN with 27068M in assets.

For media inquiries please contact. For example 118 billion carbon credit contracts were traded in. One credit permits the emission of a.

The Clean Development Mechanism CDM allows industrialised countries with GHG reduction commitments to invest in emission-reducing projects in developing countries as an alternative to more costly emission reductions in their own countries. A revolution is underway in the world of carbon credits. While all Gold Standard-certified projects play a critical role in our transition to a low-carbon economy our projects also go far beyond carbon mitigation.

Cancel anytime during your trial. In the last trailing year the best-performing Carbon Credits ETF. A PDS for the Carbon Fund was lodged with the Financial.

Pricing based on value delivered. The Fund broadly tracks the price of Carbon Credits and the value of your investment will follow the current Carbon Price. Opinions expressed by Forbes Contributors are their own.

But financial products cannot match the power. The Fund utilises the investment expertise of highly experienced managers who have a multi-decade perspective on investment opportunities and investment risk. Although carbon credits are beneficial to society it is not easy for an average investor to start using them as investment vehicles.

As a result the Fund may also provide exposure to the price of carbon offshore. Then 68 per month. The Carbon Funds investment objective is to provide investors with a total return exposure to movements in the price of carbon credits.

Anzeige In Wachstumsunternehmen direkte Investments tätigen. One carbon credit is an allowance to emit one metric tonne of CO2 and is called a CO2e or CO2 equivalent. The Fund has the ability to buy carbon credits in emissions trading schemes in New Zealand and offshore.

The ETF could integrate other carbon credit markets over time its backers say pointing to South Korea New Zealand and China as potential additions. The certified emissions reductions CERs are the only product that can be used as investments in the credits. A European steel producer might already have the most efficient technology available and choose to invest in.

It offers investors the ability to invest in New Zealands lower carbon future.

Carbon Trading The One Way Bet For Hedge Funds Financial Times

Carbon Trading The One Way Bet For Hedge Funds Financial Times

Investment Funds With Carbon Emissions Offset Umi

Investment Funds With Carbon Emissions Offset Umi

Carbon Pricing What Is A Carbon Credit Worth The Gold Standard

Carbon Pricing What Is A Carbon Credit Worth The Gold Standard

Https Www Mdpi Com 2071 1050 12 10 4021 Pdf

Carbon Credit Definition Types And How Does It Works Textile Learner

Carbon Credit Definition Types And How Does It Works Textile Learner

Financing Ji Projects Janwillem Van De Ven Head

Carbon Trading The One Way Bet For Hedge Funds Financial Times

Carbon Trading The One Way Bet For Hedge Funds Financial Times

Carbon Credit Investment Fund To Bet Against Rising Fuel And Power Prices Rnz News

Carbon Credit Investment Fund To Bet Against Rising Fuel And Power Prices Rnz News

Carbon Offsets What Are They How Do They Work Nativeenergy

Carbon Offsets What Are They How Do They Work Nativeenergy

What Are Carbon Offsets And How Do They Work Sustainable Travel International

What Are Carbon Offsets And How Do They Work Sustainable Travel International

Fundamentals Of Carbon Credit Markets Opportunities Barriers And Enablers Pinebridge Investments

Fundamentals Of Carbon Credit Markets Opportunities Barriers And Enablers Pinebridge Investments

Carbon Credits Buy Carbon Credits Or Offset You Carbon Footprint South Pole

Carbon Credits Buy Carbon Credits Or Offset You Carbon Footprint South Pole

Comments

Post a Comment