Featured

Treasury Yields Bloomberg

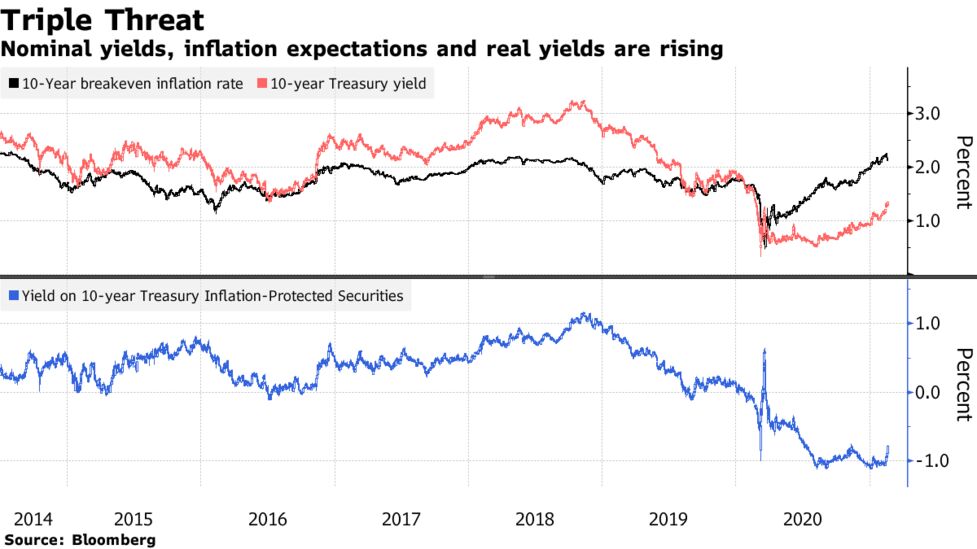

Early Thursday Bloomberg conveyed a warning from the Asian Development Bank ADB amid the rising US Treasury yields. Bloomberg Opinion -- The 10-year US.

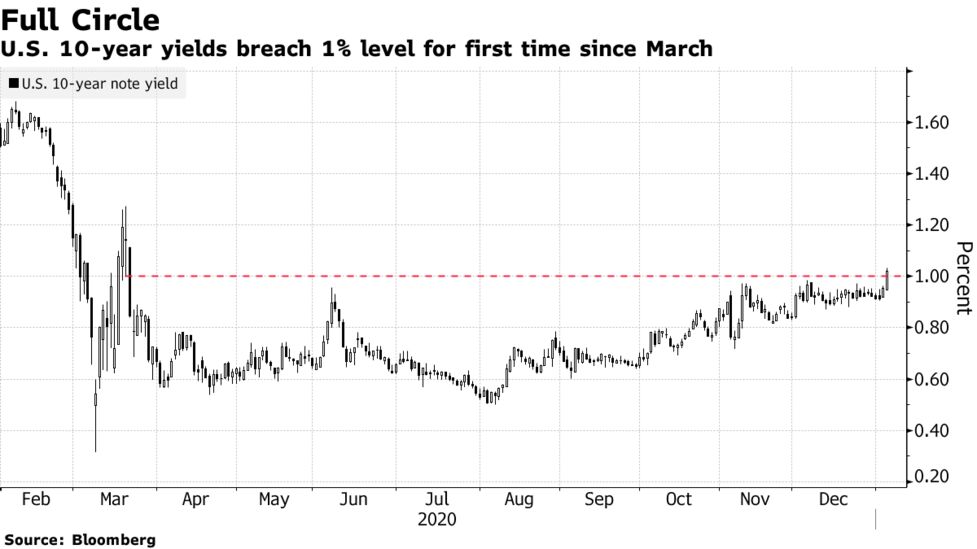

Treasuries Breaching 1 On Democratic Win May Just Be The Start Bloomberg

Treasuries Breaching 1 On Democratic Win May Just Be The Start Bloomberg

Bloomberg Security fencing outside the US.

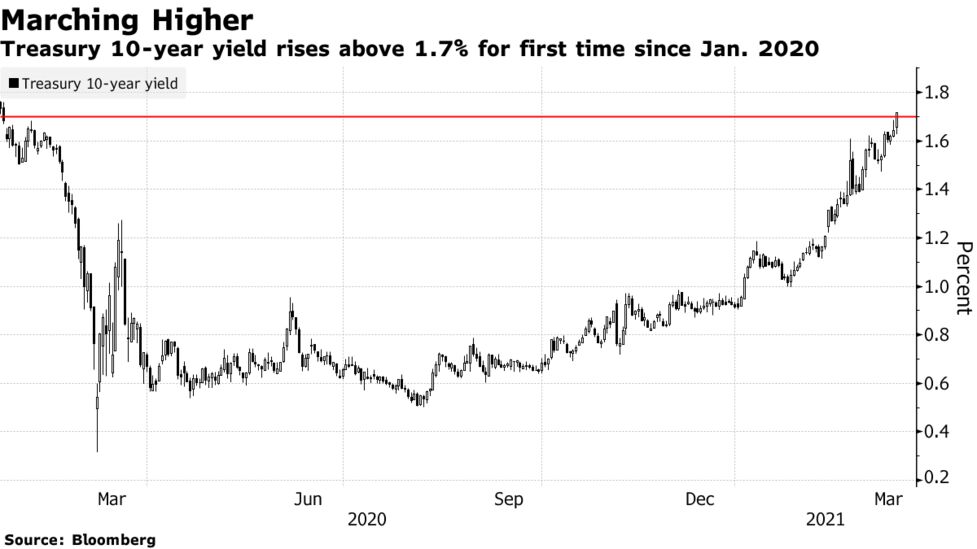

Treasury yields bloomberg. Government must pay to service its growing debt. The US 10-year Treasury yields poke February 2020 peak currently around. Gold Extends Drop as Surge in Treasury Yields Weighs on Demand Bloomberg -- Gold fell a second day as bond yields surged with some investors shrugging off the Federal Reserves dovish message.

Stocks and how much the US. The current 10 year treasury yield as of May 11 2021 is 164. At times financial market conditions in conjunction with extraordinary low levels of interest rates may result in negative yields for some Treasury securities trading in the secondary market.

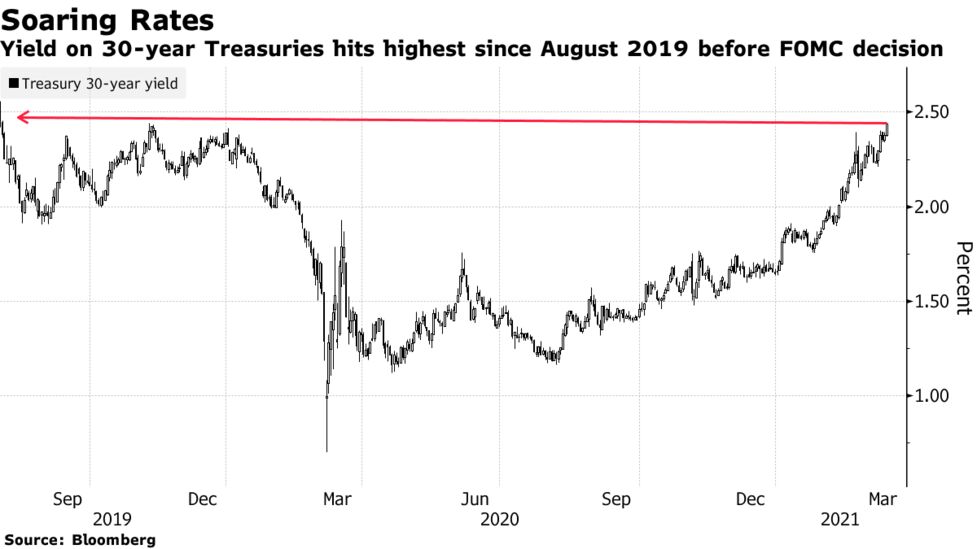

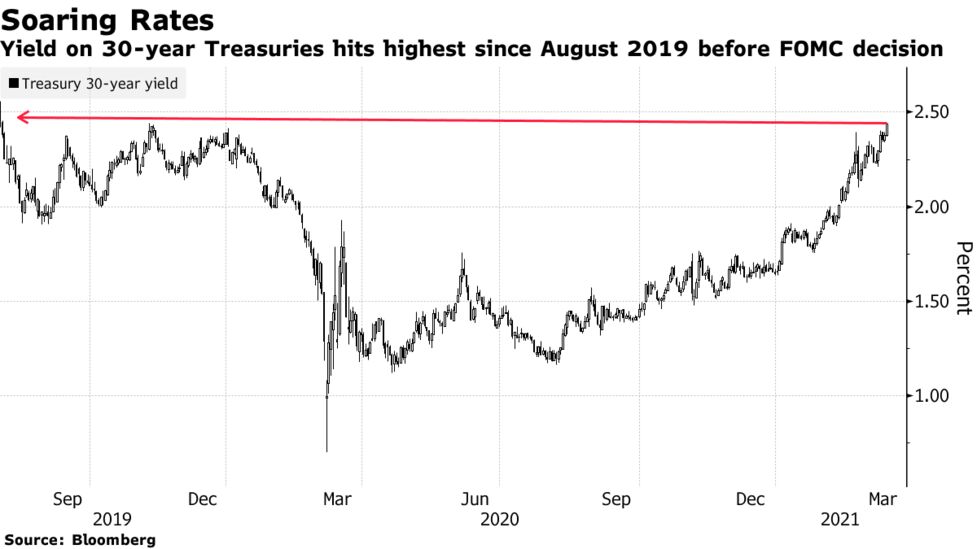

Treasury note is part of the foundation of global finance. Yields took off with startling speed on Thursday with the rate on 10-year Treasuries at one point reaching 161 per cent the highest in a year. Thats still very low by historical standards but it was high.

Stocks Slide for Second Day. The yield on two-year Treasuries fell one basis point to 015 per cent. January 11 2021 330 AM January 11 2021 325 PM.

Its yield helps determine the cost of mortgages the value of US. 10 Year Treasury Rate - 54 Year Historical Chart. The news begins with The Asian Development Bank warned that rising US.

Treasury Yields yesterday rose to the highest since February 2020 as. Rising Treasury Yields Flash a Warning Sign. Stocks lower as the pullback centered in the technology sector.

Securities in Bloomberg function GY. Jan 11 2021 330 AM Jan 11 2021 325 PM. The yield on 30-year Treasuries fell one basis point to 244 per cent.

Price Change -01328. The yield on 10-year Treasuries climbed two basis points to 173 per cent the highest in about 14 months. Enter GT10 GY in command line and Bloomberg will show you the yield graph of 10-year US Treasury bond.

Yield Day Low 1586. Price Prev Close 957031. Treasury note is part of the foundation of global finance.

The Days of Low Treasury Yields Are Numbered - Flipboard. In this lab you should focus on the yields of bonds in June 2013 June 2014 and the current month. Negative Yields and Nominal Constant Maturity Treasury Series Rates CMTs.

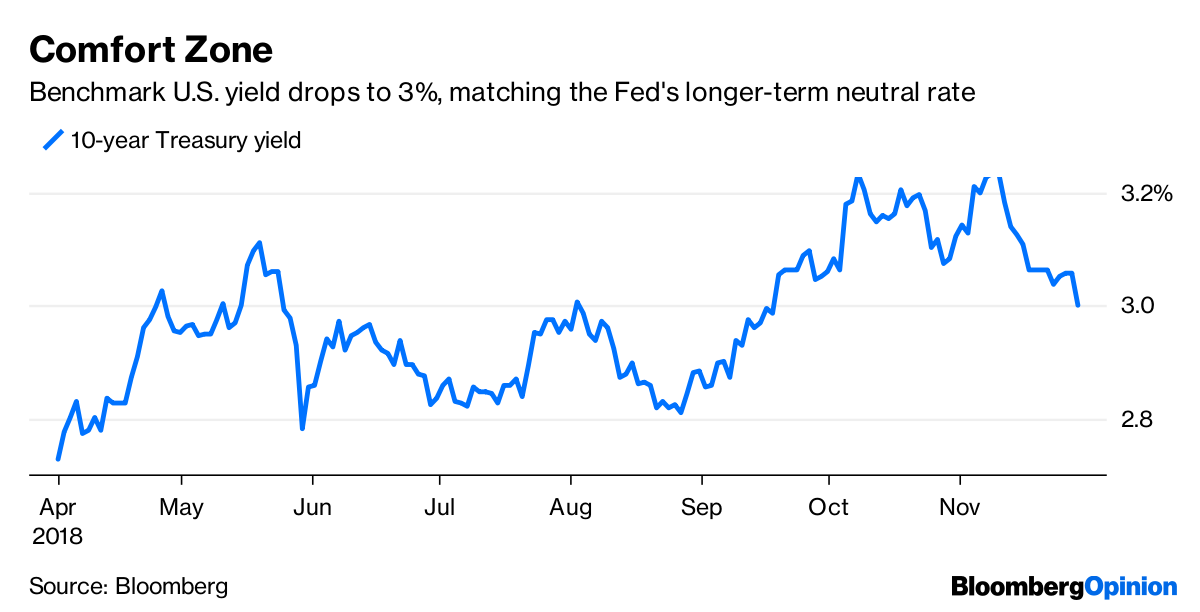

The default setting in GY may not show you a time window that covers the three periods. Markets Wrap Bloomberg -- Energy financial and industrials shares led US. Bloomberg - The benchmark 10-year rate is likely to more than double in coming years.

The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity and should be monitored closely as an indicator of the government debt situation. Government bond yields have registered some notable moves in the first few days of 2021. Yields on the benchmark 10-year note.

The 10 year treasury is the benchmark used to decide mortgage rates across the US. Yield Day High 1622. And is the most liquid and widely traded bond in the world.

Daily Treasury Bill Rates Data. See our Treasury Yield Curve Methodology page for details. Bloomberg came out with an analytical piece on early Tuesday in Asia describing further upside for the Treasury yields.

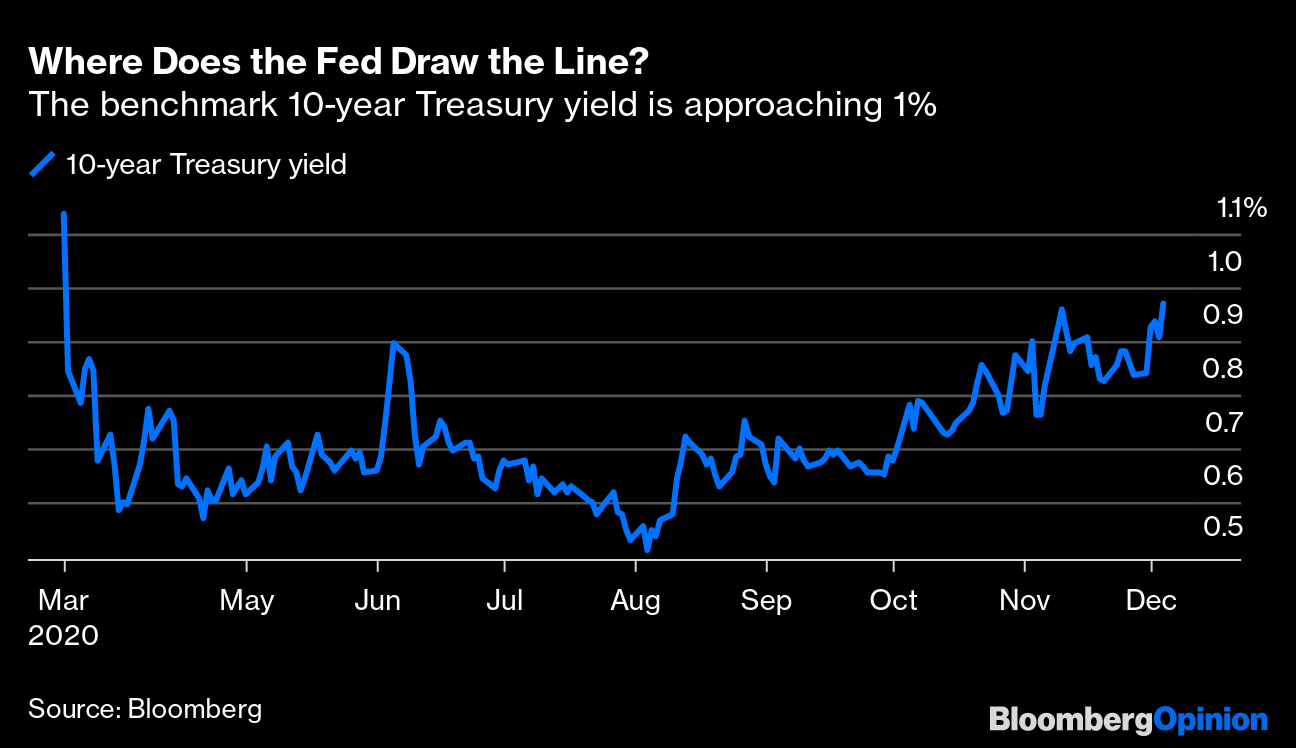

Should they continue on their current pace they risk causing. In a telltale warning sign for some strategists the 5-year Treasury yield soared convincingly above 075 per cent a crucial level that was expected to exacerbate selling as traders pulled forward bets on when the Federal. Bloomberg -- Treasury yields breached key levels as traders boosted bets the Federal Reserve will allow inflation to overshoot amid an economic rebound.

Treasury building in Washington DC US on Wednesday Feb. Interactive chart showing the daily 10 year treasury yield back to 1962. Yield Prev Close 1602.

The yield on the benchmark 10-year Treasury climbed this month to as high as 162 up from less than 1 at the start of the year. Bloomberg Opinion -- US. Negative yields for Treasury securities most often reflect highly technical factors in Treasury.

Why 3 Is A Magic Number For 10 Year Treasury Yields Bloomberg

Why 3 Is A Magic Number For 10 Year Treasury Yields Bloomberg

Treasury Yields Hit Pre Pandemic Levels Ahead Of Fed Decision Bloomberg

Treasury Yields Hit Pre Pandemic Levels Ahead Of Fed Decision Bloomberg

Treasury Yields Breach More Key Levels As Inflation Bets Surge Bloomberg

Treasury Yields Breach More Key Levels As Inflation Bets Surge Bloomberg

Treasury Yields Falter At 2 Hurdle As Sell Off Runs Out Of Road Bloomberg

Treasury Yields Falter At 2 Hurdle As Sell Off Runs Out Of Road Bloomberg

Yield Curve Inverts For First Time In More Than A Decade Bloomberg

Yield Curve Inverts For First Time In More Than A Decade Bloomberg

Treasury Curve Steepens To February 2016 Levels Before Sales Bloomberg

Treasury Curve Steepens To February 2016 Levels Before Sales Bloomberg

Treasury Yields Face Curbs From Fistful Of Money Market Dollars Bloomberg

Treasury Yields Face Curbs From Fistful Of Money Market Dollars Bloomberg

Term Premium Climbs Toward Zero As Treasury Yield Surges Chart Bloomberg

Term Premium Climbs Toward Zero As Treasury Yield Surges Chart Bloomberg

Will 1 10 Year Treasury Yield Force The Fed Into Curve Control Bloomberg

Will 1 10 Year Treasury Yield Force The Fed Into Curve Control Bloomberg

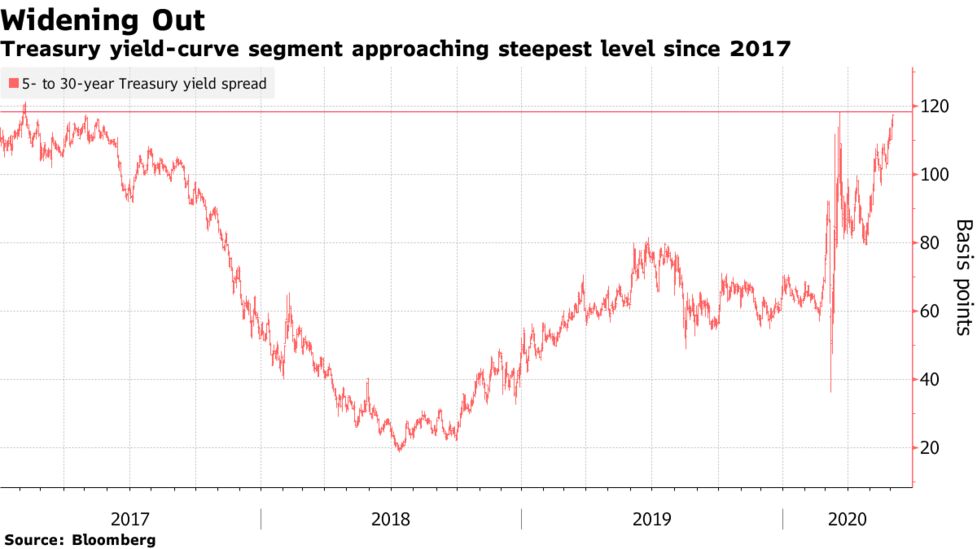

Treasury Curve Near Steepest Since 2017 As 30 Year Yields Climb Bloomberg

Treasury Curve Near Steepest Since 2017 As 30 Year Yields Climb Bloomberg

Wall Street Targets 1 Treasury Yields Or Well Below On Virus Bloomberg

Wall Street Targets 1 Treasury Yields Or Well Below On Virus Bloomberg

Bond Market Turns Attention To Risk Of U S Yields Cracking 2 Bloomberg

Bond Market Turns Attention To Risk Of U S Yields Cracking 2 Bloomberg

The Runway Toward Higher Treasury Yields Looks Free And Clear Bloomberg

The Runway Toward Higher Treasury Yields Looks Free And Clear Bloomberg

Comments

Post a Comment