Featured

Federal Gas Tax Increase 2021

Sin taxes increase will come soon and 100 increase in gas in the last 45 days and you can bet gas will go above 400 very soon And with little Alfred E Newman bootinthebutt in charge of the Communist Chao Transportation position hold on tight. Gas taxes both those imposed federally or at the state level are regressive.

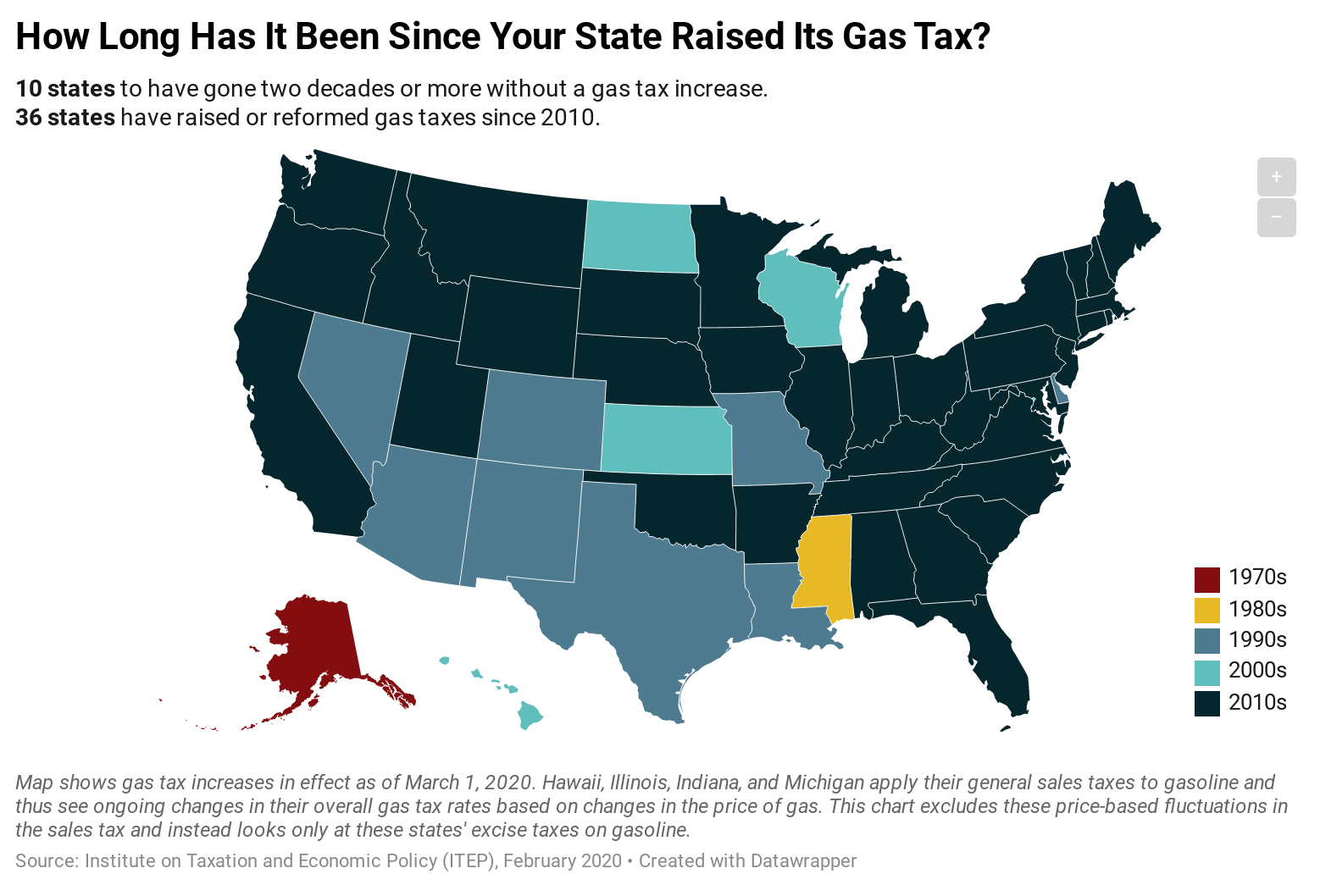

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

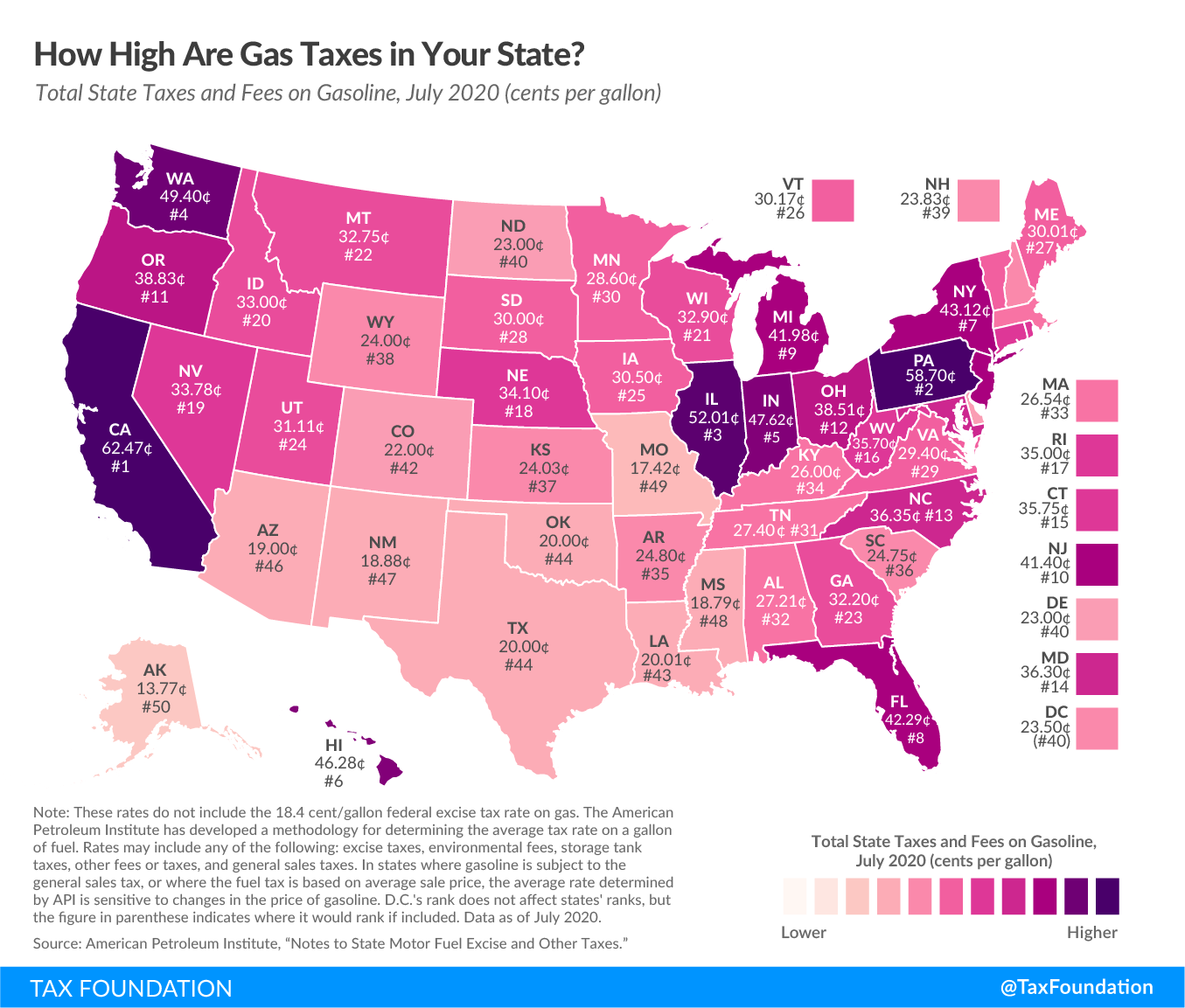

In addition to the federal tax each state adds its own tax to every gallon of gas sold in the state.

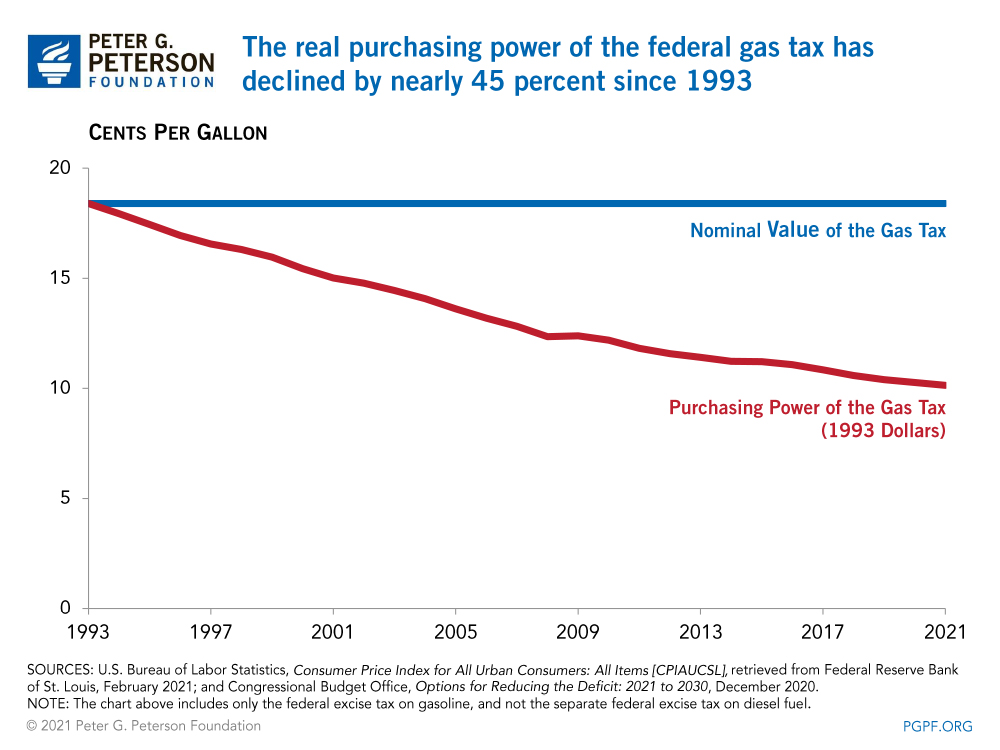

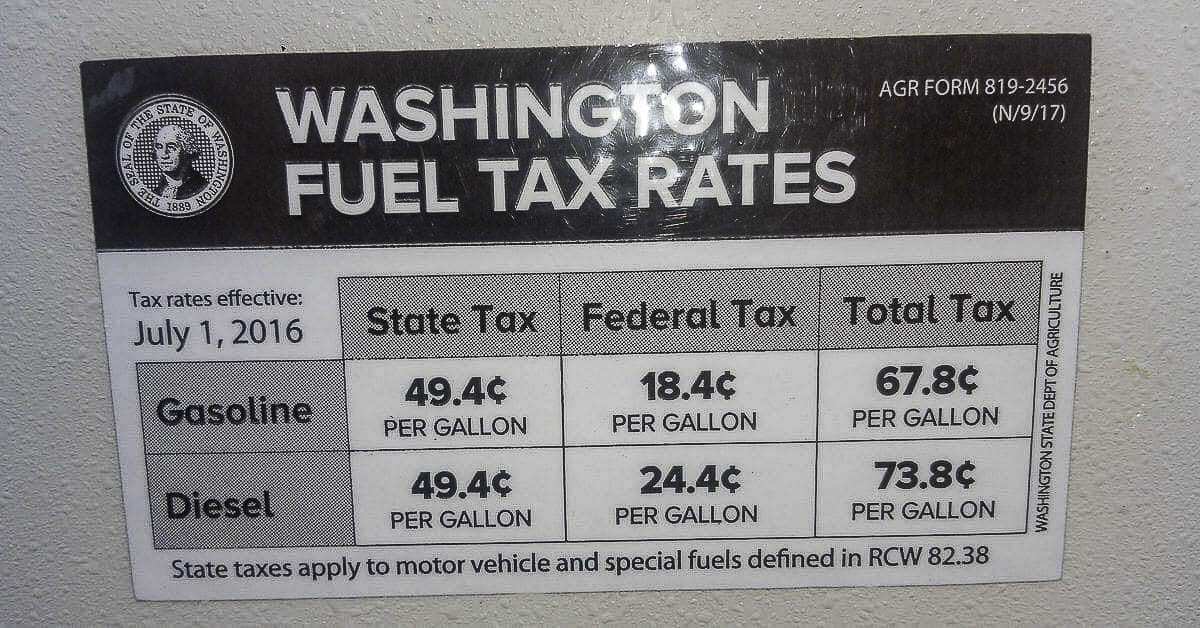

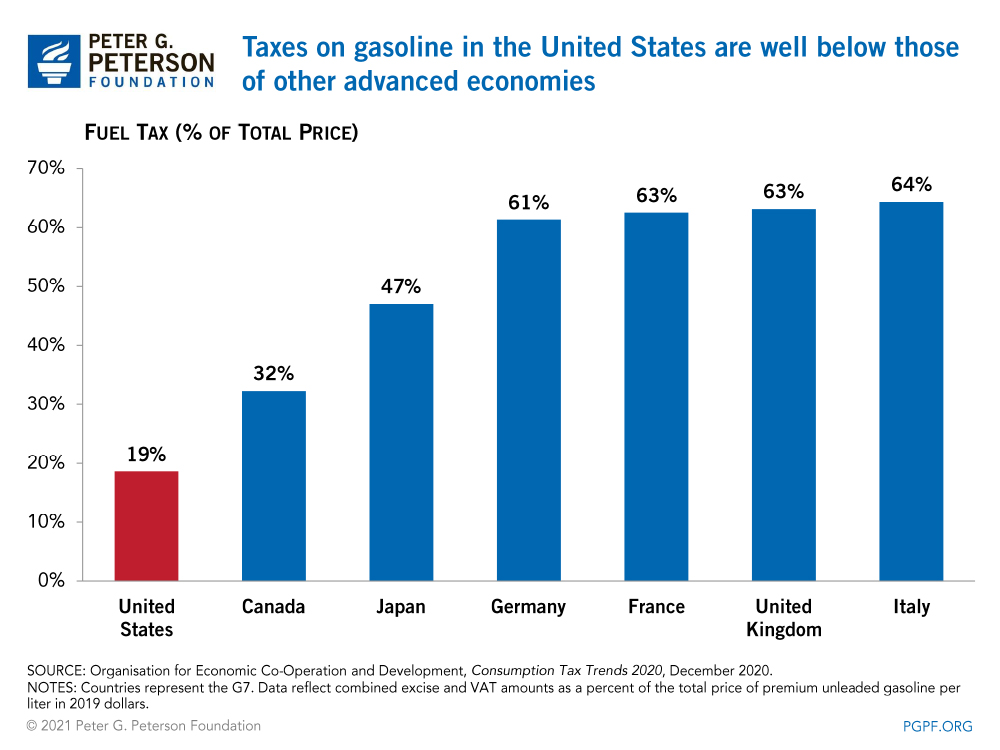

Federal gas tax increase 2021. The federal tax was last raised October 1 1993 and is not indexed to inflation which increased by a total of 77 percent from 1993 until 2020. Income amounts greater than 40125 but not more than 85525. The federal gasoline tax is 184 cents per gallon for unleaded and 244 cents for diesel.

The current 2021 US. In 2018 the US. Income amounts greater than 9875 but not more than 40125 are taxed at 12.

Gasoline prices are much higher in 2021. The idea of raising a broad-based and regressive tax right now is just a political non-starter said Marc. And an increase to the federal gas tax should be out of the question.

Biden has vowed not to increase taxes on anyone making less than 400000 a year. Critics are calling a potential increase in the federal gas tax the wrong policy at the wrong time Monday January 25 2021. The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel.

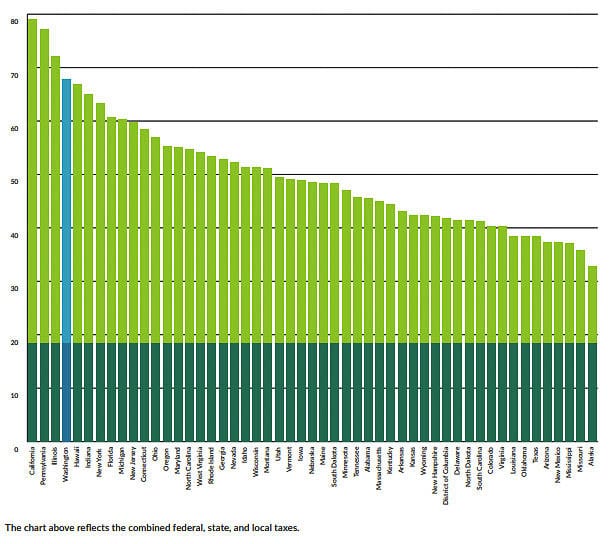

Simply adjust the rate for inflation and the federal gas tax would be 33 cents per gallon today. In fact gas taxes accounted for about one-fifth of the 250 average price for a gallon of gas as of February 2021. CoPilot used 2021 data from the American Petroleum Institute to rank states with the highest gasoline and diesel taxes.

Chamber of Commerce proposed phasing in a 25-cent-a-gallon increase in the gas tax over five years to generate nearly 400 billion over a decade. Regressive tax structures are those that when applied uniformly take a larger percentage of income from low earners than high earners. It would apply to our current gas tax it would be 10 cents the first year McFarland said.

Throw in the 184 cent federal tax and it starts to add up. Transportation Secretary nominee Pete Buttigieg suggested raising the federal gas tax in order to fund infrastructure initiatives during his confirmation hearing Thursday before the Senate Commerce Science and Transportation Committee. Meanwhile the highest tax rate on aviation fuel is Indiana at 051 gallon.

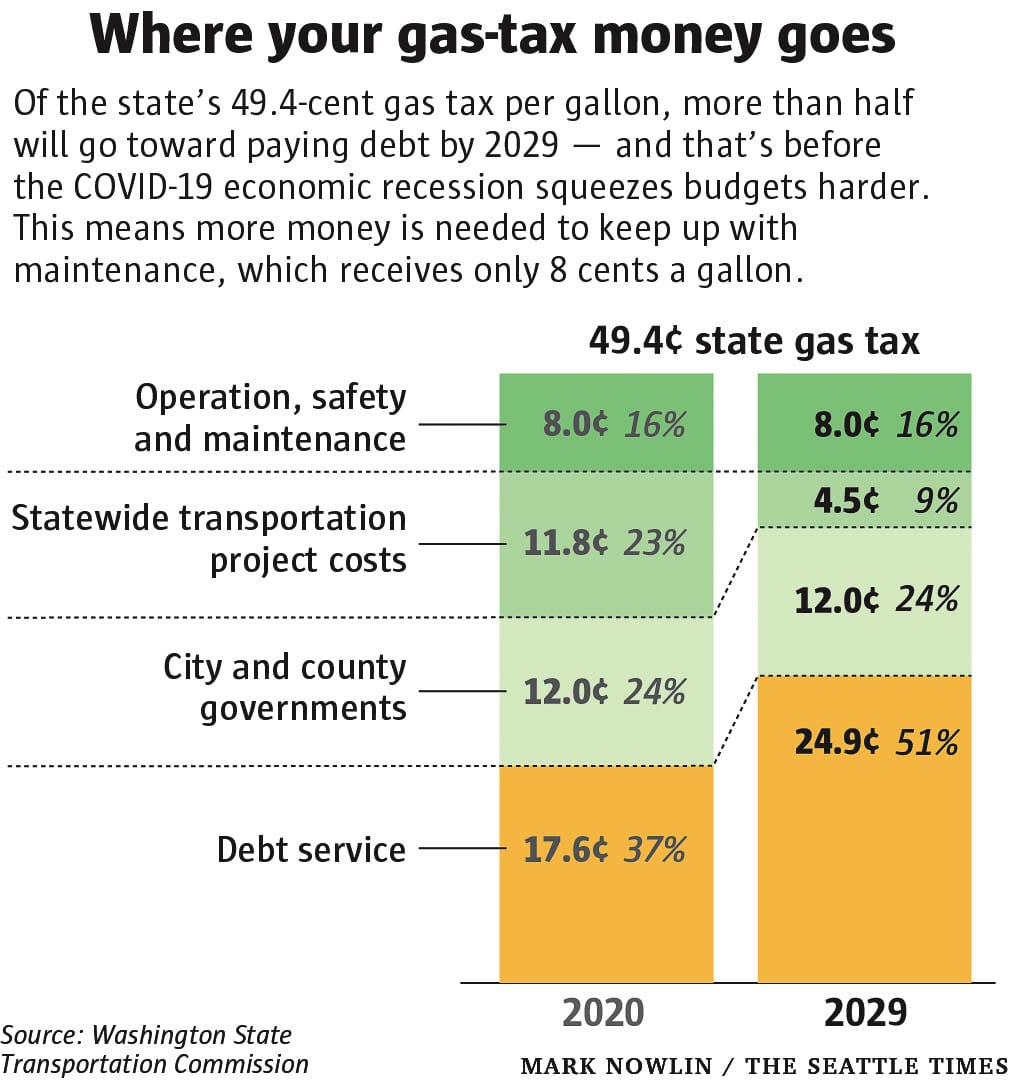

That total tax revenue flows to the Highway Trust Fund which was expected to raise 363 billion in revenue. The highest tax rate on diesel is 0741 gallon again from Pennsylvania. And then two cents every other year for the next 10.

The first 9875 of income or less is taxed at 10. Drivers now pay 184 cents a gallon in the federal gas tax. Heres who would get hit by Bidens proposed tax hikes - CNN.

The state with the highest tax rate on gasoline is Pennsylvania at 0586 gallon followed closely by California at 0533 gallon. On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for. And theyre expected.

Average tax rate stands at 3683 per gallon for gasoline and 3785 for diesel fuel. Under this law in 2021 those people will get a tax increase of about 365 each. And getting frozen in time for 28 years has consequences.

Others are promoting green initiatives that could see increases at the pump. 0 comments These increases on taxes for low-income Americans may have been put in place to try to make up for the massive tax breaks given to the extremely wealthy and corporations during the Trump administration. First authorized by Congress in 1932 to help balance the federal budget the federal gas tax is now used to pay for building and maintaining interstate highways and bridges.

The Gas Tax is Regressive. The question is not whether we need better transportation infrastructure its how to pay for it. Gas prices in 2021 are up more than 1 per gallon compared to a year ago according to the American Automobile Association AAA climbing from 179 in 2020 to 289 now.

January 21 2021 852 PM ET.

Highest Gas Tax And Prices In The U S By State 2020 Statista

Highest Gas Tax And Prices In The U S By State 2020 Statista

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Https Energyinnovation Org Wp Content Uploads 2020 04 Effects Of A 0 25 Federal Gas Tax April 2020 Update Pdf

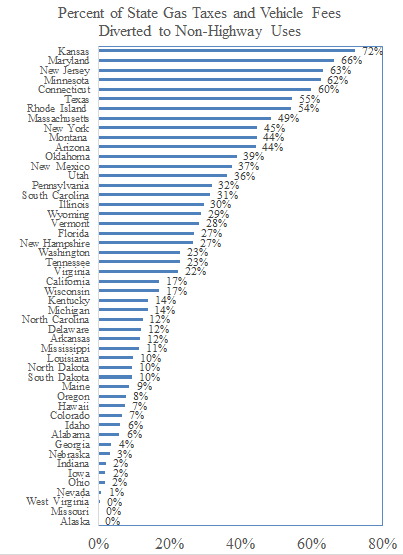

Highways And Gas Tax Diversions Cato At Liberty Blog

Highways And Gas Tax Diversions Cato At Liberty Blog

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Gas Tax Increases A Carbon Tax And A Low Carbon Fuels Tax Part Of Legislature S Transportation Tax Proposals Clarkcountytoday Com

Gas Tax Increases A Carbon Tax And A Low Carbon Fuels Tax Part Of Legislature S Transportation Tax Proposals Clarkcountytoday Com

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

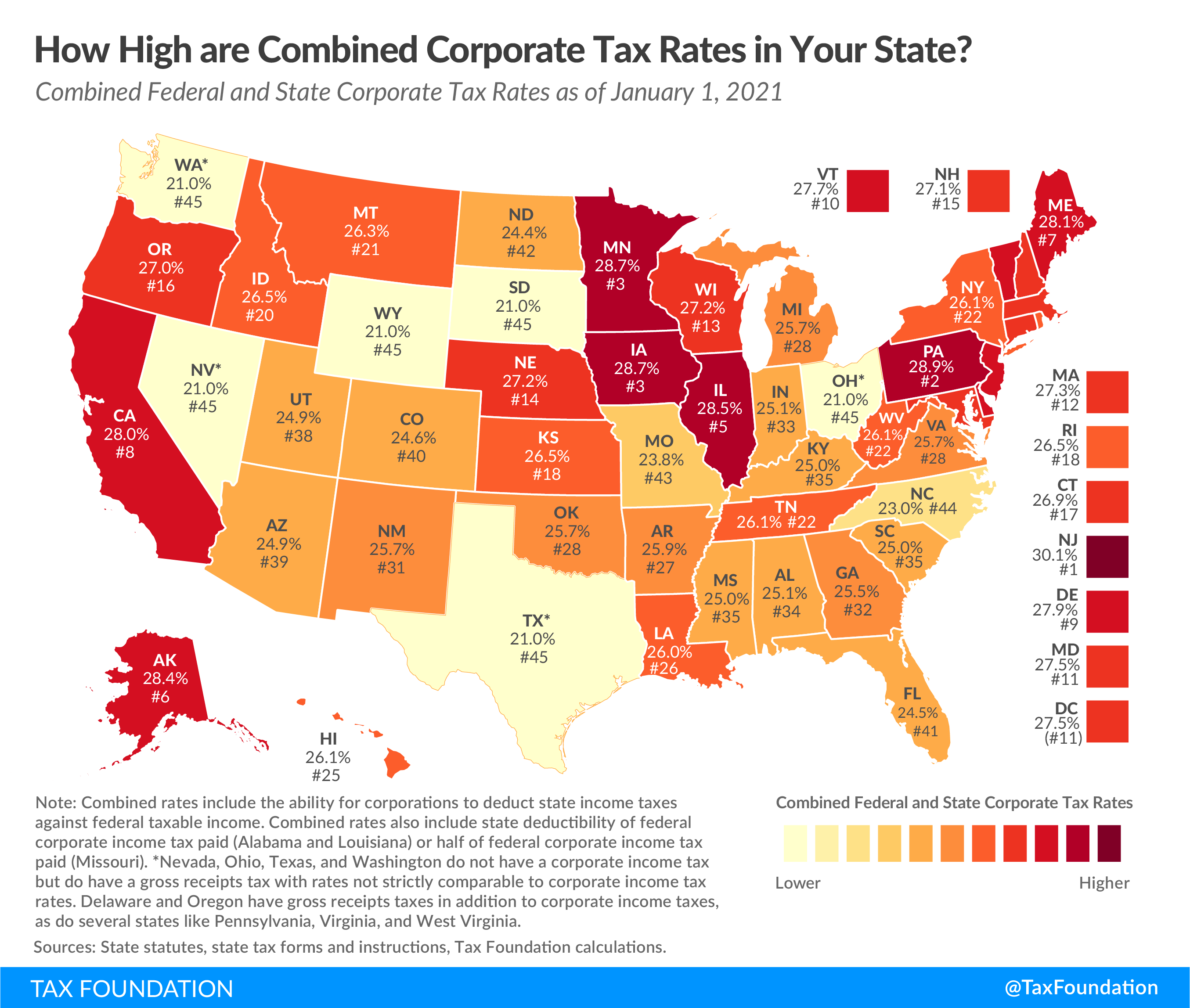

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Comments

Post a Comment