Featured

Glg Partners Hedge Fund

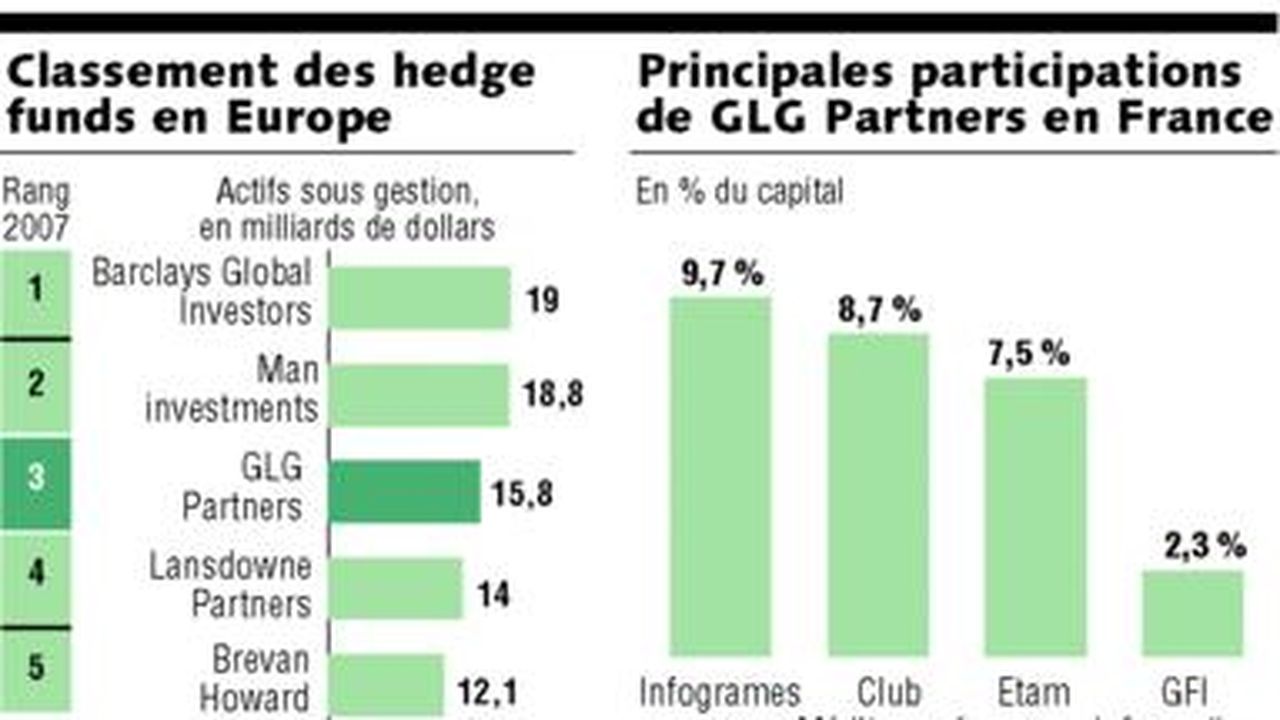

Raoul Pal has previously co-managed the GLG Global Macro Fund in London for GLG Partners one of the largest hedge fund groups in the world. Man Group the worlds largest listed hedge fund has agreed a deal to buy its rival GLG Partners.

Nicknamed The Wizard of Oz during his time at GLG Partners and Moore Capital Management in 2012 he declared retirement at the age of 41 and returned to Sydney.

Glg partners hedge fund. The move which values GLG at 16bn 11bn. Gained a New York Stock Exchange listing in November 2007. Man Group the worlds largest listed hedge fund has agreed a deal to buy its rival GLG Partners.

It was founded in 1995 by Noam Gottesman Pierre LaGrange and Jonathan Green. GLG Partners is a hedge fund based in New York with offices in London. The Hedge Fund Journal is a monthly magazine focusing on the global hedge fund industry.

British hedge fund adviser GLG Partners LP and a former holding company agreed to pay about 9 million to settle US. June 24 2007 GLG Partners one of Europes biggest hedge fund managers is expected to announce plans to list on the New York Stock Exchange on Monday via a reverse takeover that will give its top. In early 2018 Coffeys plans to launch a new fund were announced.

During a decade when equity markets delivered no gains this market neutral strategy has returned over 11 on an annualised basis with volatility of 9. Launched first macro business and expanded into other asset classes covering emerging markets credit convertible bonds and fixed income. Became an independent business.

Raw capitalism goes green next month with the launch of an environmentally-friendly fund from GLG Partners the 17bn London hedge fund manager. The company focused on managing long-only funds before moving into hedge-funds. The GLG European LongShort Fund launched in October 2000.

GLG Partners specializes in Global Macro Emerging Markets and Convertibles and was founded in 2010. The move which values GLG at 16bn 11bn will create a. Raoul came to GLG from Goldman Sachs where he co-managed the hedge fund sales business in Equities and Equity Derivatives in Europe.

Hedge fund GLG Partners founded by billionaire Noam Gottesman and based in London was founded in 1995 as a division of Lehman Brothers and later became independent in 2000. They hold 208 billion in assets under management as of September 29 2017. Read their Plain English Brochure.

April 18 2011 GLG Partners is preparing to close one of its largest funds to new investors amid growing concerns about the ability of supersize hedge fund portfolios to deliver strong returns. GLG told investors in a letter on Friday that it. GLG Partners the ultra-secretive hedge fund whose cult status makes its owners among Britains biggest earners has been declared Londons most respected alternative investment house.

GLG Partners is a hedge fund management company based in New York NY and has approximately 137 billion in assets under management. Greg Coffey is an Australian hedge fund manager based in London. Regulatory charges that internal control failures had caused them to.

Gerson Lehrman Group Wikipedia

Gerson Lehrman Group Wikipedia

I Leave Stock Picking To The Experts Financial Times

Pierre Lagrange 32 Years In Finance The Hedge Fund Journal

Man Group Buys Fellow Hedge Fund Glg Partners Bbc News

Man Group Buys Fellow Hedge Fund Glg Partners Bbc News

Travailler Chez Glg Partners Glassdoor

Travailler Chez Glg Partners Glassdoor

Top Glg Trio Set To Earn More Than Man Chief Executive

Top Glg Trio Set To Earn More Than Man Chief Executive

Le Fonds D Arbitrage Glg Partners Vise La Bourse De New York Les Echos

Le Fonds D Arbitrage Glg Partners Vise La Bourse De New York Les Echos

Le Rachat De Glg Par Man Group Donne Naissance Au Premier Hedge Fund Mondial Les Echos

Le Rachat De Glg Par Man Group Donne Naissance Au Premier Hedge Fund Mondial Les Echos

Glg Partners Lp Societes De Gestion De Portefeuille Identite

Glg Partners Lp Societes De Gestion De Portefeuille Identite

Hedge Fund Fact Sheets Message Design

Hedge Fund Fact Sheets Message Design

Comments

Post a Comment