Featured

Is Fico A Credit Score

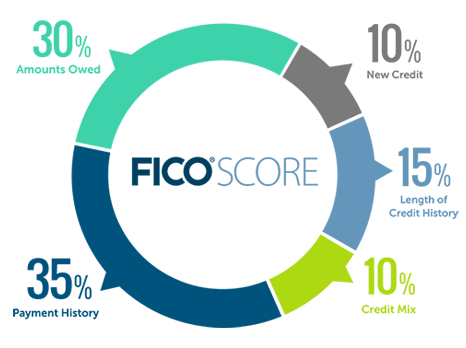

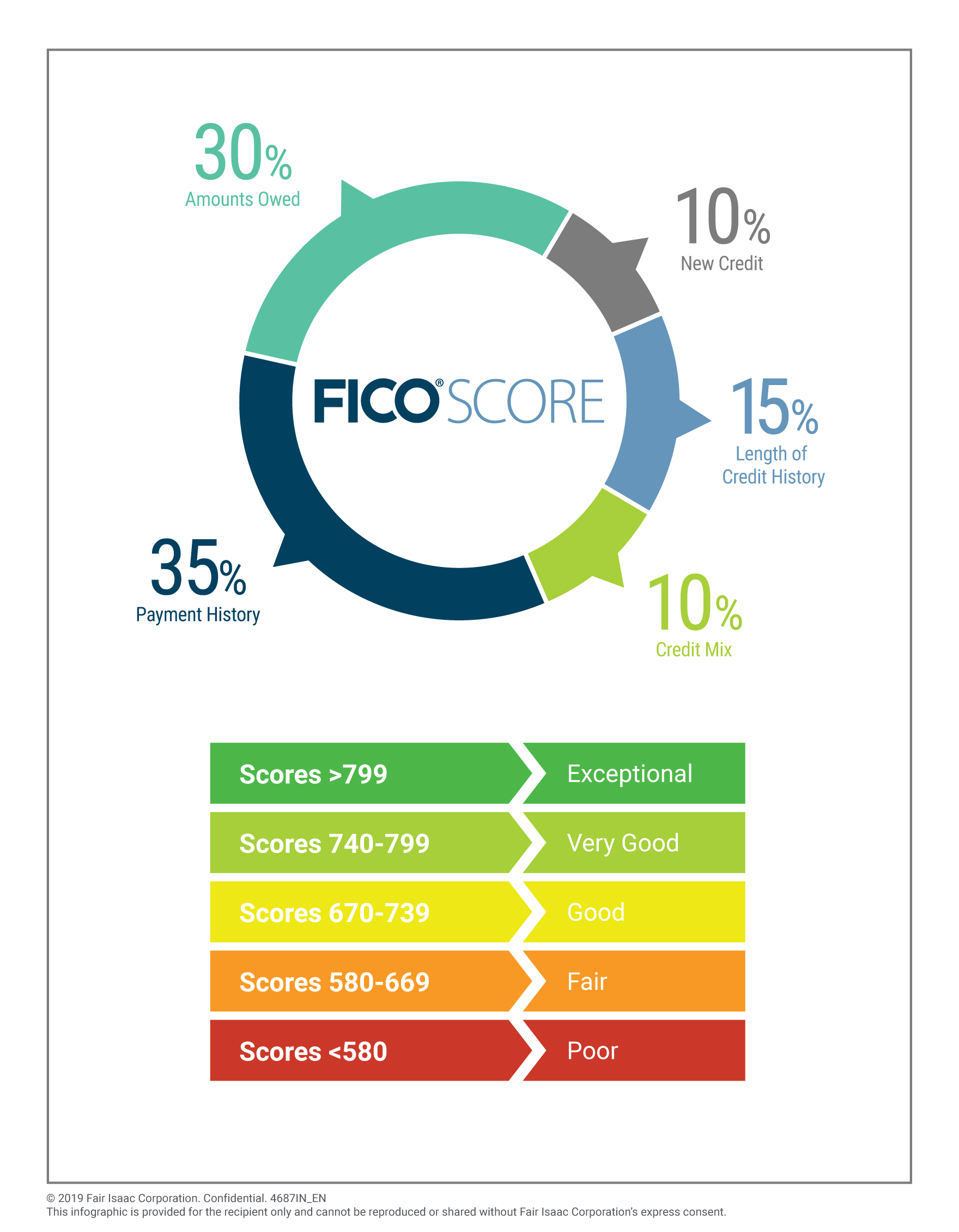

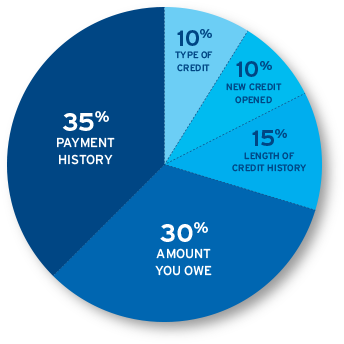

Credit mix means having different types of credit accounts such as credit cards a car loan and a mortgage. But some lenders choose to make their own scoring models or use competitors credit scores.

How Are Fico Scores Calculated Myfico Myfico

How Are Fico Scores Calculated Myfico Myfico

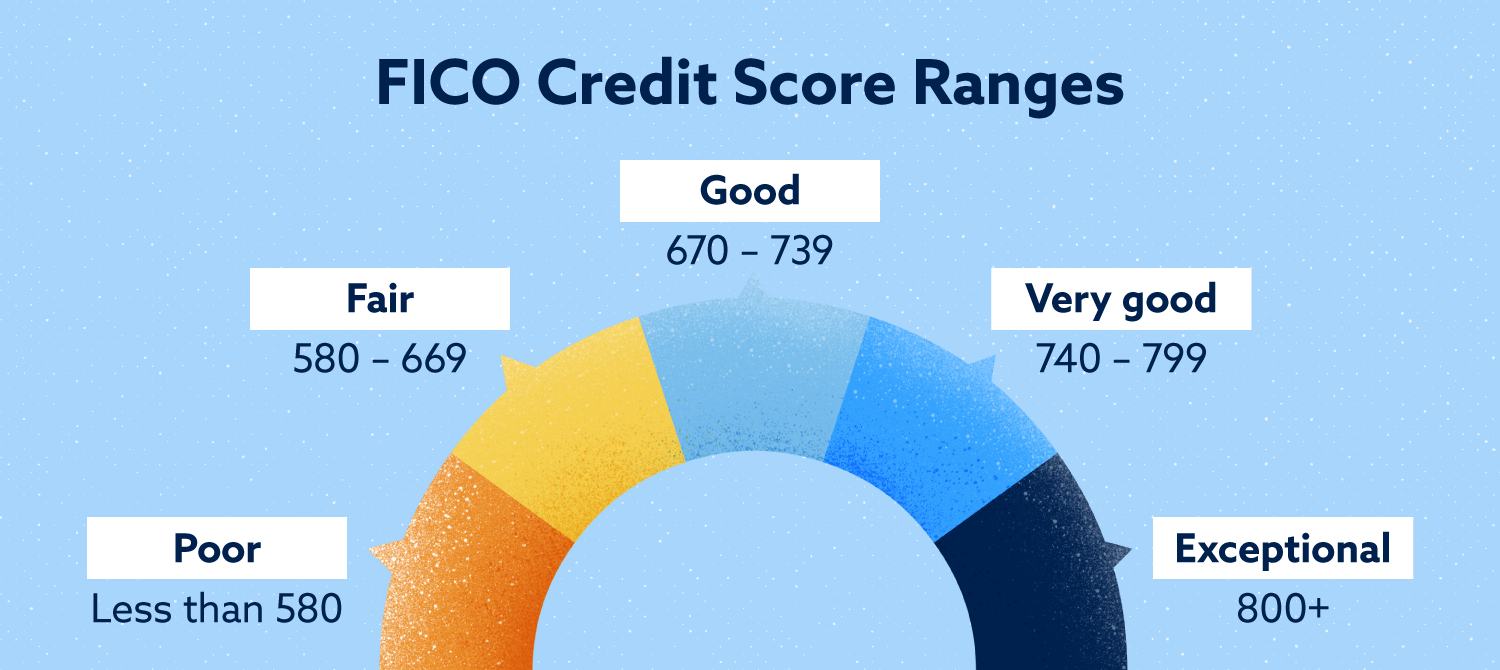

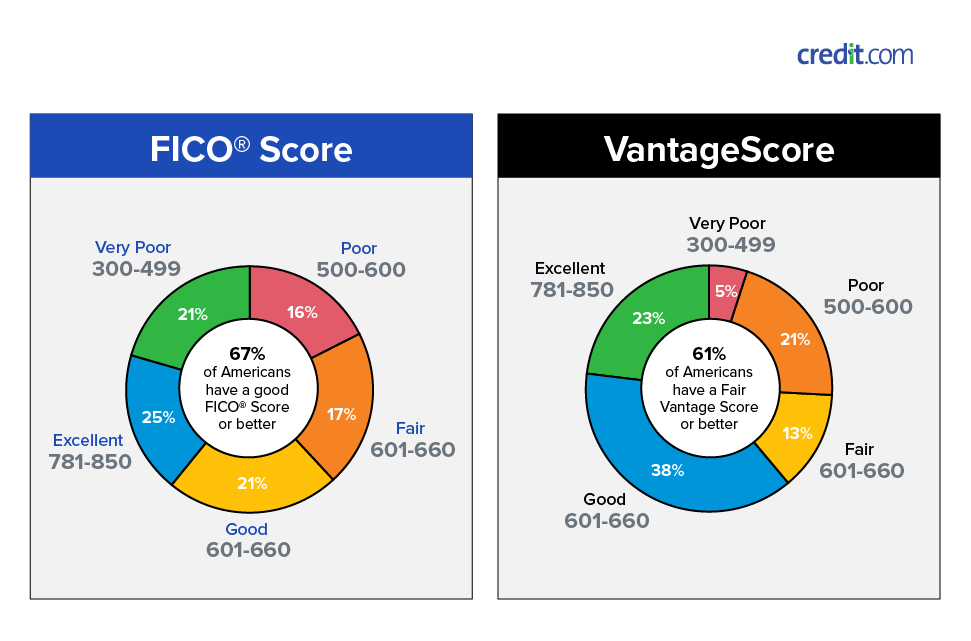

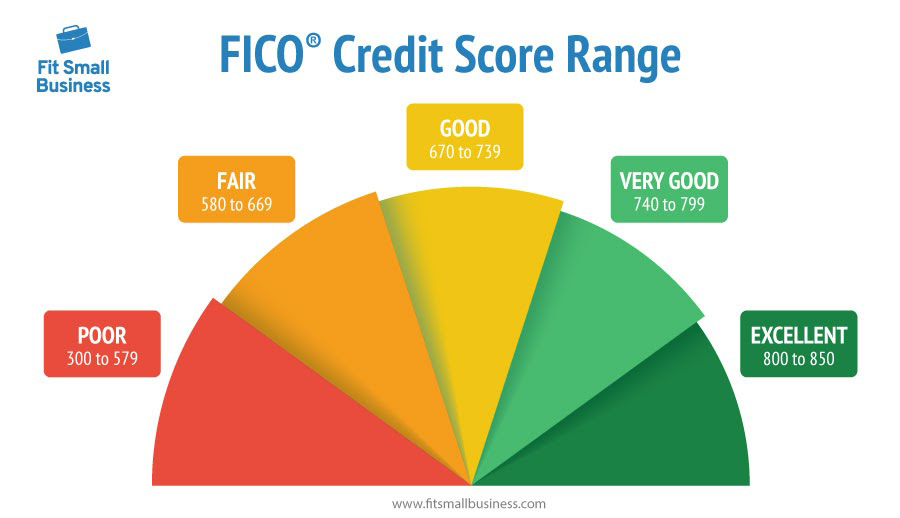

FICO Scores range from 300 to 850 and are used to determine your credit risk.

Is fico a credit score. FICO Scores are calculated using different components. Your credit mix makes up about 10 of your FICO Score. But how is it calculated.

Your FICO scores which typically range from 300 to 850 could affect whether your credit application gets accepted and the. A FICO score is a credit score created by the Fair Isaac Corporation FICO. FICO uses a multitude of various scoring models and regularly updates their calculating algorithms which means that you wont have just one FICO score.

Recent credit applications. Base FICO Scores. Credit mix can influence up to 10 of your FICO Score.

The mix you have is considered you being able to manage different types of loans and that makes you a good credit risk. Lenders typically consider it a red flag if you open up several new. FICO is perhaps the most recognizable name in credit scores.

The Fair Isaac Corporation now called FICO which developed the FICO credit scoring algorithm says its. A FICO score is a credit score system created by the Fair Isaac Corporation FICO. The base scores are what you may see when you check your FICO scores after logging into your credit card account or paying for FICO scores online.

Credit Mix 10 of calculation. But there are other companies that use different scoring models to determine your credit. The higher the score the lower a lender may determine the consumers credit risk.

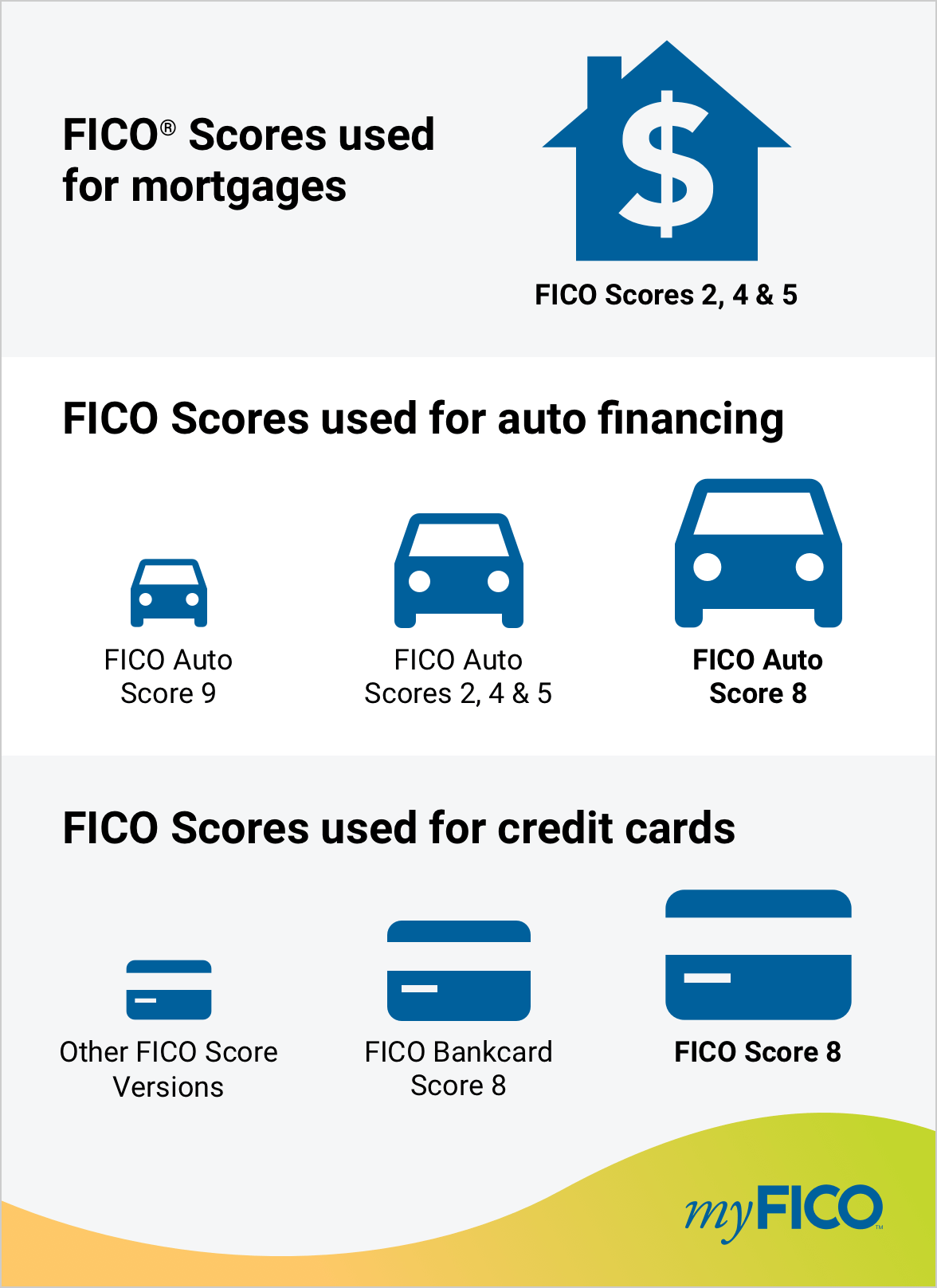

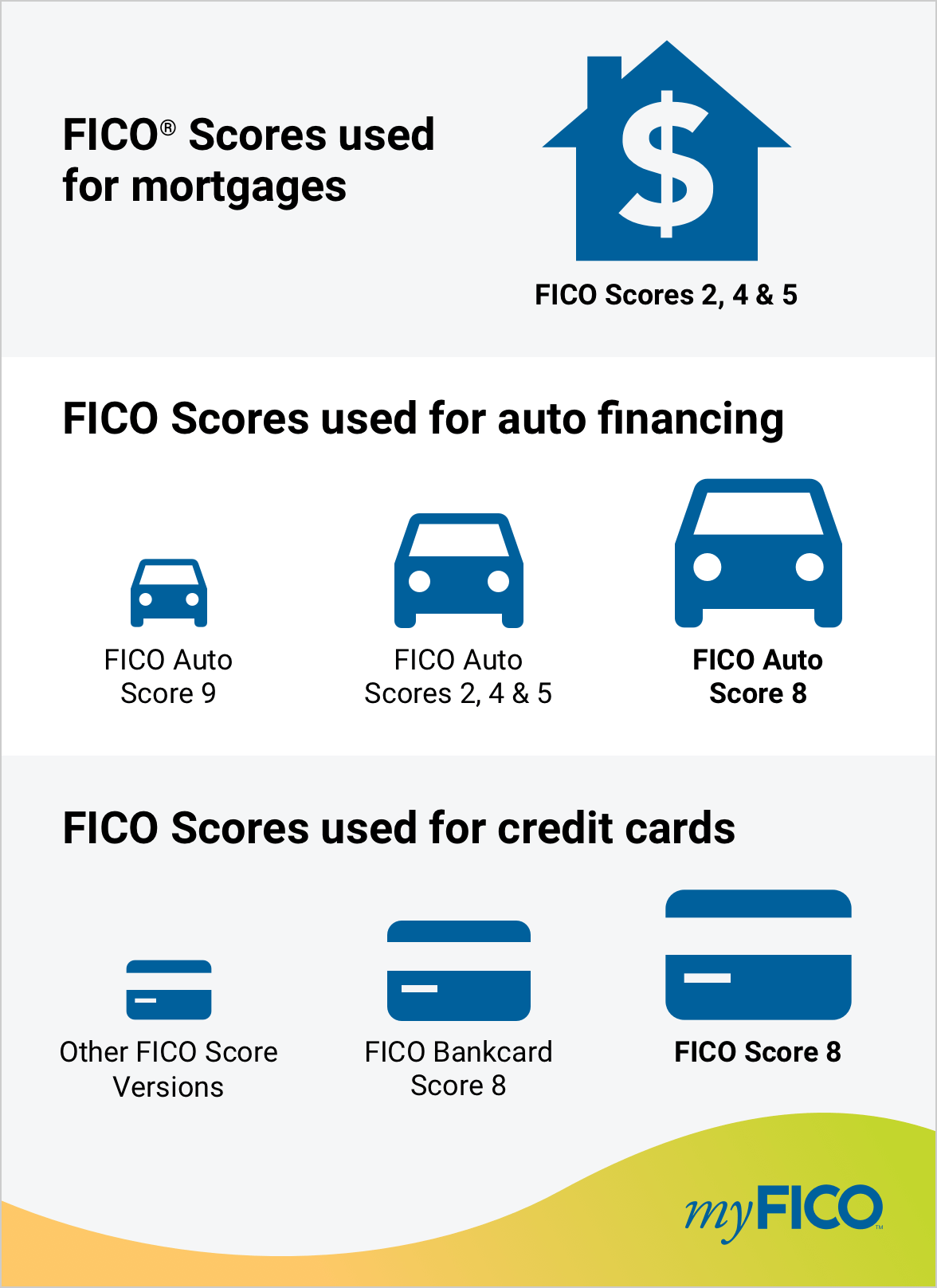

This is because FICO is a company that creates specific scoring models used to calculate your scores. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account and the scores. Fair Isaac Corporation or FICO creates a variety of credit scores for use by lenders credit card issuers and other creditors.

Base FICO Scores range from 300 to 850. Components of FICO Scores. This is because FICO is a company that creates specific scoring models used to calculate your scores.

Having a wide range of accounts plays a small role in determining your FICO Scores. Because FICO Scores are calculated based on your credit information you have the ability to influence your score by paying bills on time not carrying too much debt and making smart credit choices. These scores are created for any type of lender to use as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation.

In other words your FICO scores are just one type of credit score you can get. When it comes to accuracy FICO scores are older than VantageScore 30 and theyre a trusted fair and reliable measure of an individuals likelihood to repay their loan as agreed. New Credit 10 0f the calculation.

But there are other companies that use. FICO breaks down its industry-specific credit score ranges based on the FICO 8 industry-specific scoring model. Understanding the factors that make up your FICO Scores can help you achieve your credit goals.

Is FICO score the same as credit score. Industry-specific FICO scores for auto lenders and card issuers. The reason youve heard about it is because its the most widely used.

They are used by lenders to assess credit risks and decide whether youre a candidate for a loan approval. Almost all major lenders have a secured credit card available. So there you have it.

New credit makes up about 10 of your score. FICO offers a specific brand of credit scorea FICO Scorethat many lenders use when determining a credit applicants creditworthiness. FICO creates auto scores and bankcard scores specifically for auto lenders and card issuers.

You can think of a credit score as the general name for a computer model that analyzes consumer credit reports to determine a score. The FICO Score tends to favor a variety of loan types including both installment credit loans with fixed monthly payments and revolving credit like credit cards with variable payments and the ability to carry a balance. Both CreditWises VantageScore 30 and FICO employ the same utilization.

FICO Credit Scores. Industry-specific FICO Scores. Base FICO scores for any credit obligation.

It was created by the Fair Isaac Corporation back in 1989. A FICO score is just one brand of credit score. Thirty years ago the Fair Isaac Corporation FICO debuted FICO Scores to provide an industry-standard for scoring creditworthiness that was fair to both lenders and consumers.

FICO scores are commonly used by lenders to assess your credit risk but other credit scores can also give you a good idea of where you stand. If you have credit you have a FICO score. Credit scores reflect your total outstanding debt and the types of credit you use.

The Fair Isaac Corporation perpetuates the mystery of its FICO scores by never releasing the details of. The industry-specific scores range from 250 to 900. Think of it this way.

Key differences between a FICO score and credit score FICO is short for Fair Isaac Corporation the first company to offer a credit-risk score. 1 Lenders use borrowers FICO scores along with other details on borrowers credit reports to assess credit risk and. In other words your FICO scores are just one type of credit score you can get.

It is not a major factor but does add or detract from a FICO score. Its the most widely used type.

How Many Credit Scores Do You Have

How Many Credit Scores Do You Have

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

How To Check Your Fico Score Mybanktracker

How To Check Your Fico Score Mybanktracker

/Balance_The_Fico_8_Credit_Scoring_Formula-1203b3ec26b34cc4aa2eddbee3a8bdb1.png) Fico 8 Credit Score What Is It

Fico 8 Credit Score What Is It

Fico Credit Score Calculations Are Changing Tax Accountant Financial Planner

Fico Credit Score Calculations Are Changing Tax Accountant Financial Planner

What Is My Fico Credit Score Lexington Law

What Is My Fico Credit Score Lexington Law

What Is A Good Fico Score Vanderbilt Mortgage And Finance Inc

What Is A Good Fico Score Vanderbilt Mortgage And Finance Inc

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Nerdwallet

What Is A Good Credit Score Nerdwallet

What Your Fico Score Is Made Up Of

What Your Fico Score Is Made Up Of

Comments

Post a Comment