Featured

How Many People Can Be On A Mortgage

Per Regulation B of the Equal Credit Opportunity Act ECOA all co-borrowers must sign a. There are a number of mortgage providers that will lend to two applicants on a joint agreement not only to married couples or couples in a civil partnership but also to friends buying together who will both live in the property.

Mortgage Due Dates 101 The Truth About Mortgage

Mortgage Due Dates 101 The Truth About Mortgage

Three or four people is usually the maximum but the answer to this question tends to vary from lender to lender.

How many people can be on a mortgage. This guide explains the benefits and risks of buying a house with friends or family. Most joint mortgages are taken out by two people but some lenders will allow up to four people to buy together. The value of gross mortgage advances was 658 billion in Q1 2020 38 higher than in Q1 2019.

How Many Applicants Are Allowed on a Mortgage. Co-borrowers also apply for FHA loans when married to the primary borrower and buying or refinancing a home located in a community property state. If you are buying a property with several others and at any point one of you decides they want to sell the property or apply for a loan against its value all the owners must agree to this.

Mortgage lenders consider the following relatives as. All Co-Borrowers are Owners. We calculate this based on a simple income multiple but in reality its much more complex.

How many people can be named on a mortgage. Compared to last year the value of new mortgage commitments was 6 higher in 2020 at 676 billion. If you want to get an FHA loan with a nonoccupant co-client you can have a maximum of two your co-client will need to meet a few basic criteria.

First your co-client must be a relative or close friend. The possibility of having a third party on the mortgage contract is there although rare. There are limitations on the number of mortgages some companies will.

A lot of things. This LTV will give you more options so youre likely to end up with the best interest rates. Over 275 billion was borrowed in 2019 for mortgages alone.

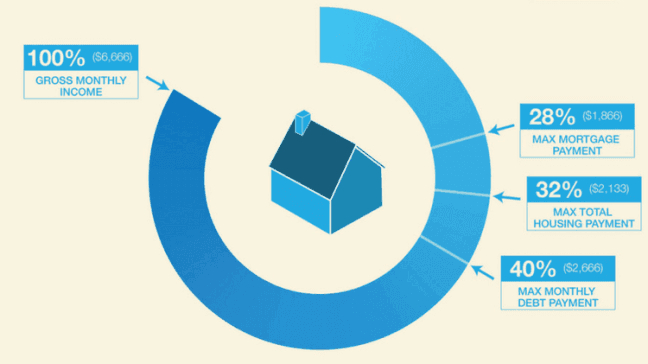

How much deposit you have is a key consideration for all mortgage providers. Borrowing 175000 over 25 years would cost you 830 a month. For repayment mortgages most lenders are happy to approve with 80 LTV which would require a 20 deposit.

When more than one name is on a mortgage loan complications sometimes arise when attempting to determine an. How Many Names Can Be on a Mortgage. Yes the answer to how many mortgages can you have is four but Fannie Mae actually provides guidelines for lending on up to 10 properties for real estate investors.

The proportion of mortgages in arrears fell to its lowest amount since 2007 at 094 Q3 2019. Sure more people can go in on the loan but I would say your idea is a terrible one. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow.

Thats 1104 or 1884 less each year. Lets assume youre buying a 250000 property at a rate of 3 and have a 30 deposit. Some lenders will consider you with 85 LTV and.

You can own a property jointly with up to three other people so in total four of you can be on the propertys deeds. FHA loans are special types of government-backed loans that can allow you to buy a home with a lower credit score and as little as 35 down. Adding an extra five years brings the monthly repayment down to 738 while a 35-year mortgage would only cost 673 a month.

However banks that are trying to protect their assets create policies that make it almost impossible to. All 4 of you would be committing to the full 400k. There is no limit to the number of mortgages one person can have.

Not only can every individual whose name appears on. Some communities participate in shared equity programs that allow home owners to qualify for mortgage. This calculator provides useful guidance but it should be seen.

Are there instances that three or more people will be allowed on a mortgage contract. For retired people on a standard mortgage plan this is no exception.

How Many Names Can Be On A Mortgage

How Many Names Can Be On A Mortgage

Loan Officer Job Description Salary And What To Expect The Truth About Mortgage

Loan Officer Job Description Salary And What To Expect The Truth About Mortgage

How Much House Can I Afford Money Under 30

How Much House Can I Afford Money Under 30

How Many People Can Get An Fha Loan Together

How Many People Can Get An Fha Loan Together

What Percentage Of Your Income Can You Afford For Mortgage Payments

What Percentage Of Your Income Can You Afford For Mortgage Payments

Proportion Of People Who Can T Pay Their Rent Or Mortgage Doubled During Pandemic Hack Triple J

Proportion Of People Who Can T Pay Their Rent Or Mortgage Doubled During Pandemic Hack Triple J

What Percentage Of Your Income Can You Afford For Mortgage Payments

What Percentage Of Your Income Can You Afford For Mortgage Payments

/joint-loans-overview-315512_final-19175f1cf9844ee0a7a2646f500e72b3.png) Joint And Shared Ownership Loans For Multiple Borrowers

Joint And Shared Ownership Loans For Multiple Borrowers

How Many Names Can Be On A Mortgage Bankrate Com

How Many Names Can Be On A Mortgage Bankrate Com

Comments

Post a Comment