Featured

Short Sold Stock

Tesla is by far the most heavily shorted stock in the entire US. This is a list of the top 100 shorted stocks on the ASX by aggregate percentage shorted along with their weekly change.

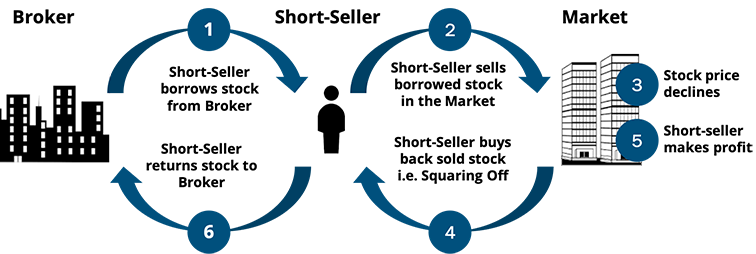

How To Short A Stock Short Selling A Stock Ig En

How To Short A Stock Short Selling A Stock Ig En

This is when the fund manager bets the price of a stock will go down.

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

Short sold stock. The investor who makes a short sell borrows the stock now and sells it. Short selling also known as shorting selling short or going short refers to the sale of a security or financial instrument that the seller has borrowed to make the short sale. Top 30 shorted stocks The technique of profiting from a price fall is called short-selling otherwise known as shorting to go short or simply short.

After some time the short seller buys the stock back using cash and returns it to the lender. Tesla has 355 billion in total short interest. Data sourced from ASIC.

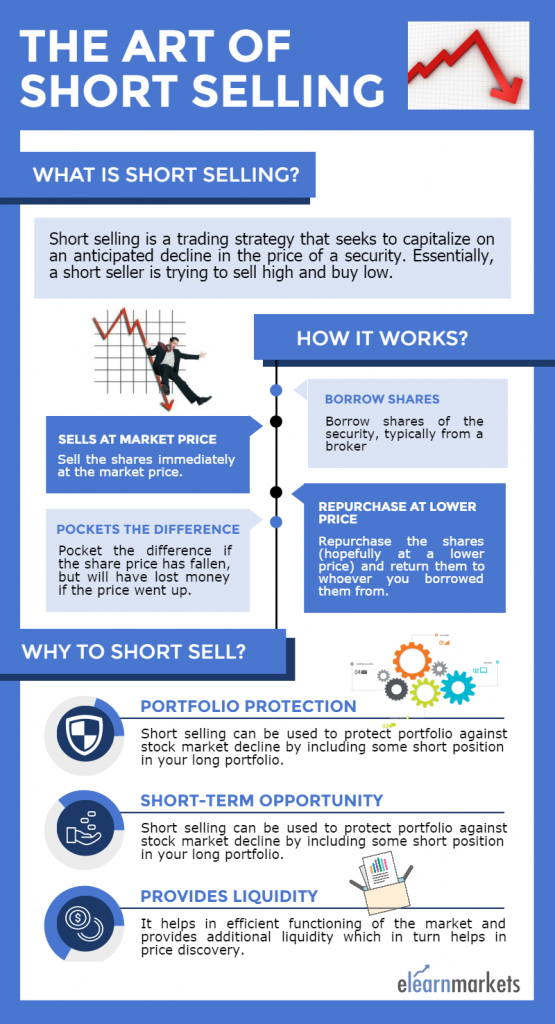

The profit is the gap between the sell price and the future buyback price. Short-selling a stock is a risky move but one that some investors like to try in certain markets. Short selling refers to the sale of security such as a stock in anticipation of prices falling.

Brokers have a variety of means to borrow stocks to facilitate locates and make good on delivery of the shorted security. Shorting stock in the US. This is called selling short or a short sell.

Also known as shorting a stock short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- but can also lose money for you if the stock. Short selling is a technique used to profit from a fall in the price of a stock. Tesla short sellers are digging in.

A short seller borrows a stock then sells it immediately on the open market and gets cash in return. The short seller then quickly sells the borrowed shares into the market and hopes that the shares will fall in price. Even if you do not participate in short selling yourself knowing which ASX stocks are being shorted.

In short selling a position is opened by borrowing shares of a stock or other asset that the investor believes will decrease in value. Blue Chips Stocks To Watch. Meer informatie over het register en een link naar het register zelf is beschikbaar op de betreffende pagina van de AFM website.

45 реда Stocks with high short interest are often very volatile and are well known. The investor then sells these borrowed shares to. If the share prices do indeed fall then the investor buys those same shares.

This is referred to as a locate. The trading strategy is motivated by the belief that the prices of a security will drop providing an opportunity for the stocks to be repurchased later and for the difference in price to be taken as profit. To sell stocks short in the US the seller must arrange for a broker-dealer to confirm that it can deliver the shorted securities.

You can sell a stock you dont have by buying it later. TheStreet takes you through what short-selling means. De informatie op deze website is gebaseerd op het Register short selling welke openbaar wordt gepubliceerd door de AFM en haar zusterorganisaties in Europa.

Short seller can profit from a share price falling by borrowing shares to sell at a high price and buy back those shares in future at a lower price to close the position. Investors who short stock must be willing to take on the risk that their gamble might not work. Yes you can short sell stock that you.

Shortsellnl geeft geen garanties over de juistheid van de. Some of the most famous or infamous trades in the hedge fund business include shorts. Shorting stock also known as short selling involves the sale of stock that the seller does not own or has taken on loan from a broker.

It is a method where you sell first and buy later - if the price of the stock drops then you are selling for a higher price than you are buying resulting in a profit. If the stock declined in price in the meantime the cash required to buy back the shares is less than the cash received from selling the shares. 65 реда Can I Short Sell a Stock I Own.

What Is Shorting How To Short A Stock In India Latest Sebi Short Selling Rules

What Is Shorting How To Short A Stock In India Latest Sebi Short Selling Rules

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png) Short Selling Vs Put Options What S The Difference

Short Selling Vs Put Options What S The Difference

Infographic Is Short Selling Stocks Worth It

Infographic Is Short Selling Stocks Worth It

Understanding Short Selling Youtube

Understanding Short Selling Youtube

Short Selling Stocks A Short Selling Example Firstrade

Short Selling Stocks A Short Selling Example Firstrade

/short-selling-e88091d376244975a460ad828f95c7ed.jpg) Short Selling How Long Does A Short Seller Have Before Covering

Short Selling How Long Does A Short Seller Have Before Covering

How To Short A Stock For Beginners Td Ameritrade

Short Selling Understanding The Art Of Implementation

Short Selling Understanding The Art Of Implementation

How To Short Stocks In 2021 Learn 2 Trade Ultimate May 2021

How To Short Stocks In 2021 Learn 2 Trade Ultimate May 2021

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

Comments

Post a Comment