Featured

Crypto Flash Loan

The lending process typically involves two or three parties. Flash loans are useful building blocks in DeFi as they can be used for things like arbitrage swapping collateral and self-liquidation.

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Flash loans however are different.

Crypto flash loan. With them users can borrow funds without having to post any collateral. Crypto News Flash liefert dir die neuesten Nachrichten und informative Inhalte über Bitcoin Ethereum XRP Litecoin Tron IOTA und viele weitere Altcoins. The deal would collapse if they do not repay.

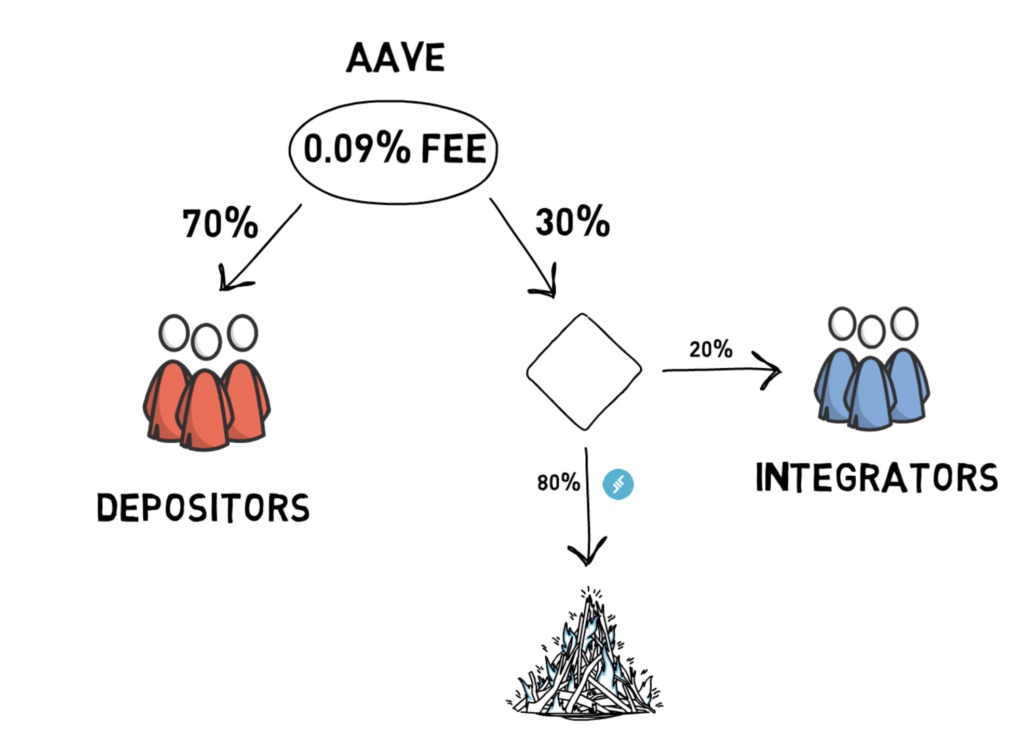

Flash loans have a 009 fee on the interest-generating protocol Aave. With a conventional cryptocurrency loan users are required to post some sort of collateral traditionally in the form of crypto. A flash loan allows a DeFi customer to borrow cryptocurrency without having to put up any collateral.

Flash loans must be paid back in the same asset you borrowed. Cest quoi un flash loan. Yield Farming and Arbitrage opportunities DeFi Flash Loans Made Easy.

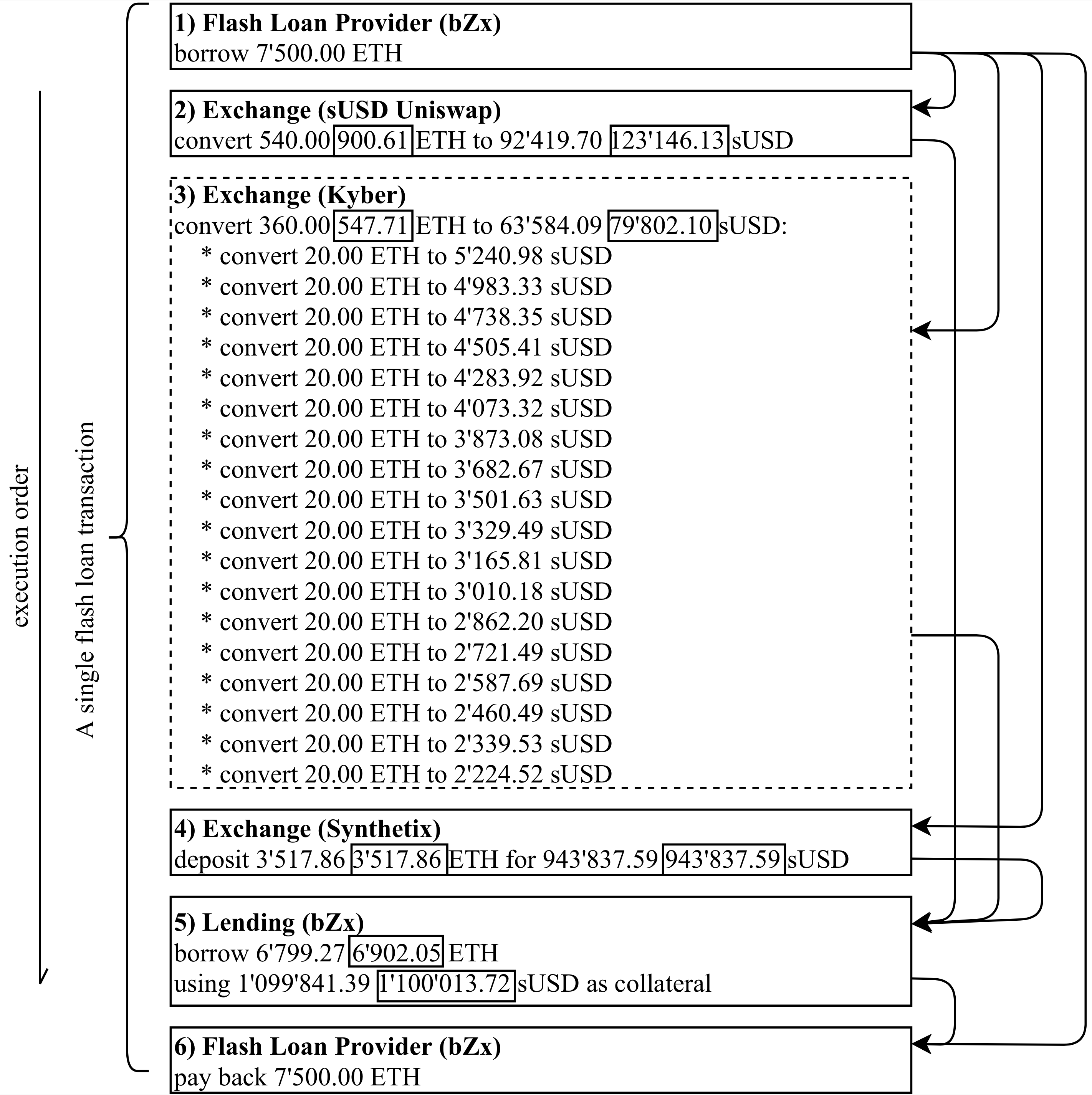

Despite the one-block restriction flash loan funds can go much further within a block than most would assume. Stani Kulechov Aaves London-based chief executive officer expects all cryptocurrency networks to eventually offer flash loans. Aave is an Open Source and Non-Custodial protocol to earn interest on deposits and borrow assets.

Those types of loans enable you to perform actions without using your funds for a really small percentage fee 009 at the time of writing on Aave and 0 on DyDx. On the good side it has no fees. However there is a catch.

Flash loans have practical applications but they have unfortunately also been used in many DeFi exploits. The protocol features Flash Loans the first uncollateralized loan in DeFi. At the end of the day flash loans are going to be everywhere.

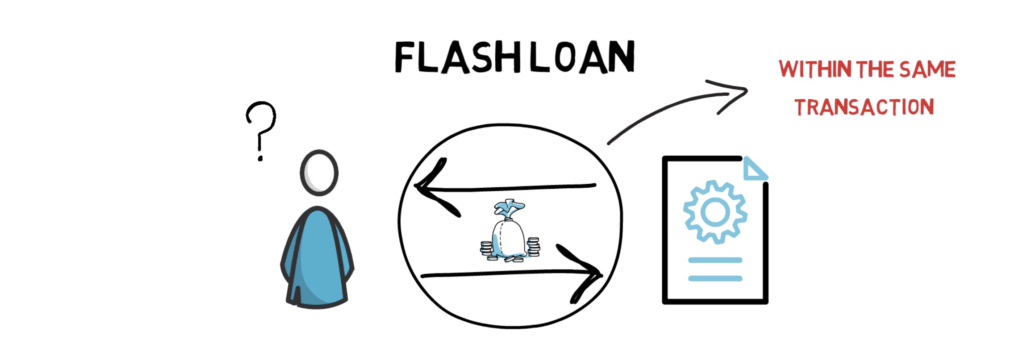

Since we are talking about the negative they have a limited selection of tokes available for flash loans. A flash loan has to be borrowed and repaid within the same blockchain transaction. Designed for developers Flash Loans enable you to borrow instantly and easily no collateral needed provided that the liquidity is returned to the pool within one transaction block.

A borrower a lender and a platform that connects both sides of the transaction. Flash loans have innumerable possible use cases. Le flash loan est une nouveauté propre à la Finance décentralisée à mi-chemin entre la technique et lingénierie financière.

This extends to their documentation which is very slim when it comes to flash lending. Cryptocurrency lending refers to the process of loaning fiat money or a stable digital asset for a fixed period of time and an interest rate. Equalizer Finance is the first dedicated flash loans platform for DeFi markets on Ethereum Binance Smart Chain Polkadot.

It requires a minimum of three operations. To execute a flash loan a user has to call several functions and sort of trick dydx unto accepting the transaction. So whats the catch.

If the amount borrowed is not repaid in full within the block the entire loan is canceled. 1 borrow on Aave 2 swap on a decentralized exchange and 3 arbitrage swap on another decentralized exchange to realize profit. Flash Loans are loans that allow the borrowing of an asset as long as the borrowed amount and a fee is returned before the end of the transaction.

Flash loans are a unique type of DeFi loan in which borrowed capital must be repaid in the same block. This technology with no collateral is going to reshape the whole cryptocurrency world. The loan must be taken out and repaid within a single Ethereum transaction.

Il sagit dun emprunt instantané sans risque de contrepartie qui ne demande aucune garantie à condition dêtre remboursé dans une seule et même transaction sur Ethereum. The catch is that the loan terms are programmed into a smart contract that allows the user to repay the loan in the same transaction until the Ethereum blockchain changes the users account balances. If this does not happen the whole transaction is reversed to effectively undo the actions executed until that point.

Flash lending is possible due to how the exchange is designed. Flash loans are on-chain loans that allow users to loan millions of dollars worth of crypto without putting up anything as collateral. The only catch is that theyd have to repay the loan within the same block.

Flash loans although initially introduced by the Marble protocol were popularised by Aave and Dydx.

Flash Loans One Month In Balancing Fees And First Usage Report By Emilio Frangella Aave Blog Medium

Flash Loans One Month In Balancing Fees And First Usage Report By Emilio Frangella Aave Blog Medium

Aave Review Flash Loans How To Make 350 000 In 15 Minutes Defi And Crypto Project Reviews

Understanding Defi Flash Loans Complex Attacks Inflation And Composable Systems Technology Bitcoin News

Understanding Defi Flash Loans Complex Attacks Inflation And Composable Systems Technology Bitcoin News

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Flash Loans Borrow Without Collateral By Gaurav Agrawal Coinmonks Medium

Flash Loans Borrow Without Collateral By Gaurav Agrawal Coinmonks Medium

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Opportunities In Crypto Ep2 Flash Loans Swaps The Arbing Blog

Flash Loans Explained Aave Dydx Finematics

Flash Loans Explained Aave Dydx Finematics

Defi Flash Loan Explained Crypto Loans Without Collateral

Defi Flash Loan Explained Crypto Loans Without Collateral

Attacking The Defi Ecosystem With Flash Loans For Fun And Profit

Attacking The Defi Ecosystem With Flash Loans For Fun And Profit

Flash Loans Explained Aave Dydx Finematics

Flash Loans Explained Aave Dydx Finematics

The Defi Flash Loan Attack That Changed Everything Coindesk

The Defi Flash Loan Attack That Changed Everything Coindesk

Attacking The Defi Ecosystem With Flash Loans For Fun And Profit

Attacking The Defi Ecosystem With Flash Loans For Fun And Profit

Comments

Post a Comment