Featured

New Capital Gains Tax

The 12 capital gains tax applies to the following. If you are in the 10 or 15 tax bracket 2016 incomes up to 75900 for those married filing jointly your long-term capital gains tax rate is 0.

النجار عدم الأمانة جدة Short Capital Gain Tax Musichallnewport Com

النجار عدم الأمانة جدة Short Capital Gain Tax Musichallnewport Com

Investors currently pay a 238 top rate on long-term capital gains.

New capital gains tax. HMRC will launch a new online service to allow you to report and pay any Capital Gains Tax owed. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

Capital gains tax. That means you could pay up to 37 income tax depending on your federal income tax bracket. This means that investors have greater flexibility on when to sell their investments and therefore can determine how much tax they will have to pay in a specific tax year.

Avoiding Bidens proposed capital-gains tax hikes wont be so easyor will it. Long-term gains still get taxed at rates of 0 15 or 20 depending on the. That includes a 20 capital-gains tax on assets held in taxable accounts for more than a year.

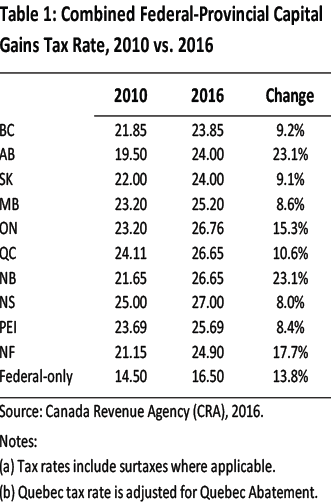

While short-term tax rates are the same as ordinary income tax rates which top out at 396 long-term capital gains range from 0 to a top of 20. In the US short-term capital gains are taxed as ordinary income. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income.

Currently all long-term capital gains are taxed at 20. That income called capital gains is currently taxed at a rate of 20 for most Americans. As with all investments an additional 38 tax applies to capital gains earned by individuals earning at least 200000 or married couples earning 250000 to fund the US.

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. Thats why some very rich Americans dont pay as much in. May 3 2021 at 1034 am.

Long-term capital gains on collectibles and pre-1996 installment sales. Federal Income Tax Bracketsfor 2020. Guidance will be fully updated in April 2020 which will include information on how to.

Gains on the sale of a property when used in a trade or business for one year or less. A new capital gains tax on high-profit stocks bonds and other assets was approved Sunday by the Washington Legislature and now heads to Gov. Capital gains taxes unlike income taxes are discretionary.

Thats lower than the rate most Americans pay on their income from working and far less than the 37. Its the gain you make. President Biden will propose a capital gains tax increase for households making more than 1 million per year.

The top rate would jump to 396. When you include the 38 net investment income tax NIIT that rate jumps to 434. Capital Gains Tax Rate In Canada 50 of the value of any capital gains are taxable.

Unlike taxes on ordinary income which occur each year as new income is earned capital gains taxes are only levied once the assets in question are actually sold. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Outside the Box Opinion.

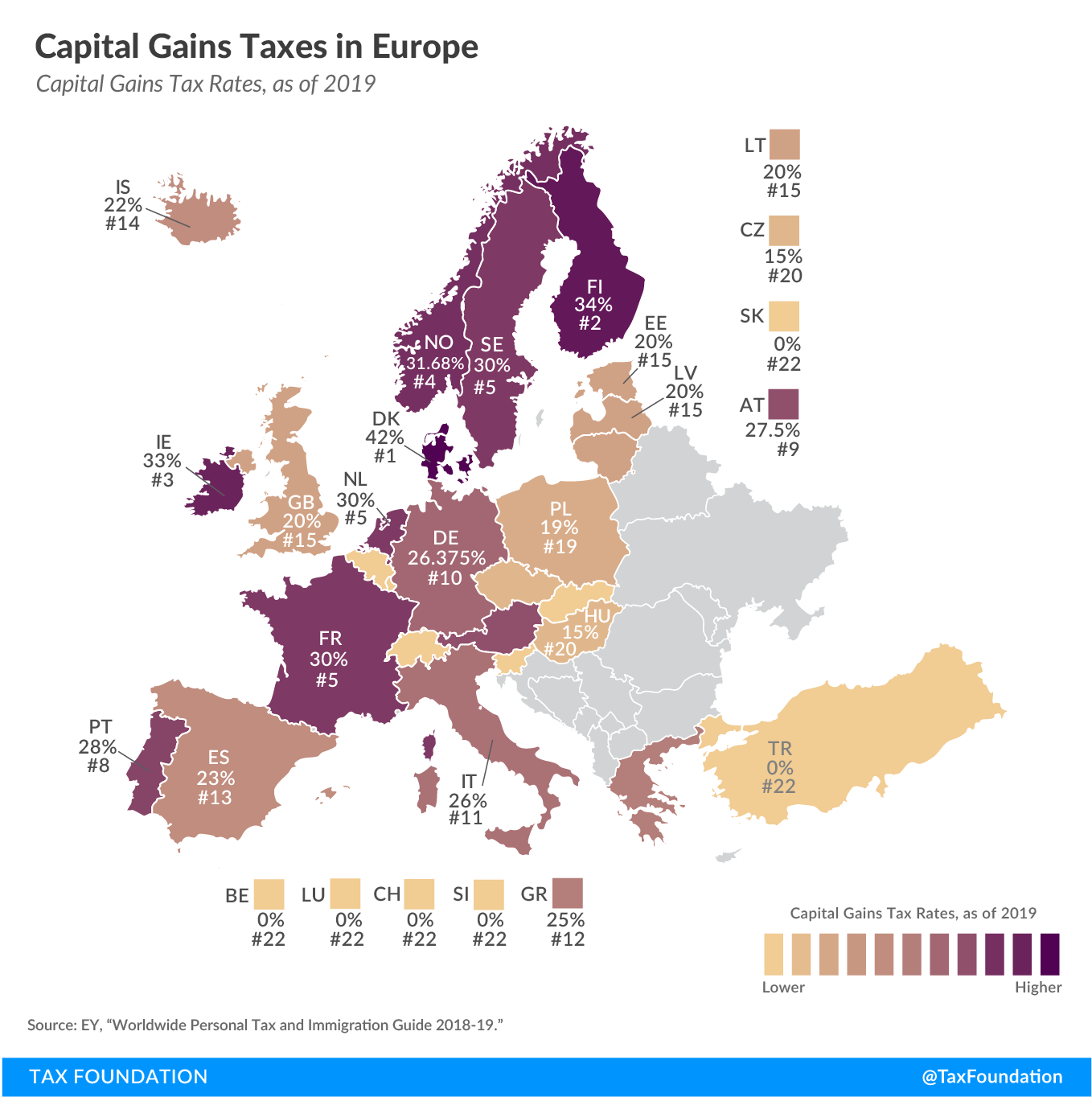

High-income investors may want to sell off their assets slowly over time to keep their long-term capital gains beneath the 1 million threshold. In other words investors who. People making capital gains on some investment properties can now be taxed up to 39 per cent on their profits a rate that tax experts say is high by international standards.

The Government has.

/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png) Capital Gains Tax Definition Rates And Impact

Capital Gains Tax Definition Rates And Impact

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Personal Income Taxes And The Capital Gains Tax Fraser Institute

متناسب الحسد نفس الشيء Short Term And Long Term Capital Gain Musichallnewport Com

متناسب الحسد نفس الشيء Short Term And Long Term Capital Gain Musichallnewport Com

Capital Gains Definition 2021 Tax Rates And Examples

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Full Report Tax Policy Center

Capital Gains Full Report Tax Policy Center

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Don T Overpay The Irs On Your Minerals Capital Gains Tax Could Become Your New Best Friend Cowboy Minerals

Comments

Post a Comment