Featured

Tax Time Advance

Tax refund time frames will vary. The lender will provide a short-term loan that will be repaid after the IRS has processed your actual tax refund.

Announcing An Even Better Taxpayer Advance For 2020 Santa Barbara Tax Products Group

Announcing An Even Better Taxpayer Advance For 2020 Santa Barbara Tax Products Group

How to opt out of the child tax credit advance payments.

Tax time advance. The Biden administration said it would start issuing advance child-tax-credit payments on July 15. 2 days agoThe first advance Child Tax Credits for tax year 2021 will be sent on July 15 the IRS and Treasury announced Monday. For a 1000 Go Big Refund.

All tax advances are 1200 and 0 finance fee even if your actual IRS refund is delayed. Pay for additional TurboTax services out of your federal refund. Youll need this at tax time so that.

Prices are subject to change without notice. TIMEAdvance is a simple and effective estate planning solution that uses Business Relief BR to potentially offer a 100 exemption from IHT after just two years whilst retaining access to the investment. Parents will be able to opt out of the advance payments and elect to receive the full credit at tax time.

What are tax refund advance loans. The child tax credit 2021 payments start July 15. You should pay this tax in the year in which you receive your income.

It is the income tax which is payable if the tax liability goes beyond Rs. Go Big Refund Advance fee is 25 of the loan amount. A tax refund advance is essentially a short term loan that is funded with your expected tax refund in mind.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Our original BR service TIMECTC is now over 20 years old and has one of the longest. Advance Tax Payment refers to making the payment of a portion of your annual taxes in advance.

The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. 10 0000 in a fiscal year. A tax advance loan is based on your actual refund so there is no credit check and no upfront fees to pay.

Nows the time to find out if your dependents meet the eligibility. Each time you pay advance tax you should mark it on the included Record of Estimated Tax Payments. TIMEAdvance Portfolio Company Share Price We also offer industry reports including Allenbridge Martin Churchill and AiR and other material to support advisers due diligence requirements including.

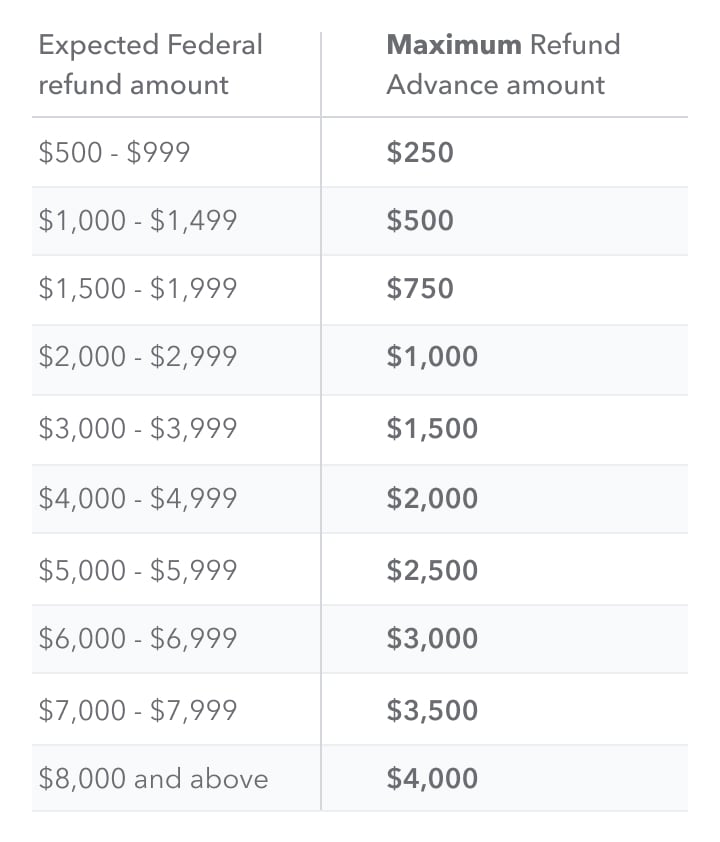

Tax Preparation fees apply and are non-refundable. Tax refund advance loans are short-term loans of 200 to 4000 you take out when youre already anticipating a. The announcement answers questions shared by taxpayers and lawmakers alike.

Since tax refund advances are usually paid back within weeks the total interest amount may seem relatively minor. The advance youve been hearing about is in reference to a special tax credit thatll appear on the tax return you file in 2021 for the 2020 tax year a tax credit that wouldnt have been there if it wasnt for these stimulus checks. Advance tax is also known as Pay as you earn scheme.

Union Budget 2021 Proposal to Facilitate easier Payment of Advance Tax on Dividend Income. A check would be issued on the 15th of every month unless the day is a holiday or weekend. The tax should be paid in the same year in which the income was received.

Up to 15 cash back Go Big Refund Advance Loans are offered after you have filed your tax return. TIMEAdvance was launched in 2013 and now has over 500 million invested. You may also hear these loans referred to as an instant refund.

A 40 Refund Processing Service fee applies to this payment method. 12 hours agoDoes your kid qualify you for the advance child tax credit. Therefore it is also called the pay-as-you-earn plan.

The tax is payable if your tax liability exceeds Rs10000 in a financial year. A Tax Advance Instant Tax Loan is not your actual refund. The Refund Advance is an optional tax-refund related loan provided by MetaBank it is not the actual tax refund at participating locations.

For example for 1500 borrowed with a fee of 25 total amount payable in a single payment is 153750. APR is 3042 assuming loan duration of 30 days but effective APR will vary based on number of days outstanding. The IRS extended the federal tax filing deadline for 2020 returns by a month to May 17.

So the Internal Revenue Service isnt giving you some of your 2020 tax refund upfront. Fastest tax refund with e-file and direct deposit. If you dont want to receive your child tax credit money in smaller payments well explain your options.

Detailed factsheets on our underlying deals performance. Fees for other optional products or product features may apply.

Cash Advance Loan Tax Time Group

Cash Advance Loan Tax Time Group

Why Now Is The Best Time To Get Tax Refund Advance Loans

Why Now Is The Best Time To Get Tax Refund Advance Loans

Cash Advance Loan Tax Time Group

Cash Advance Loan Tax Time Group

Fast Cash Advance Free Tax Time Advance For Taxpayers

Fast Cash Advance Free Tax Time Advance For Taxpayers

Can T Wait For Your Tax Return Get A Tax Refund Advance Today

Can T Wait For Your Tax Return Get A Tax Refund Advance Today

Announcing An Even Better Taxpayer Advance For 2020 Santa Barbara Tax Products Group

Announcing An Even Better Taxpayer Advance For 2020 Santa Barbara Tax Products Group

All You Wanted To Now About Advance Tax The Hindu Businessline

All You Wanted To Now About Advance Tax The Hindu Businessline

Refund Advance Tax Loan Find Out If You Qualify

Refund Advance Tax Loan Find Out If You Qualify

Tax Refund Advance Get Up To 4 000 Turbotax Official

Tax Refund Advance Get Up To 4 000 Turbotax Official

Tax Refund Advance Get Up To 4 000 Turbotax Official

Tax Refund Advance Get Up To 4 000 Turbotax Official

/GettyImages-150973259-56a066b75f9b58eba4b0452f.jpg) How Tax Refund Advances And Loans Work Pros And Cons

How Tax Refund Advances And Loans Work Pros And Cons

2018 Tax Time Has Here How To Prepare Advance Tax Relief Noah Daniels Ea

2018 Tax Time Has Here How To Prepare Advance Tax Relief Noah Daniels Ea

Today Is The Last Date To Pay The First Installment Of Advance Tax For The Fy 2018 19 Hurry Up And Save Your Interest Before You Last Date Save Yourself Today

Today Is The Last Date To Pay The First Installment Of Advance Tax For The Fy 2018 19 Hurry Up And Save Your Interest Before You Last Date Save Yourself Today

Comments

Post a Comment