Featured

Hdfc Pension Plan

Option of Return of Purchase Price on death. DOWNLOAD BROCHURE CALCULATE PREMIUM 4 Easy steps to get your annuity Step 1.

Hdfc Life Pension Guaranteed Plan Plan Your Retirement Today Youtube

Hdfc Life Pension Guaranteed Plan Plan Your Retirement Today Youtube

HDFC Life Pension Guaranteed Plan is a single premium annuity product which provides a regular guaranteed income for lifetime.

Hdfc pension plan. HDFC pension plans aim to provide financial security along with life protection during retired life. Features of HDFC Life Pension Guaranteed Plan are as follows. Track the performance of all funds.

HDFC Life Pension Guaranteed Plan Wide range of annuity options to cater to your needs. Age at retirement years. HDFC Life Guaranteed Pension Plan is a non-participating deferred pension plan that offers assured benefit on death or at vesting.

The premium will be determined using the filled details. Provide your loved ones guaranteed benefits with HDFC Banks Life Guaranteed Pension Plan enjoy lifelong benefit of guaranteed income after retirement. This plan covers you to 99 years of age.

Click 2 Wealth It is a Unit Linked Non-Participating Life Insurance plan that provides market-linked returns and financial protection for you and your family. BounceBack - The true story of Darpan Inani. 30 years 65 years.

Key Benefits of HDFC Life Click 2 Wealth. The plan is ideal for individuals who seek to plan for their retirement to get adequate corpus to fulfill all their post-retirement goals. Option to receive annuity monthly quarterly half-yearly or yearly.

HDFC Life Pension Plan. Calculate how much you need to grow your wealth to ensure a smooth and hassle free post retirement life with HDFC Retirement Planning calculator. Assured benefit on death is 101 of all premiums excluding taxes paid till date.

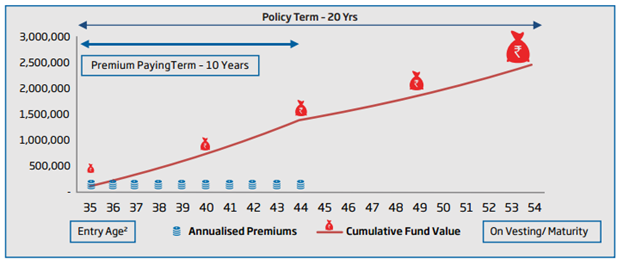

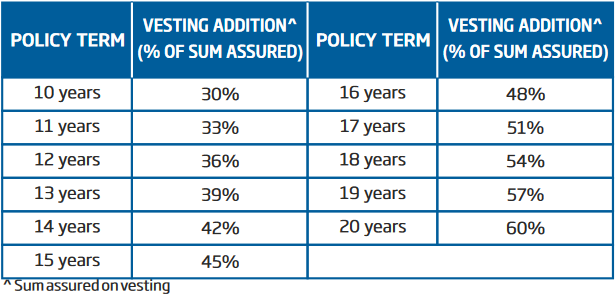

The company offers specific HDFC pension plans which are available online only. HDFC Life Guaranteed Pension Plan. The product offers guaranteed additions that are added every year and the lump sum vesting addition is payable at vesting.

It is a smart way to ensure regular and steady incomes after your retirement. The customer then needs to pay the. HDFC retirement plans are a bundle of attractive features including guaranteed additions death benefit tax benefits and flexibility to suit each unique requirement of individuals.

Here an individuals savings is pooled in a pension fund. HDFC Pension Plans Applying for a Pension Plan from the company. Option to take the plan on a Single or Joint Life basis.

Protect your familys future goals at just Rs. Your present age years. The minimum age of entry in this plan is 40 years that is a good age to start an investment.

Therefore you can explore the HDFC Life Single Premium Pension Super Plan that is a unit-linked plan. It provides a regular and guaranteed income for a lifetime. It acts as the first point of interaction between the subscriber and the NPS architecture.

Your savings is handled by professional fund managers and invested in the. Click Here to Buy this Plan Online. It includes the payment of only a single premium amount and you will not have to compromise your lifestyle even after your retirement.

Hassle free premium payments options. HDFC Securities has been appointed by PFRDA to act as one of the Point of Presence POP for the NPS. Calculate Your Loan EMI.

Choice of increasing youre Annuity. Plan for guaranteed tax-free income to secure your future with HDFC Life Sanchay Plus. DOWNLOAD BROCHURE CALCULATE PREMIUM Its never too early to plan for your retirement start now Tell us about yourself.

1000 pm with HDFC Life Click 2 Wealth. Contributing a small sum now gets me a pension after 60. There are a few reasons to choose HDFC pension plans.

POP shall facilitate the subscriber registration and submission of contributions. Get a guaranteed pension of 1000 to 5000 per month after 60 years depending on your contributions now. The customer only needs to log into the companys website choose the required HDFC pension plan choose the coverage and provide the details.

Presenting HDFC Life Guaranteed Pension Plan one of the best retirement pension plans in India designed to help you build and secure your retirement fund to enjoy the post retirement income. Choose the purchase price that you wish to pay to buy annuity or choose the annuity amount you wish to receive. 18 years 60 years.

HDFC Life Pension Guaranteed Plan is an annuity product plan which has a single premium amount.

Hdfc Life Pension Guaranteed Plan Should You Invest Basunivesh

Hdfc Life Pension Guaranteed Plan Should You Invest Basunivesh

Https Www Hdfclife Com Documents Apps 015482018 20hdfc 20life 20pension 20guaranteed 20plan 20brochure 20 20retail Pdf

Hdfc Pension Plan Super Pension Plus Should You Buy For Retirement

Hdfc Life Assured Pension Plan Comparepolicy

Hdfc Life Assured Pension Plan Comparepolicy

Hdfc Life Guaranteed Pension Plan Review Features And Benefits Jagoinvestor

Hdfc Life Guaranteed Pension Plan Review Features And Benefits Jagoinvestor

What Is Hdfc Life Pension Guaranteed Plan Is Hdfc Pension Plan Good Details Review Hindi Youtube

What Is Hdfc Life Pension Guaranteed Plan Is Hdfc Pension Plan Good Details Review Hindi Youtube

Hdfc Life Pension Guaranteed Plan Review Features And Benefit Full Detail In Hindi Youtube

Hdfc Life Pension Guaranteed Plan Review Features And Benefit Full Detail In Hindi Youtube

Hdfc Life Guaranteed Pension Plan Review Features And Benefits Jagoinvestor

Hdfc Life Guaranteed Pension Plan Review Features And Benefits Jagoinvestor

Why You Shouldn T Buy The Hdfc Life Pension Guaranteed Plan Misleading And Low Returns Capitalmind Better Investing

Why You Shouldn T Buy The Hdfc Life Pension Guaranteed Plan Misleading And Low Returns Capitalmind Better Investing

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

Hdfc Life Assured Pension Plan Review Key Features Benefits

Hdfc Life Assured Pension Plan Review Key Features Benefits

Which Is A Better Unit Linked Pension Plan Or National Pension System

Which Is A Better Unit Linked Pension Plan Or National Pension System

National Pension Scheme Nps Based Pension Fund Management Company Hdfc Pension

National Pension Scheme Nps Based Pension Fund Management Company Hdfc Pension

Comments

Post a Comment