Featured

Fannie Mae Rate And Term Refinance

The Eligibility Matrix also includes credit score minimum reserve requirementsin months and. If youve recently purchased your home and the mortgage balance is higher than your homes current value then HIRO is worth a look.

Https Www Plazahomemortgage Com Downloadfile Aspx Filepath Documents Plazaprograms Fannie 20mae 20retained 20conforming 20and 20high 20balance 20fixed 20program 20guidelines Pdf Filename Fannie 20mae 20retained 20conforming 20and 20high 20balance 20fixed 20program 20guidelines Pdf

After the homeowner completes a trial period plan all eligible unpaid amounts are added to the unpaid principal balance and monthly principal and interest mortgage payments are permanently modified to what may be a lower amount after applying a series of steps that may include rate reduction and a term.

Fannie mae rate and term refinance. The Supplemental Loans product is subordinate financing for properties with a pre-existing fixed or adjustable Fannie Mae Mortgage Loan that has been in place for a minimum of 12 months. This type of refinance is available. 1 The Eligibility Matrix provides the comprehensive LTV CLTV and HCLTV ratio requirements for conventional first mortgage loans eligible for delivery to Fannie Mae.

If were talking about a standard conventional mortgage such as those backed by Fannie Mae and Freddie Mac you can refinance almost immediately if the new loan doesnt result in cash out. July 2018 4 of 4 Calculating a Student Loan Repayment Total outstanding balance of all student loans Example. In other words if youre simply executing a rate and term refinance where the interest rate andor term of the loan changes its generally fine to refinance right away.

MBS as Tax-Exempt Bond Collateral MTEB - Fixed Rate A Fannie Mae Multifamily MBS that can be used as collateral to credit enhance either i existing fixed-rate bond refundings or ii new fixed-rate bond issues in conjunction with 4 Low-Income Housing Tax Credits LIHTC. About Fannie Mae Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of Americans. Fannie Mae and Freddie Mac instituted a new Adverse Market Refinance Fee It adds a 50 basis points fee 05 to most mortgage refinances starting Sept.

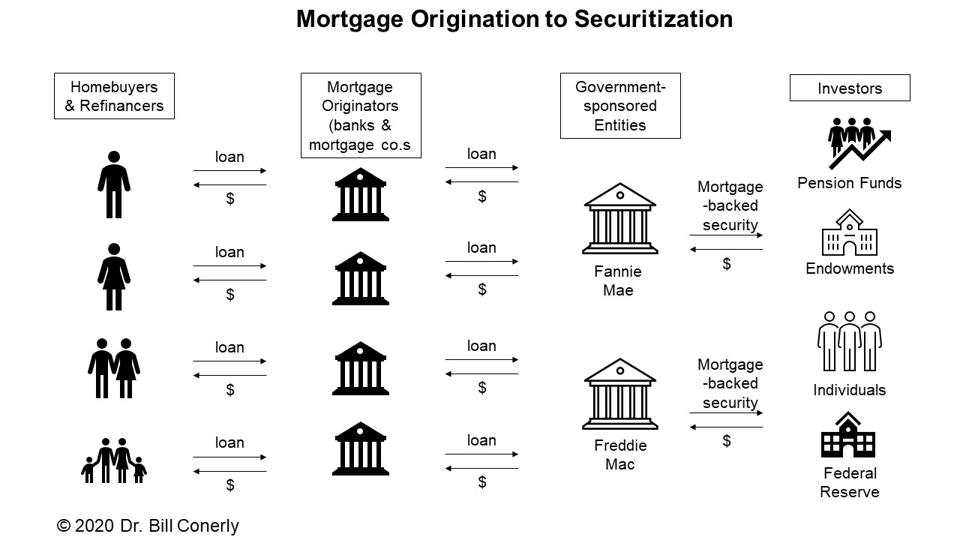

DSCR On an annual basis or any specified period the ratio of Net Cash Flow to the total of. Mortgage rates under 3 percent led many homeowners to refinance in 2020 and during the first quarter of 2021 into a shorter-term loan for a quicker loan payoff or into a new 30-year fixed-rate. Maximum LTV is 85 for purchases and 80 for refinances with a 120x DSCR requirement.

Fannie Mae Flex Modification. Trademarks of Fannie Mae. Fannie Mae Selling Guide.

Maximum LTV is 75 and minimum DSCR is 130x. Additionally the low mortgage rate environment has been a boon to the housing market but may not last long as consumer inflation has accelerated at its fastest pace in more than twelve years and may lead to higher mortgage rates. Homeowner has experienced a permanent impact to their ability to pay their regular monthly mortgage payment.

Maximum interest rate that could be supported based on the UPB. Requirements for Limited CashOut Refinance Transactions with LTV CLTV or HCLTV Ratios of 9501 97. If all the fees are paid for you a payment savings of just 50 to 100mo might be attractive.

Principal interest and required Mezzanine Financing or Hard Preferred Equity payments. Fannie Maes various mortgage products may be able to help you finance a home renovation allow you to pay for energy efficiency-related improvements or offer a low-down-payment option. Calculating an Repayment period 1 7499 10 years 7500 9999 12 years 10000 19999 15 years 20000 39999 20 years 40000 59999 25 years 60000 30 years.

One industry group says the new fee increases the average cost of a refinanced mortgage by 1400. COVID-19 FAQs Selling - Temporary Purchase Refinance Eligibility Published. Different types of refinance include Traditional Refinance and Cash-Out Refinance.

These FAQs provide additional information on the temporary policies. In December 2007 during the mortgage crisis Fannie Mae mandated something called continuity of obligation. 2018 Fannie Mae.

I would throw in that if FNMA sent an audit back stating why was the large deposit not sourced on this refinance my answer would be please see FNMA B3 42-02 and the guidance stated which is Refinance transactions Documentation or explanation for large deposits is not required. We are driving positive changes in housing finance to make the home buying process easier while reducing costs and risk. We partner with lenders to create housing opportunities for families across the country.

Not only may it. In response to the COVID-19 pandemic Fannie Mae and Freddie Mac have provided temporary guidance to lenders on several policy areas to support mortgage originations. The Fannie Mae High LTV Refinance Option HIRO is worth a look for underwater homeowners that would like to take advantage of todays low rates but dont have enough equity to qualify for a traditional mortgage.

And projected Net Cash Flow. UPB Unpaid Principal Balance. Low rates offer homeowners an opportunity to lower their monthly payment by refinancing and our most recent research shows that many borrowers especially Black and Hispanic borrowers who could benefit from refinancing still arent pursuing the option.

Simply stated Fannie Mae largely required a new borrower to be on title for at least. However the lender remains responsible for ensuring that any. Modifications can include a lower interest rate and extending the term of the loan which would lower monthly payments.

If the LTV CLTV or HCLTV ratio exceeds 95 for a limited cash-out transaction the following requirements apply. Whether it makes sense also depends on what your costs are to accomplish to refinance - 05 might be worth it for a larger loan if there are minimal or no fees you will be paying directly for the new loan. You have a number of options when making your decision to refinance.

A conventional refinance is any refinance loan that conforms to guidelines set by Fannie Mae or Freddie Mac. May 5 2021 2021 Fannie Mae. Subprime loans which have higher rates than prime rate loans.

Can I Qualify For A Cash Out Mortgage

Can I Qualify For A Cash Out Mortgage

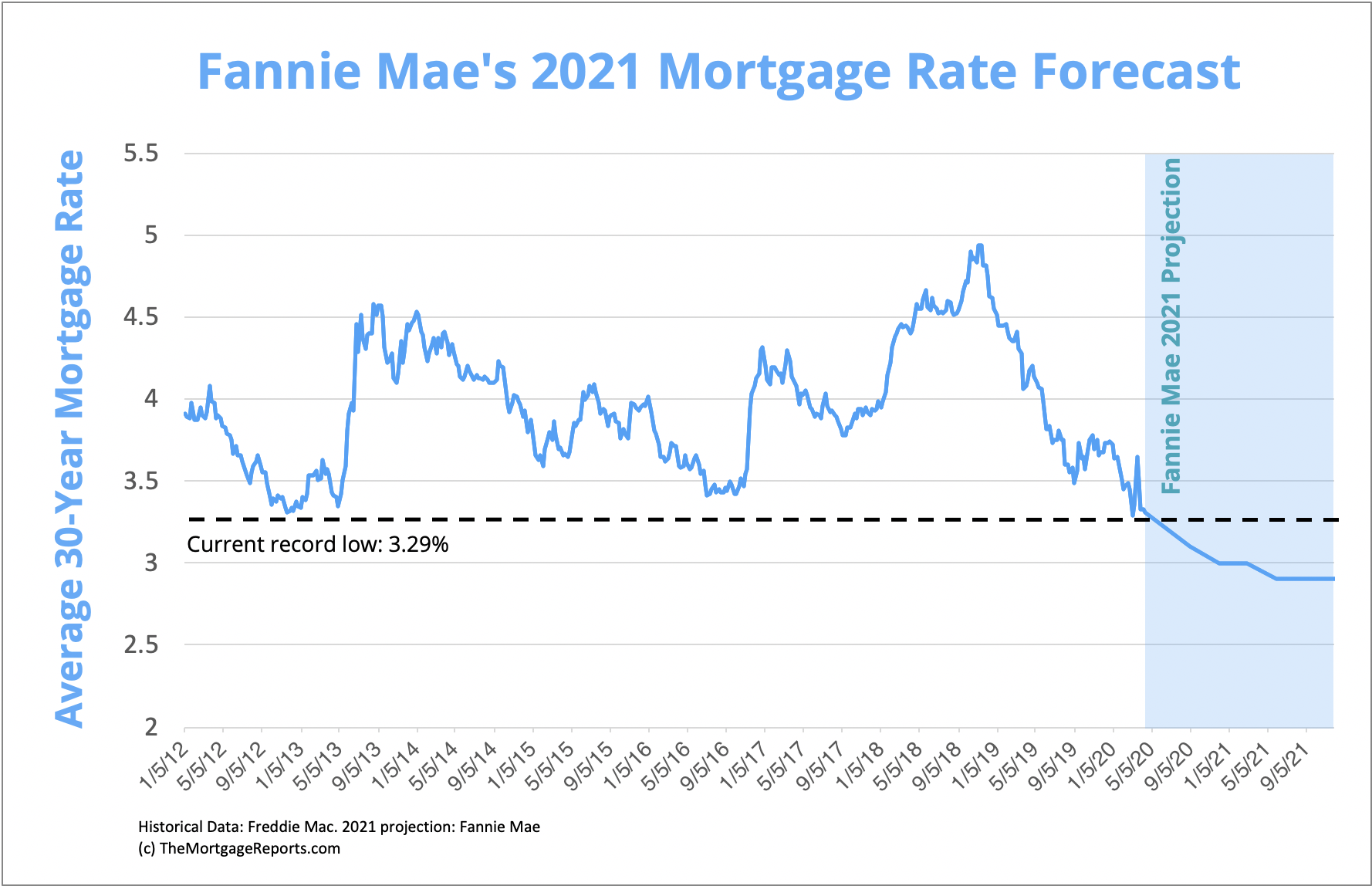

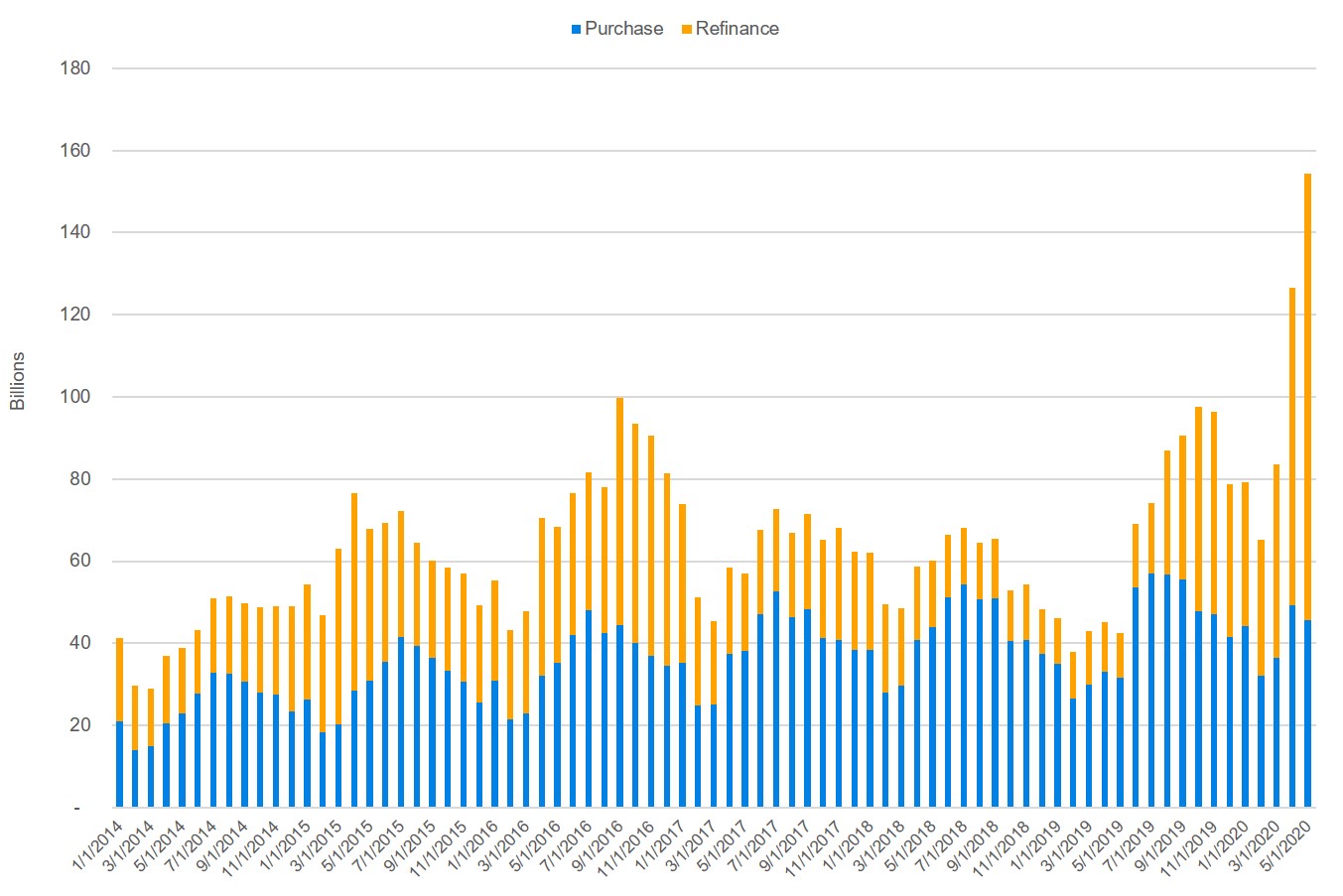

Fannie Mae Predicts Highest Refinancing Volume In Nearly A Decade National Mortgage News

Fannie Mae Predicts Highest Refinancing Volume In Nearly A Decade National Mortgage News

Atlantic Mortgage Services Purchase

Fannie Mae Requirements For Investor And Second Home Borrowers With Five To Ten Financed Properties Iloan Home Mortgage

Fannie Mae Requirements For Investor And Second Home Borrowers With Five To Ten Financed Properties Iloan Home Mortgage

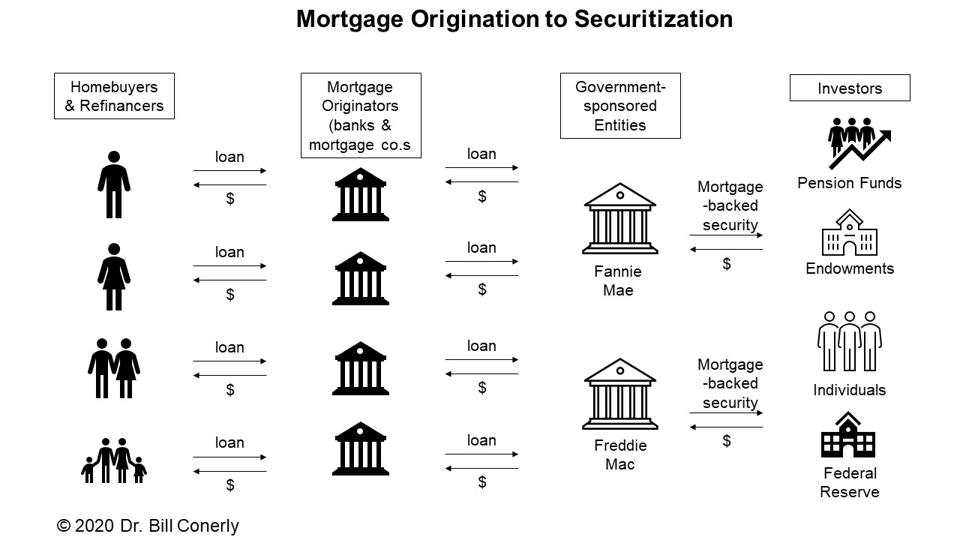

Mortgage Backed Security Wikipedia

Mortgage Backed Security Wikipedia

Fannie Mae Du Refi Plus Program

Fannie Mae Du Refi Plus Program

30 Year Fixed At 3 5 With 0 Points Fannie Mae And Freddie Mac To Raise Rates Mortgage News And Rates

30 Year Fixed At 3 5 With 0 Points Fannie Mae And Freddie Mac To Raise Rates Mortgage News And Rates

Mortgage Rate Decline Slowed By New Fee Charged By Fannie Mae And Freddie Mac

Mortgage Rate Decline Slowed By New Fee Charged By Fannie Mae And Freddie Mac

Du Job Aid Entering The Data For A Refinance Loan

Du Job Aid Entering The Data For A Refinance Loan

Breaking This Agency Predicts 2 9 Mortgage Rates By 2021 Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Breaking This Agency Predicts 2 9 Mortgage Rates By 2021 Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Loan Underwriting Fannie Mae Guidelines Allow For 95 Ltv On Purchase And Rate Term Refinance For 1 Unit Properties 85 Loan To Value For Cash Out Refinances

Fannie Mae Freddie Mac Unveil New Refinance Program For Low Income Families New American Funding

Fannie Mae Freddie Mac Unveil New Refinance Program For Low Income Families New American Funding

Fannie Mae S 2021 Mortgage Forecast Boosted As Covid 19 Vaccine Circulates National Mortgage News

Fannie Mae S 2021 Mortgage Forecast Boosted As Covid 19 Vaccine Circulates National Mortgage News

Comments

Post a Comment