Featured

Llc Business Loan

The purpose of the Business Industrial BI Guaranteed Loan Program is to improve develop or finance business industry and employment and improve the economic and environmental climate in rural communities. Set forth the loan amounts the expectation of repayment the LLCs repayment schedule and the consequences of failure to make a timely payment.

Sba Loans And Sba Funding By Sba Loan Group All Business Loans Sba Loans And Sba Funding By Sba Loan Group

Sba Loans And Sba Funding By Sba Loan Group All Business Loans Sba Loans And Sba Funding By Sba Loan Group

Apply for a d-u-n-s number from Dun Bradstreet.

Llc business loan. Here are the basics of how to apply for an LLC loan. The process of getting money for an LLC loan is different from taking out a personal loan. The Economic Injury Disaster Loan while yes is technically a loan includes a 10000 grant for eligible businesses.

The CARES Act allowed these credits for wages paid after March 12. Some loan programs set restrictions on how you can use the funds so check with an SBA-approved lender when requesting a loan. Can I borrow money from my LLC.

Clearly designate the relationship between you the creditor and your LLC the debtor. In the operating agreement it stats who is responsible who can take out loans what can be completed. Get 500 to 55 million to fund your business.

Loans guaranteed by the SBA range from small to large and can be used for most business purposes including long-term fixed assets and operating capital. If you are a member of a limited liability company LLC you can borrow money from the company. Find a Commercial Lender.

The answer is yes. Put a paid for property into an LLC to give the LLC some assets. This purpose is achieved by bolstering the existing private credit structure through the guarantee of.

You may qualify for a loan of more than that amount but if you meet the following eligibility criteria you may qualify for a 10000 grant. A business term loan is the quintessential traditional loan type. While some loans are for general business funding others are for specific uses such as working capital loans real estate loans.

Its where a business borrows money usually from a bank. The money is handed over as a lump sum to be repaid over set intervals over a designated period of time. Borrowing Money From Your Business.

Talk to a lender to ensure you are building credit in the companys name and establishing a history for the company. Getting an LLC loan can provide you with a way to get funding for your new business venture. It is also possible to borrow from a 401K plan.

Small-business loans are used for business expenses. Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees. Business and Industrial Loans.

All LLC loans require an operating agreement. Lending Your LLC Money Correctly To have an enforceable loan put the terms in written form. This is usually the simplest way to voluntarily make yourself liable for your companys debts.

If you cosign on a business loan you are as equally responsible as the corporation or LLC to pay it back. You the borrower are personally 100 responsible for the payment the rates are even based of your credit score. To put it simple they are still taking out the loan but its just in llc name.

Be located in a low-income community Have suffered an economic loss greater than 30. One of the advantages of owning your own business is the option to borrow and lend money to your business. Dun Bradstreet is a credit bureau for businesses It reports the payment history from your LLC to creditors.

This allows the LLC to have some LLC owned collateral to secure loans to. There are several advantages to business term loans. An advance of money by a member to a limited liability company LLC classified as a partnership may be in the form of a capital contribution or a loan.

An LLC can grow its business with business loans if it is properly structured so as to increase chances for approval.

Llc Business Loans How To Finance A Limited Liability Company Become

Llc Business Loans How To Finance A Limited Liability Company Become

Llc Business Loans How To Finance A Limited Liability Company Become

Llc Business Loans How To Finance A Limited Liability Company Become

3 Basic Business Loan Requirements

3 Basic Business Loan Requirements

Llc Business Loans How To Finance A Limited Liability Company Become

Llc Business Loans How To Finance A Limited Liability Company Become

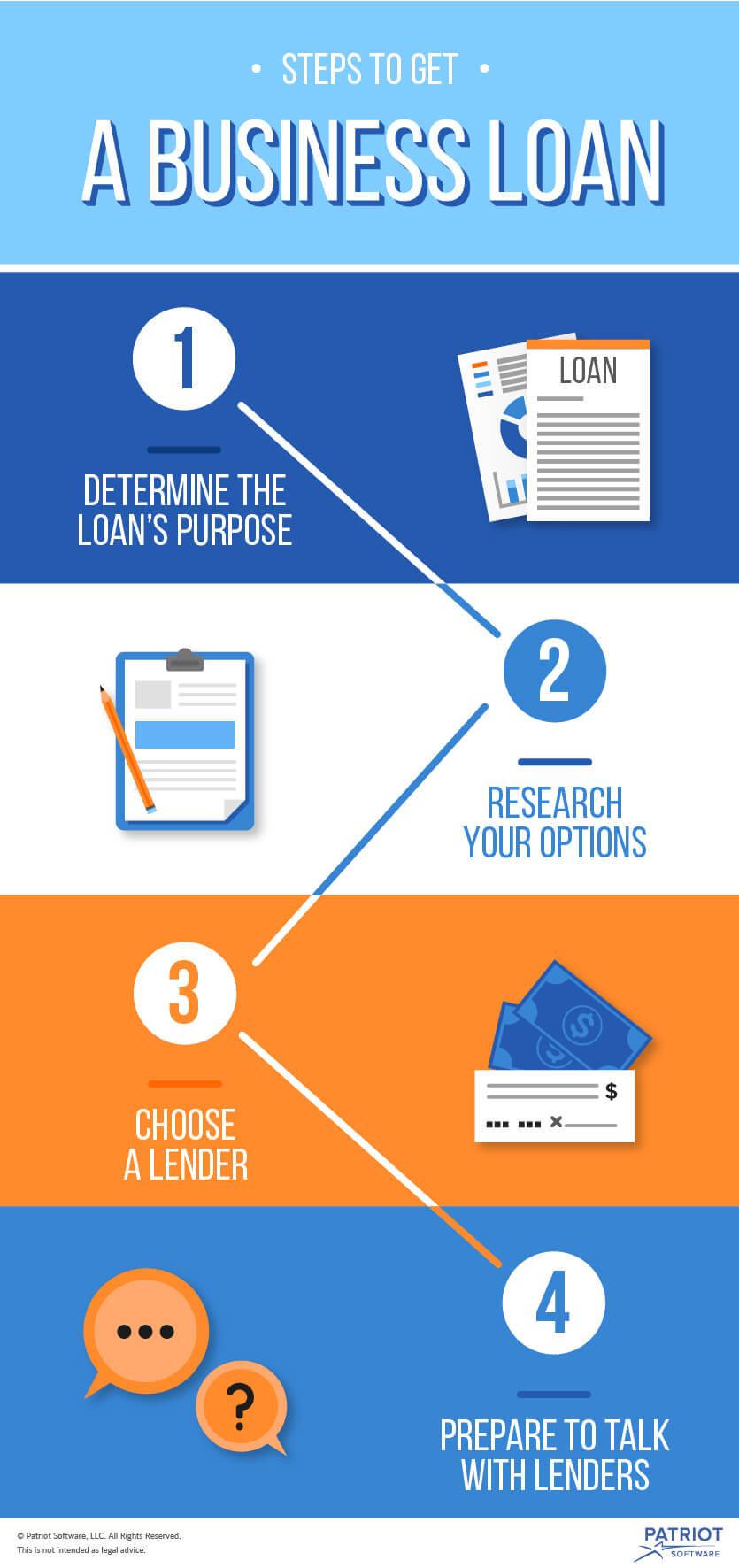

Small Business Loans How To Get A Small Business Loan Truic

Small Business Loans How To Get A Small Business Loan Truic

Considerations Before Small Business Loans Business Funding

Considerations Before Small Business Loans Business Funding

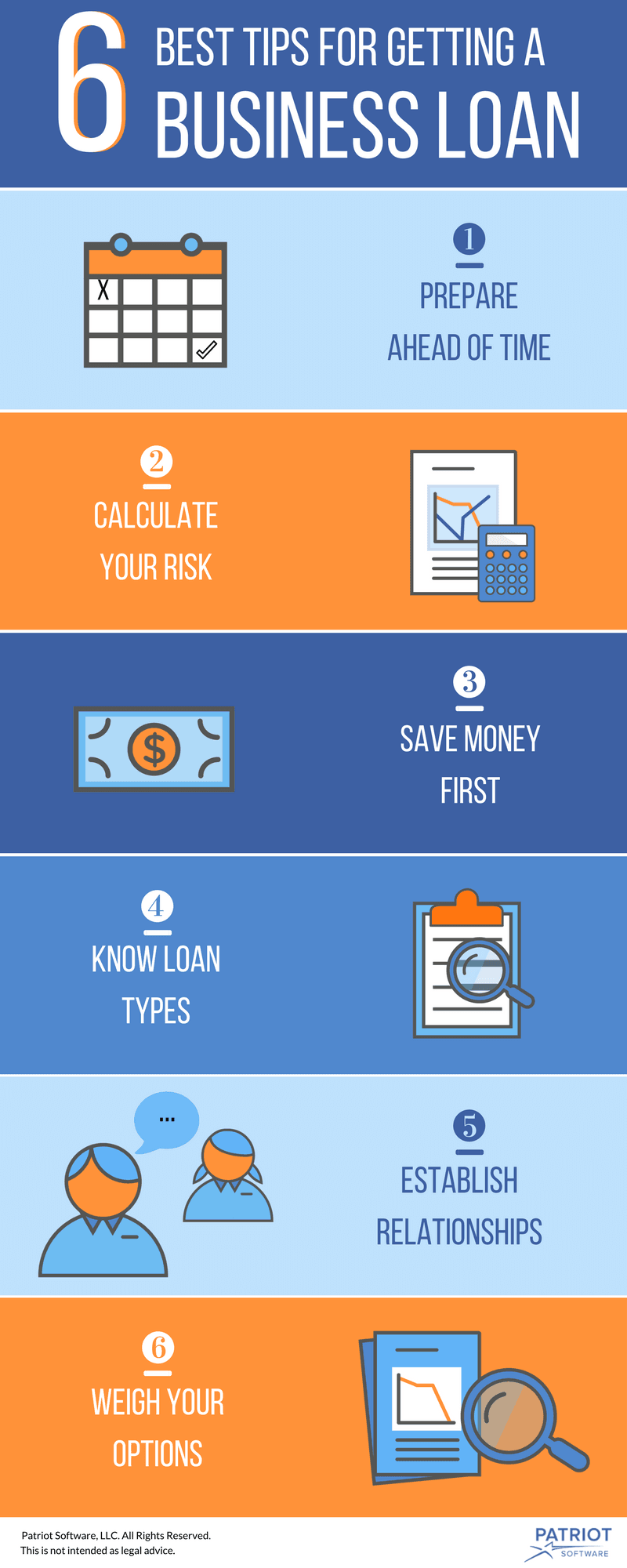

Best Small Business Loan Tips How To Improve Your Chances

Best Small Business Loan Tips How To Improve Your Chances

How To Get A Small Business Loan Tips To Improve Your Chances

How To Get A Small Business Loan Tips To Improve Your Chances

Llc Business Loans How Can You Get One Lending Valley

Llc Business Loans How Can You Get One Lending Valley

Small Business Loans How Hard Is It To Get A Bank Loan Explained By Dallin Hawkins With Integrity Financial Groups Llc Newswire

Small Business Loans How Hard Is It To Get A Bank Loan Explained By Dallin Hawkins With Integrity Financial Groups Llc Newswire

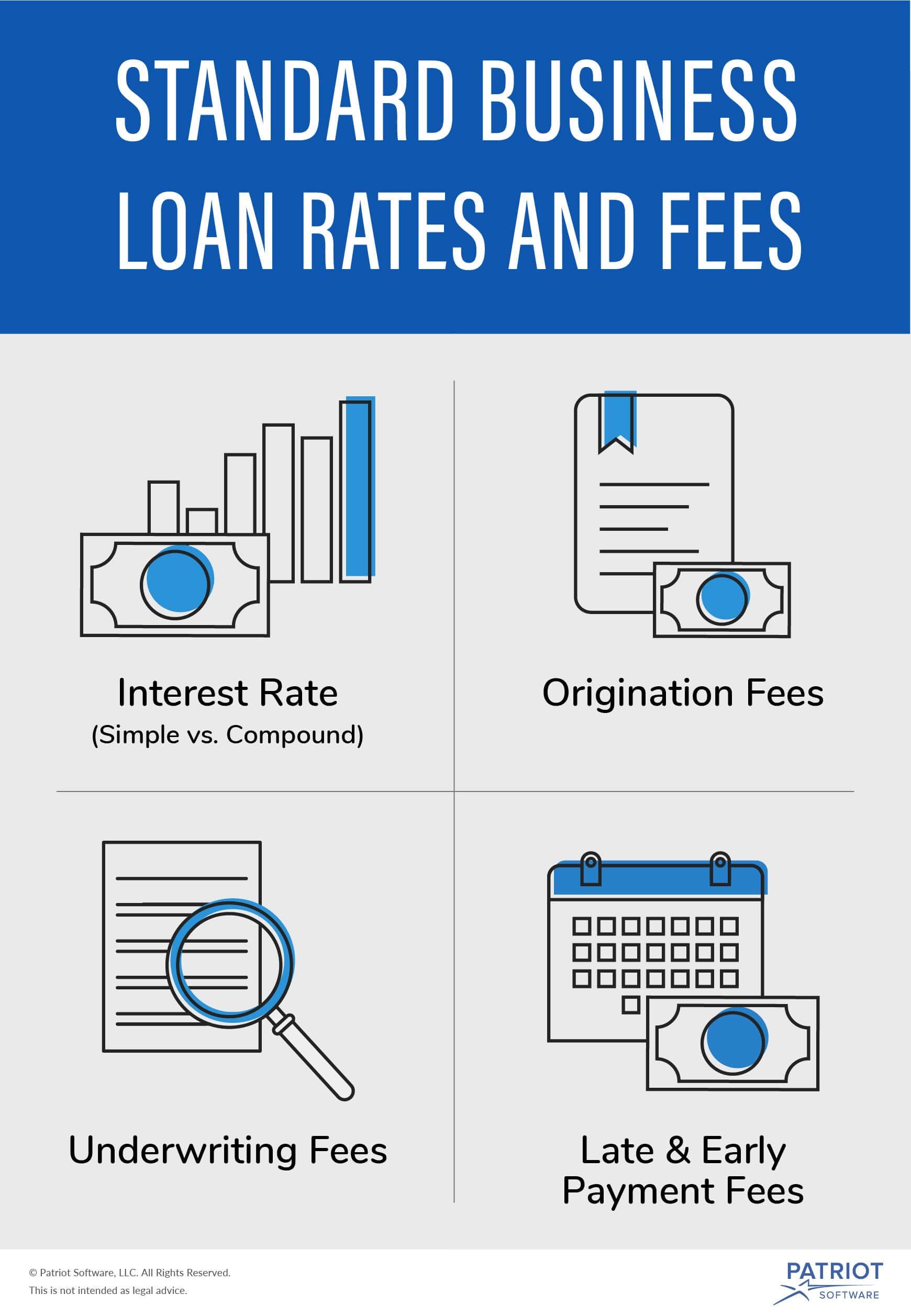

Business Loan Rates And Fees You Need To Know About

Business Loan Rates And Fees You Need To Know About

Sba Loan Requirements How To Get An Sba Loan

Sba Loan Requirements How To Get An Sba Loan

7 Simple Steps On How To Apply For A Business Loan

7 Simple Steps On How To Apply For A Business Loan

Comments

Post a Comment