Featured

What Does Child Tax Credit Mean

For the tax year 2021 if you claim the child tax credit you will receive up to 3000 per qualifying child between the ages of 6 and 17 at the end of 2021 the IRS explains. But because the credit is non.

SEE MORE 2021 Child Tax Credit Calculator Presently the child tax credit is worth 2000 per kid under the age of 17 whom you claim as a dependent and who has a Social Security number.

What does child tax credit mean. At a basic level the child tax credit is a credit that parents and caregivers can claim to help reduce their tax bill depending on the number and. The measure would increase the amount of the child tax credit to 3600 per child under 6 and 3000 per child between the ages of 6 and 18. If your child tax credit exceeds the amount taxes owed you can receive.

So what exactly is the Child Tax Credit. It also expands the ages of children eligible which was previously capped at age 17. Under current law up to 1400 of the credit is refundable.

Similar to other credits the child tax credit lowers the amount you owe in taxes. How much will you receive. What is the child tax credit.

The measure is generally referred to as a child tax credit but that doesnt completely capture the impact it will have on most American families. How the advance child tax credit differs from last year The first thing to know is you wont get your child tax credit payments all at once this. The child tax credit is a tax credit intended to make caring for children or qualifying dependents more affordable for working families.

Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund. There are requirements stating. For each qualifying child.

The Child Tax Credit is given to parents and caregivers to help reduce their tax bill. The credit includes children who turn 17 in 2021. A tax credit reduces the amount of taxes owed dollar for dollar.

The child tax credit is a tax benefit granted to American taxpayers for each qualifying dependent child. 1 Designed to help taxpayers support their families this credit has been greatly expanded. While the 500 credit for older dependents is nonrefundable up to 1400 of the 2000 child tax credit can be refunded.

What is the Child Tax Credit CTC. The Child Tax Credit which has been expanded significantly by Congress since it was first written into law nearly 25 years ago is a significant element of. That is up from a maximum benefit of 2000 under the current policy.

The child tax credit typically works by lowering the amount of federal income tax parents owe by 2000 per qualifying child which parents could either write off on their W-4 or at the end of the year on their tax return. The advance child tax credit program is part of the Biden administrations 19 trillion economic aid package called the American Rescue Plan that was passed. Additionally you may receive part of the credit in 2021 before filing your 2021 tax return.

The Republican-led 2017 tax overhaul doubled the credit to 2000 per child under 17 and added a 500 credit for older children and other dependents. Under the existing policy American taxpayers can claim a credit of up to 2000 for each qualifying child a US citizen under the age of 17 who has lived with the taxpaying caregiver for a minimum of six months. What is Biden Proposing.

Traditionally the child tax credit provides parents who earn at least 2500 with a 2000 credit for each child under 17. Mario TamaGetty Images FILE. In addition to increasing the amounts of the credits Bidens plan would make the tax credit fully refundable.

But under the new rules they could receive the full 3000 or 3600. Instead of simply reducing the tax burden the credit will be dispensed in periodic payments to people who qualify functioning sort of like a version of temporary universal basic income for families with kids. The goal is to get more money into the hands of qualifying parents by reducing the taxes that come out of their paycheck.

The tax credit is refundable if you dont owe any taxes which means you can.

What Is Child Tax Credit What Does Child Tax Credit Mean Child Tax Credit Meaning Explanation Youtube

What Is Child Tax Credit What Does Child Tax Credit Mean Child Tax Credit Meaning Explanation Youtube

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

The Truth Behind The Expanded Child Tax Credit For Montana Families Montana Budget Policy Center

The Truth Behind The Expanded Child Tax Credit For Montana Families Montana Budget Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

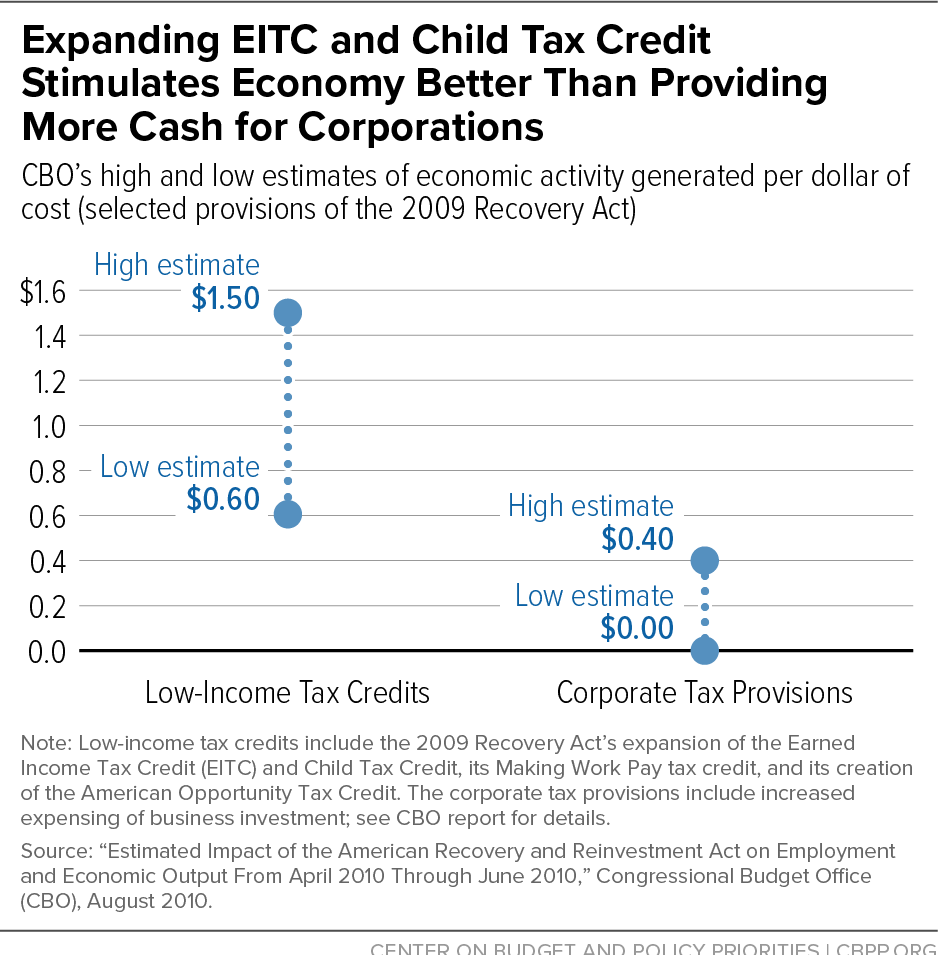

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

This Year S Child Tax Credit Could Mean Extra Money In Your Pocket By Summer Cbs Pittsburgh

This Year S Child Tax Credit Could Mean Extra Money In Your Pocket By Summer Cbs Pittsburgh

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

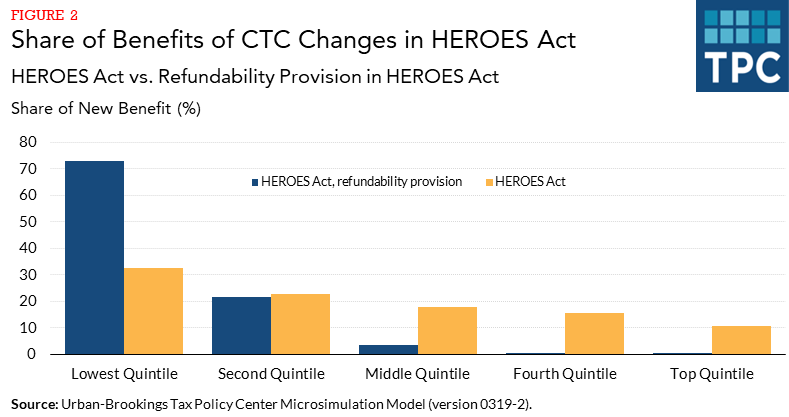

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png) Can You Claim A Child And Dependent Care Tax Credit

Can You Claim A Child And Dependent Care Tax Credit

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Advanced Child Tax Credit Payments 2021 All You Need To Know Marca

Advanced Child Tax Credit Payments 2021 All You Need To Know Marca

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Comments

Post a Comment