Featured

Honolulu Property Tax

The Net Taxable Value will be mailed to you at the appropriate time. To continue no one typically visits your home.

Oahu Property Taxes 2020 2021 Honolulu County Judy Sobin And Associates

Oahu Property Taxes 2020 2021 Honolulu County Judy Sobin And Associates

Is 035 of the assessed value of the property.

Honolulu property tax. Thank you for using County of Hawaiis online payment service. Real property tax deadline on Thursday February 20 2020. Each year on December 15th the assessment data is updated.

Guide To Honolulu Property Taxes. Pay your real property tax online or by telephone by credit card. Honolulu County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Honolulu County Hawaii.

These records can include Honolulu County property tax assessments and assessment challenges appraisals and income taxes. Online Real Property Tax Payments. These categories are Residential Residential A and Hotel Resort.

You can use the Hawaii property tax map to the left to compare Honolulu Countys property tax to other counties in Hawaii. 1-1-1-001-011-0000-000 and select an amount to pay as shown on your tax bill. The City and County of Honolulu Real Property Assessment and Treasury Divisions.

Certain types of Tax Records are available to the general public while some Tax Records are only. The fee will be disclosed to you when you confirm the payment. City and County of Honolulu Public Access.

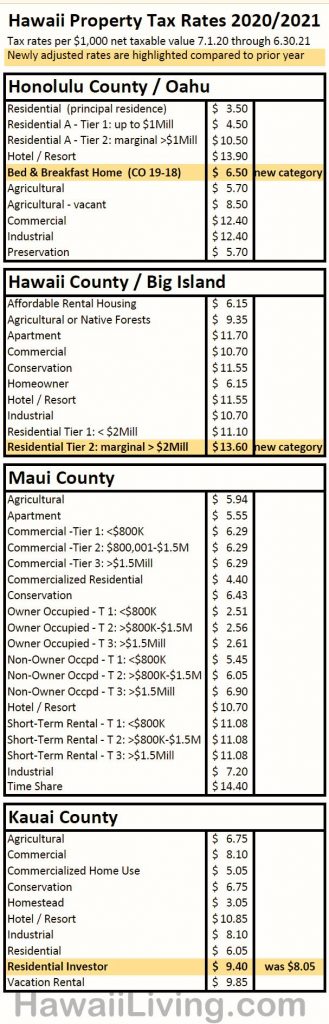

New Hawaii Property Tax Rates 2020 2021. Tax Rate Per 1000 net taxable building and land Agriculture. How is the assessed value of my Hawaii home determined.

You can use a formula to calculate your property tax in Hawaiiyou multiply the Net Taxable Value with the Tax Rate and divide the total by 1000. Service fees associated with online payments will be passed on to you in the form of an additional fee by the online vendor. Property owners receive their October 1st assessment notice as early as December 15th.

Here is the table of Honolulu property tax rates for the fiscal year July 1 2020 through June 30 2021. Tax bills have been mailed to all property. The new assessed value will be used to calculate the property tax for the following fiscal year starting July 1st.

To start the tax assessed value of a home is different from the price a buyer will actually pay for it. Honolulu Payments for the City and County of Honolulus second installment of real property taxes for the 2019-2020 tax year are due by Thursday Feb. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The point of contention is the accuracy of the assessed value. Honolulu County Property Records are real estate documents that contain information related to real property in Honolulu County Hawaii. Property Search Instructions Click Here Real Property Assessment Division - Property Data Search The Property Search tab on the menu bar provides access to individual property tax records of the City and County of Honolulu.

You will be asked to enter the numeric parcel IDTMK example. The average yearly property tax paid by Honolulu County residents amounts to about 172 of their yearly income. Pay your real property tax online or by telephone with a creditdebit card.

Profile map values sales residential commercial out buildings permits skeches photo and buffer information. Honolulu County collects the highest property tax in Hawaii levying an average of 154900 028 of median home value yearly in property taxes while Hawaii County has the lowest property tax in the state collecting an average tax of 68200 019 of median home value per year. Honolulu County is ranked 1744th of the 3143 counties for property taxes as a percentage of median income.

The exact property tax levied depends on the county in Hawaii the property is located in. The link address is. Welcome to the City and County of Honolulus Real Property Assessment and Tax Billing Information website.

You can find the tax rates on the County of Hawaii Real Property Tax Office website. How Does Honolulu Real Property Tax Assessment Work. Service fees apply to each online property tax payment processed.

Online property search by address account or parcel number. A discrepancy of 500K in assessed value translates into a difference of 1750year w 035 residential tax rate or 6950year w 139 resort tax. The property taxes for homes in Honolulu Hawaii can be classified in three categories.

View and download tax plat maps. Owner occupied residental rates remained the same. The tax rate for Oahus new Bed Breakfast Home category is 650 per 1000 assessed value.

Electronic payments will be accepted until further notice. An owner is able to claim home exemption if the property. The fee for a payment made with a credit card will be.

1 the amount due now or 2 new balance. Bed Breakfast Home. They are maintained by various government offices in Honolulu County Hawaii State and at the.

Property Records Search Disclaimer The Real Property Assessment Division RPAD provides general information regarding real property tax assessments and makes no guarantee of the completeness or accuracy of any information provided on its web site. This rate applies to any property where the owner is able to claim home exemption regardless of the assessed value of the property. In addition to these four residential Honolulu property tax rates there are a number of other Oahu property tax rates.

Honolulu Property Tax 2020 21 Fiscal Year

Honolulu Property Tax 2020 21 Fiscal Year

Http Www Honolulu Gov Rep Site Bfs Treasury Docs 2021 Tax Credit Application Pdf

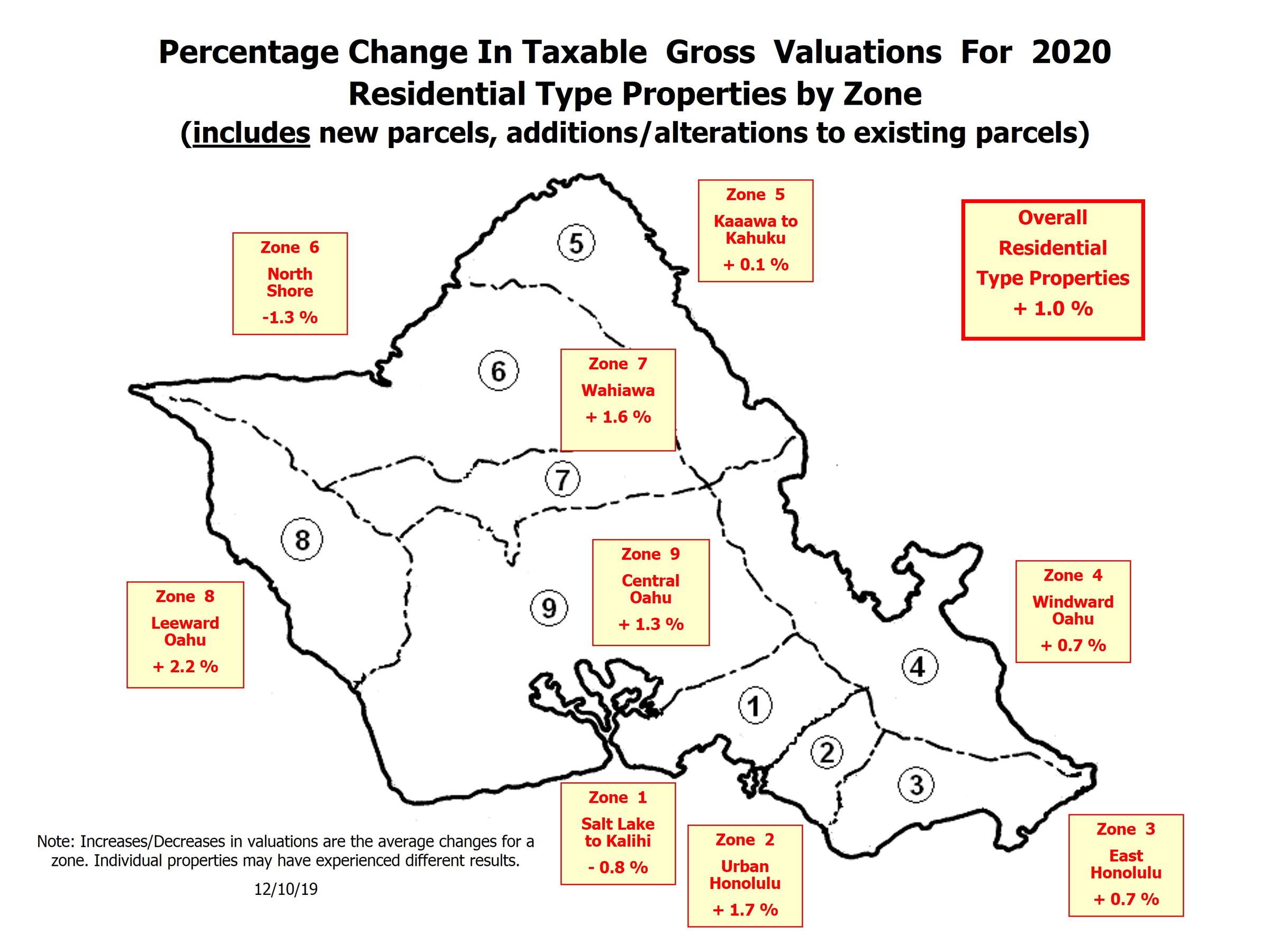

What To Know About Oahu Real Property Assessments Coming To Mailboxes Soon Hawaii Public Radio

What To Know About Oahu Real Property Assessments Coming To Mailboxes Soon Hawaii Public Radio

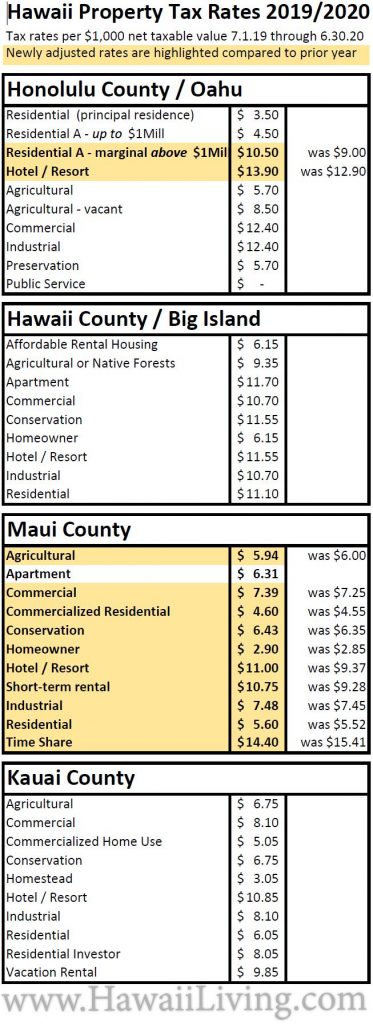

New Hawaii Property Tax Rates 2019 2020

New Hawaii Property Tax Rates 2019 2020

Honolulu Real Property Tax Rates On Oahu Remain Stable For 2012 2013 Oahu Hawaii Real Estate Blog Kailua Real Estate And Oahu Homes For Sale

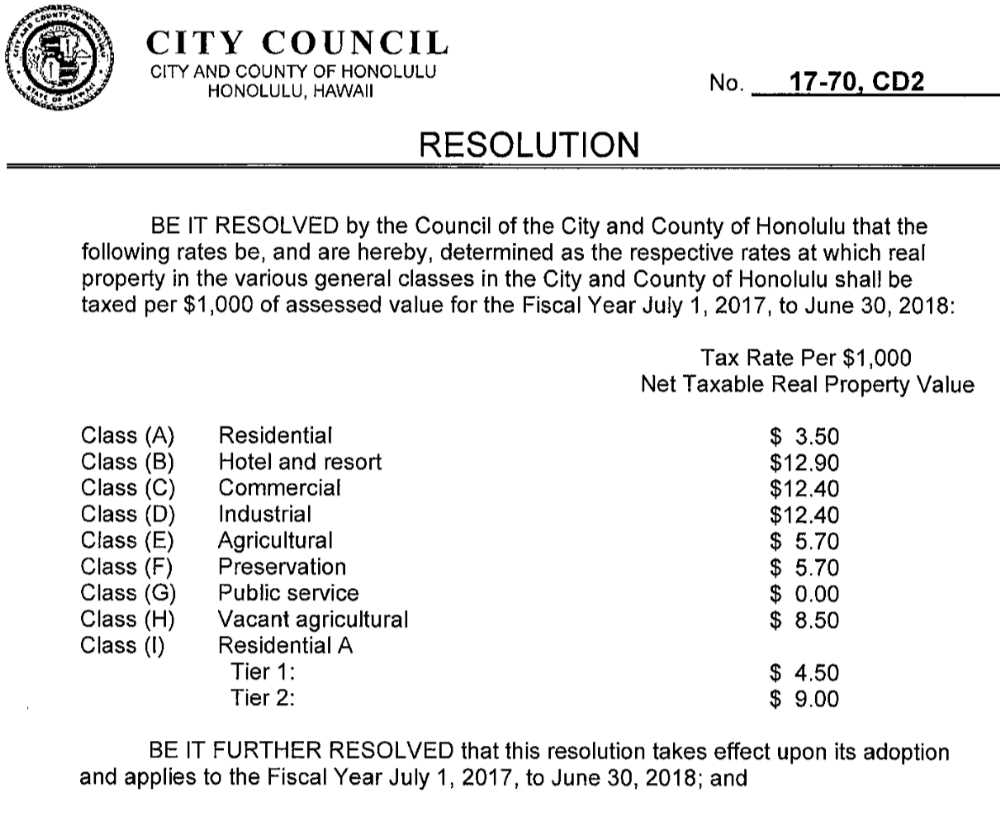

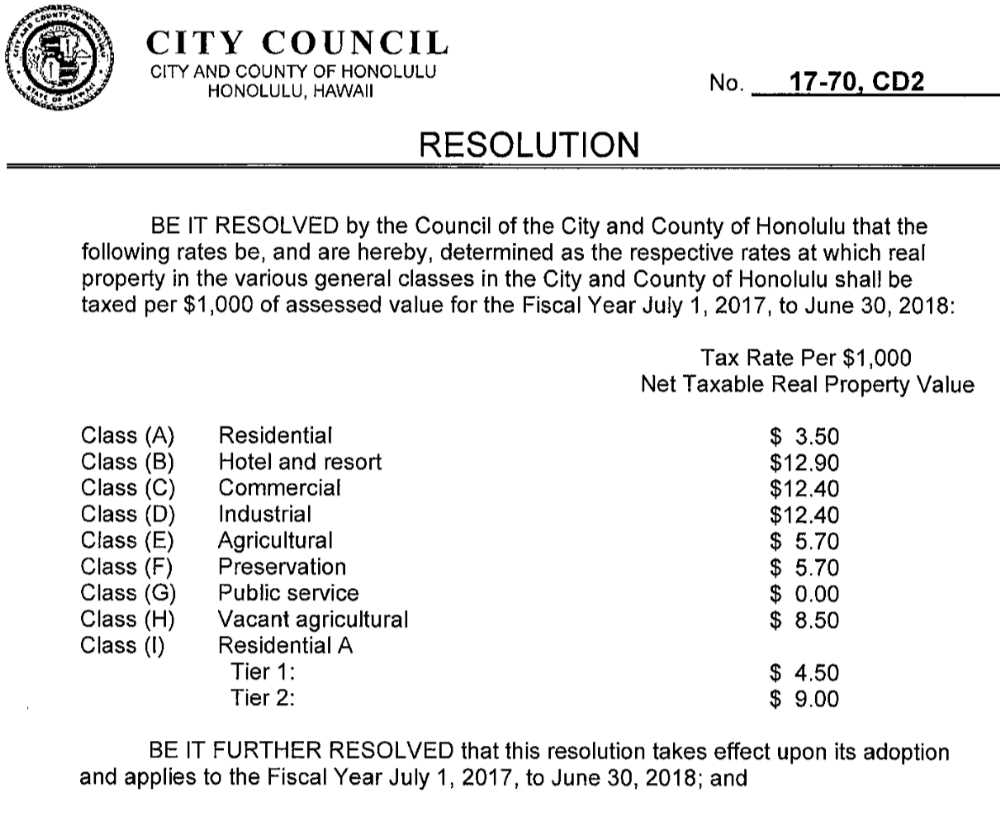

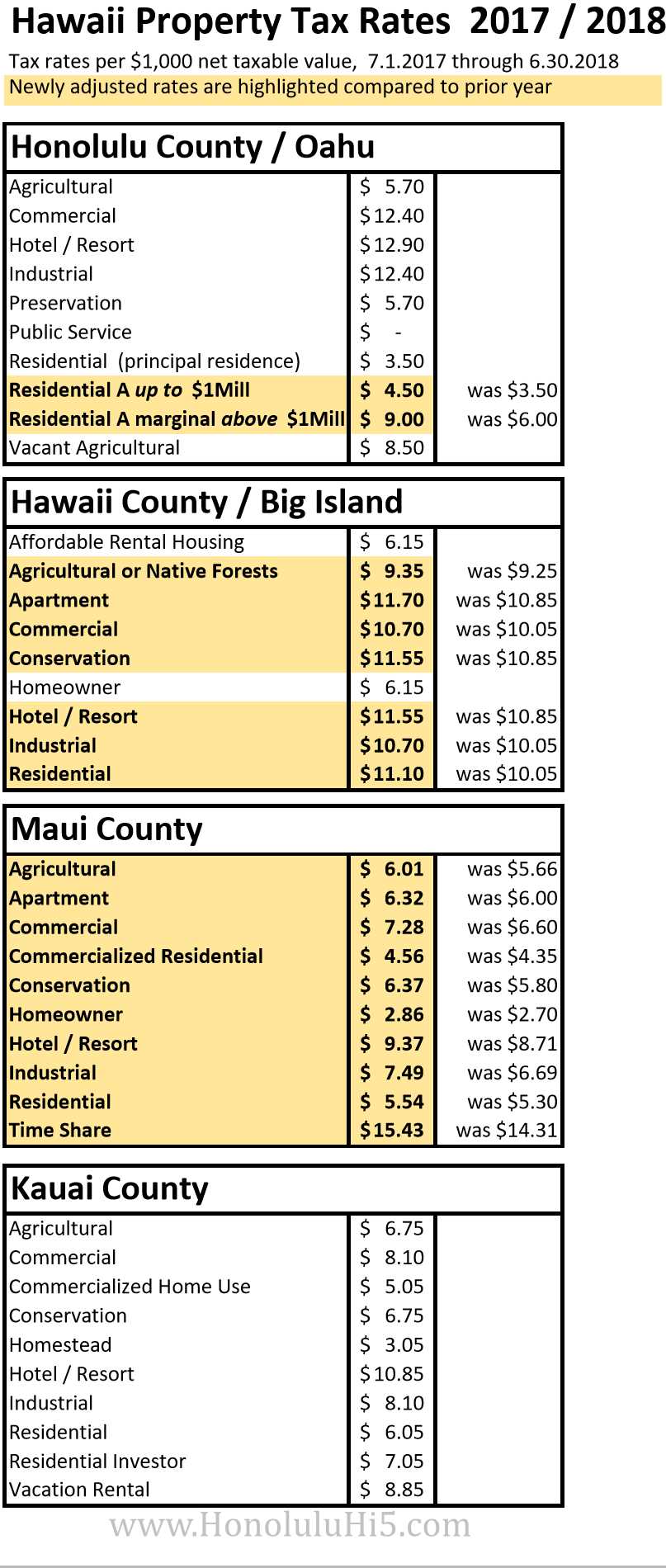

New Hawaii Property Tax Rates 2017 2018

New Hawaii Property Tax Rates 2017 2018

Https Realpropertyhonolulu Com Media 1685 Review Notice Pdf

Little Known Honolulu C C Real Property Tax Credit For Homeowners With Gross Income Under 60 000

Little Known Honolulu C C Real Property Tax Credit For Homeowners With Gross Income Under 60 000

New Hawaii Property Tax Rates 2020 2021

New Hawaii Property Tax Rates 2020 2021

Honolulu Property Tax 2020 21 Fiscal Year

Honolulu Real Property Tax Credit Available Hawaii News Online Independent Trusted

Honolulu Real Property Tax Credit Available Hawaii News Online Independent Trusted

New Hawaii Property Tax Rates 2017 2018

New Hawaii Property Tax Rates 2017 2018

Honolulu Property Tax 2020 21 Fiscal Year

Guide To Honolulu Property Taxes Rates Due Dates How To Pay More

Guide To Honolulu Property Taxes Rates Due Dates How To Pay More

Comments

Post a Comment