Featured

- Get link

- X

- Other Apps

Low Volatility Factor

Several explanations have been proposed for the low volatility anomaly. The notion that greater risk pays off in the long run by generating higher returns has been proven incorrect by academic research.

Factor Investing The Paradox Of Low Volatility Special Report Ipe

Factor Investing The Paradox Of Low Volatility Special Report Ipe

Yields low risk-adjusted returns.

Low volatility factor. Robert Haugen who discovered the low-volatility anomaly in 1972 wrote numerous articles and books to try to popularise what he called the hidden factor. Academic Factor Portfolios are Extremely Painful. A Low Volatility strategy is highly appealing from a risk perspective but results in a portfolio of unexciting stocks which is equally difficult to hold.

Why these factors generate excess returns is not clear. Unless you are an Alien. The same can be said for low beta stocks.

Low volatility factor volatility Investors have been rushing into Low Volatility products over the last few years as the factor performance was strong and supportive research was published. Low volatility or low risk is expressed by purchasing assets with the least movement or the least volatility over a set period or optimizing a basket of assets designed to produce the lowest movement. Soe in The low-volatility effect.

Or as Wes eloquently put it. The notion of buying stocks which typically have higher returns than bonds but with low volatility is an intuitively appealing strategy it almost sounds like a free lunch. The low-risk effect aka low volatility is based on the empirical observation that assets with low risk have high alpha.

A factor that we like at The Index Standard is low volatility. The same is true for corporate bonds. Constraints for or aversion to the use of leverage andor shorting thereby driving investors to high-volatility stocks.

MSCI EM Low Volatility Factor Net Overzicht Hieronder zult u informatie aantreffen over de MSCI International EM Low Volatility Factor Net Real time inhoudsopgave. Like quality low volatility is a defensive factor that protects investors from heavy losses in bear markets while also capturing most of the gains to be had during market upturns. A comprehensive look claims that volatility-effect challenges the traditional equilibrium asset pricing theory that an assets expected return is directly proportional to its beta or systematic risk or in other words higher-risk securities should be rewarded with higher expected returns while lower-risk assets receive lower expected returns.

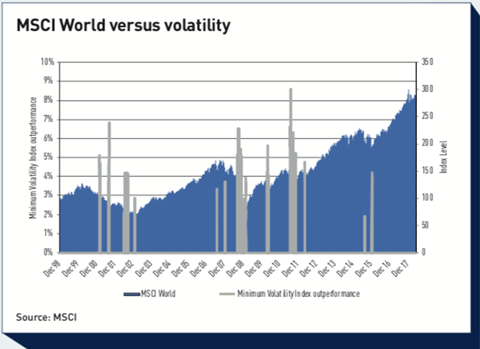

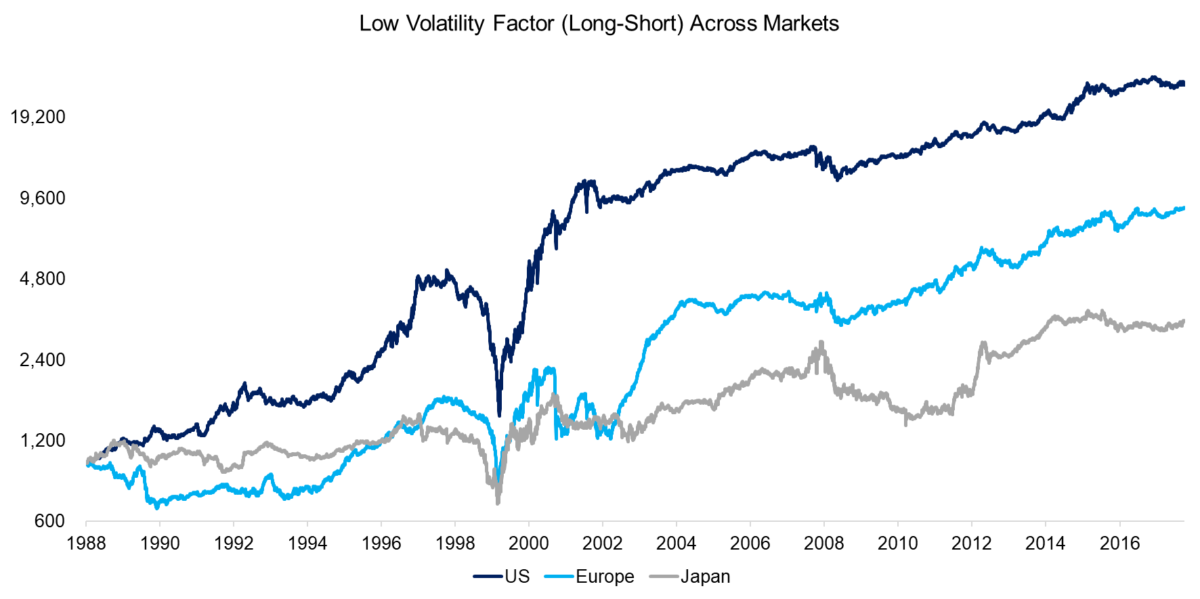

Specifically in this research the effect is defined as the risk-adjusted return spread between low-risk and high-risk portfolios and not just low-risk stocks. To some extent it was only the advent of smart beta investment strategies that turned his dream into reality as low volatility is central to the smart beta approach. The low volatility factor has been pervasive across geographies and asset types for the past 90 years.

The low volatility factor provides a mechanism for investors to control risk while generating similar if not superior investment returns relative to the market over the long run. The PowerShares Low Volatility Portfolio PLV combines all four of these ETFs as well as two US-listed funds and a 30 allocation to a bonds in a globally balanced portfolio. Furthermore I find that momentum and low-volatility have low correlation.

Most factors 1 do quite well in an above median VIX-environment when volatility levels are relatively high. Low volatility stocks realize comparatively high risk-adjusted returns. Starting from 1960 onwards does a low idiosyncratic volatility factor strategy start to generate positive returns but in earlier periods there is no evidence for the existence of this phenomenon.

U kunt meer informatie vinden door naar een van de secties op deze pagina te gaan zoals historische data grafieken technische analyse en anderen. Low volatility is very asymmetric in that regard. The Low Vol factor as a driver of equity stock returns The low volatility risk factor seeks to exploit the historic tendency for securities with smaller price fluctuations to give higher returns.

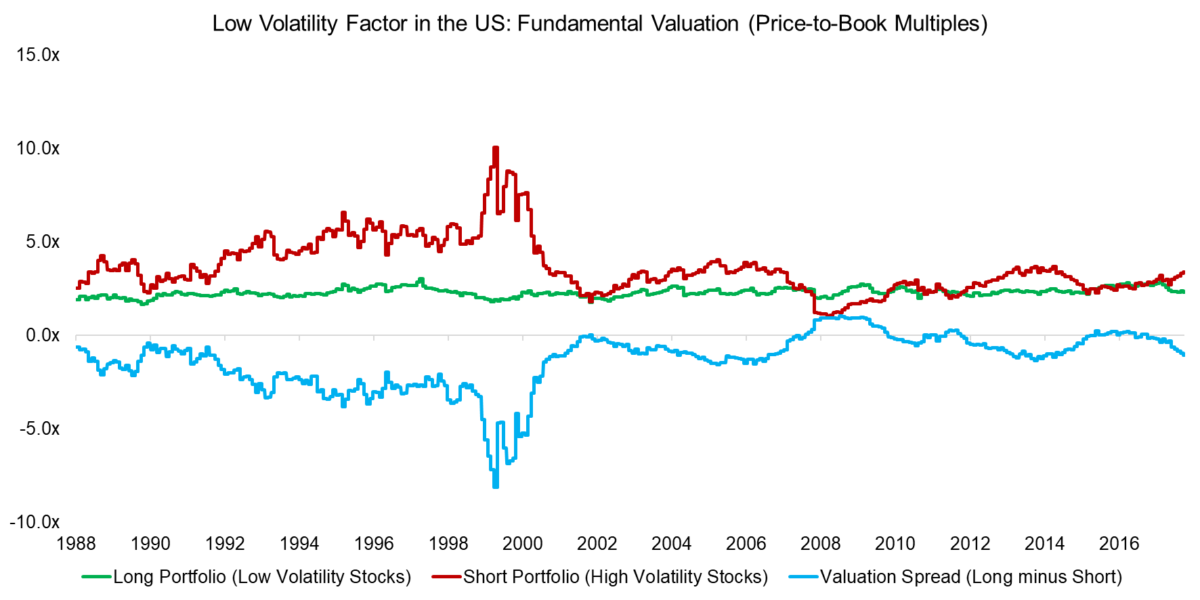

Timing Low Volatility With Factor Valuations

Timing Low Volatility With Factor Valuations

Low Volatility Factor Effect In Stocks Quantpedia

Low Volatility Factor Effect In Stocks Quantpedia

What Is Low Volatility And Why Does It Matter Invesco

What Is Low Volatility And Why Does It Matter Invesco

Low Volatility Factor Quant Investing

Low Volatility Factor Quant Investing

Low Volatility Factor Quant Investing

Low Volatility Factor Quant Investing

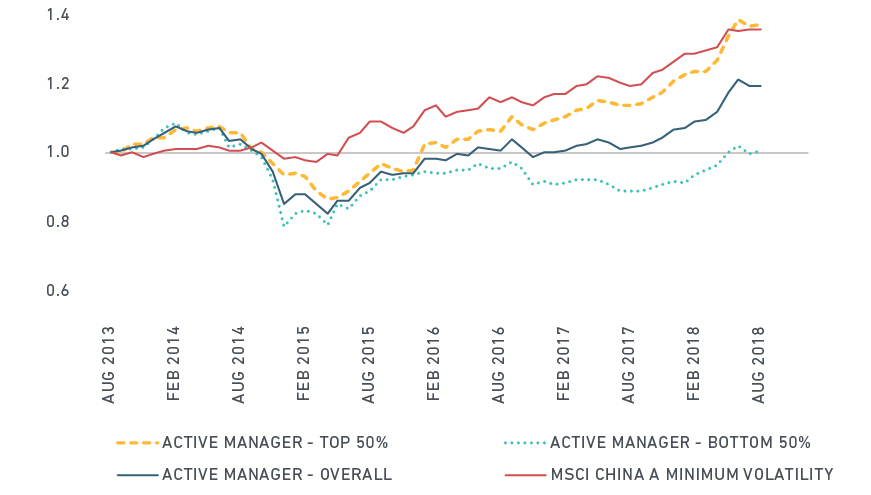

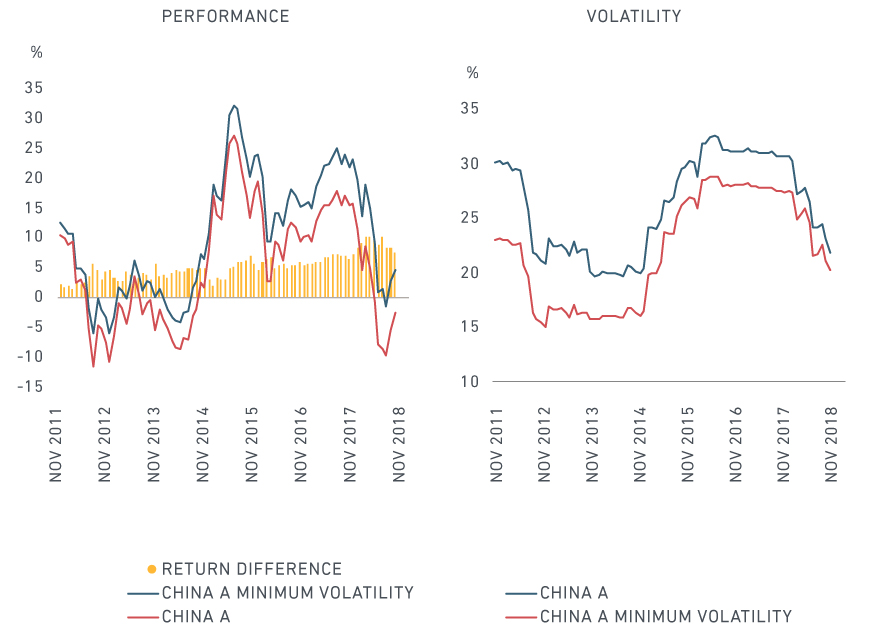

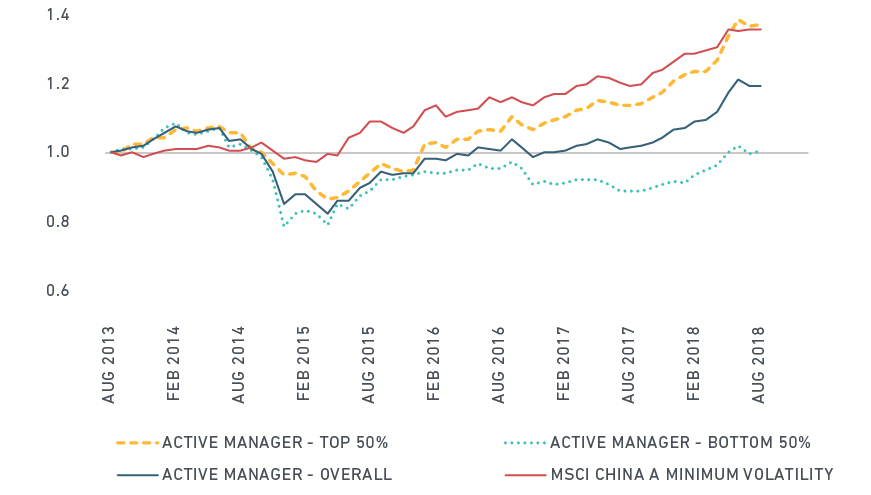

How The Low Volatility Factor Has Performed In China A Shares Msci

How The Low Volatility Factor Has Performed In China A Shares Msci

How The Low Volatility Factor Has Performed In China A Shares Msci

How The Low Volatility Factor Has Performed In China A Shares Msci

Low Vol Factor From Obscurity To Stardom

Low Vol Factor From Obscurity To Stardom

What Is Low Volatility And Why Does It Matter Invesco

What Is Low Volatility And Why Does It Matter Invesco

How The Low Volatility Factor Has Performed In China A Shares Msci

How The Low Volatility Factor Has Performed In China A Shares Msci

Low Volatility Equities Under Covid 19

Low Volatility Equities Under Covid 19

Timing Low Volatility With Factor Valuations

Timing Low Volatility With Factor Valuations

Low Volatility Factor Performance Institutional Investor

Low Volatility Factor Performance Institutional Investor

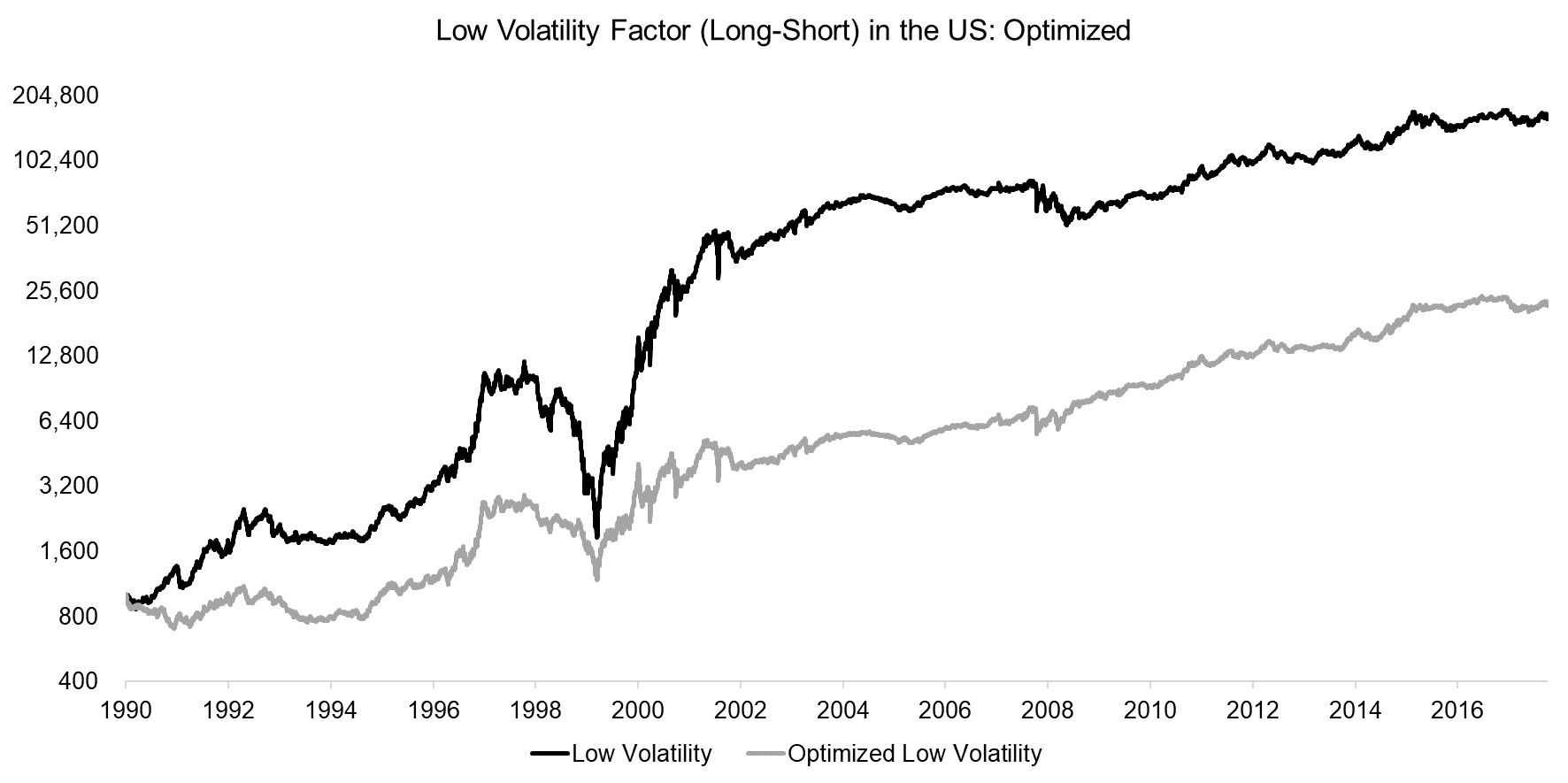

Constructing Low Volatility Strategies Msci

Comments

Post a Comment