Featured

- Get link

- X

- Other Apps

Fidelity Volatility Etf

Fidelity Low Volatility Factor ETF. Let us help you get the answers by reading more here.

The Fidelity Low Volatility Factor ETF FDLO tracks a proprietary index of large- and mid-cap US.

Fidelity volatility etf. Normally investing at least 80 of assets in securities included in the Fidelity US. If you use ETFs Fidelity offers the iShares SP 500 ETF. Why invest in this ETF.

For example a min vol ETF might exhibit less risk during market turbulence compared with a broadly diversified index. Fidelity Low Volatility Factor ETF FDLO More information. The fund seeks to provide investment returns that correspond before fees and expenses generally to the performance of the Fidelity US.

With mid caps soaring this year volatility reduction may not be top of mind for many investors. Low Volatility Factor Index which is designed to reflect the performance of stocks of large and mid-capitalization US. Volatility ETPs are intended for short-term trading and should not be used as a buy and hold investment.

A min vol ETF as well as other min vol investment vehicles attempts to reduce exposure to volatility by tracking indexes that aim to provide lower-risk alternatives to other riskier investments. If an issuer changes its ETFs it will also be. Companies with lower volatility than the broader market.

Low Volatility Factor Index which is designed to reflect the performance of stocks of large and mid-capitalization US. The metric calculations are based on US-listed Low Volatility ETFs and every Low Volatility ETF has one issuer. An Overview of Factor Investing PDF Fidelity Index Rebalance Schedules Methodologies.

FIDELITY LOW VOLATILITY FACTOR ETF mit aktuellem Kurs Charts News und Analysen. Low Volatility Factor IndexSM. Low Volatility Factor IndexSM.

The fund seeks to provide investment returns that correspond before fees and expenses generally to the performance of the Fidelity US. An outcome-oriented approach that seeks to provide market-like returns with lower volatility. The third component of the.

Single-factor exposure to companies with lower volatility than the broader international equity market. Timothy Plan US Small Cap Core ETF 316 TPIF. The funds sector allocations are broadly similar to the Russell 1000 index though there is some variation.

Aktueller Fondskurs Charts Nachrichten Realtime ISIN. The Morningstar Analysis section contains a thorough evaluation of an. Or view all ETF-related topics at our Learning Center.

FDLO owns more than 100 securities and so may not be diversified enough to stand alone as. Stocks that are less susceptible to market swings. Fidelity Low Volatility Factor ETF 453 TPSC.

At Fidelity the index fund of choice to get broad US. The fund seeks to provide investment returns that correspond before fees and expenses generally to the performance of the Fidelity US. Volatility ETPs should not be expected to appreciate over.

Fidelity Viewpoints provides stock volatility insight for people looking for clarity during a volatile market. Exchange traded products ETPs that offer exposure to stock market volatility Volatility ETPs entail significant risk and are intended for very experienced aggressive sophisticated investors who actively manage their investments daily. Low Volatility Factor Index which is designed to reflect.

Timothy Plan International ETF 144 Top Redemptions. You might also see these types of investments referred to as low volatility ETFs. Normally investing at least 80 of assets in securities included in the Fidelity US.

If you use ETFs the commission-free iShares ETF is AGG ER 005. Learn about factor ETFs. ETPs Prospectus Stated Objectives.

FIDELITY INTERNATIONAL LOW VOLATILITY INDEX ETF Fond. Yet those those looking for engagement with an asset class with reduced turbulence can consider the Invesco SP MidCap Low Volatility ETF XMLV CXMLV follows the SP MidCap 400 Low Volatility Index which is home to the 80 members of the SP MidCap 400 with the lowest. Fidelity Low Volatility Factor ETF FDLO Portfolio - ARCX Morningstar.

Normally investing at least 80 of assets in securities included in the Fidelity US. Fidelity Low Volatility Factor ETF FDLO. Learn more about factor investing and how to use strategic factors in your investing style with select articles and courses below.

ETF issuers who have ETFs with exposure to Low Volatility are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. Bonds because a 100 stock portfolio has a lot of volatility. Bond exposure is FXNAX ER 0025.

Most investors will want some exposure to US. Companies with lower volatility than the broader market. Low Volatility Factor IndexSM.

About Fidelity Low Volatility Factor ETF The investment seeks to provide investment returns that correspond before fees and expenses generally to the performance of the Fidelity US. An efficient complement to a well-diversified portfolio.

Fidelity Low Volatility Factor Etf Usd Fdlo Price Us3160928244 Marketscreener

Fidelity Low Volatility Factor Etf 1 Statistics Netdania Com

Using Low Volatility Etfs In Uncertain Markets

Fidelity Real Estate Msci Etf Frel Stock Volatility

Fidelity Real Estate Msci Etf Frel Stock Volatility

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Day_Trade_Volatility_ETFs_Nov_2020-01-75599a6b78da4f37ae8a08ebebfa465b.jpg) How To Day Trade Volatility Etfs

How To Day Trade Volatility Etfs

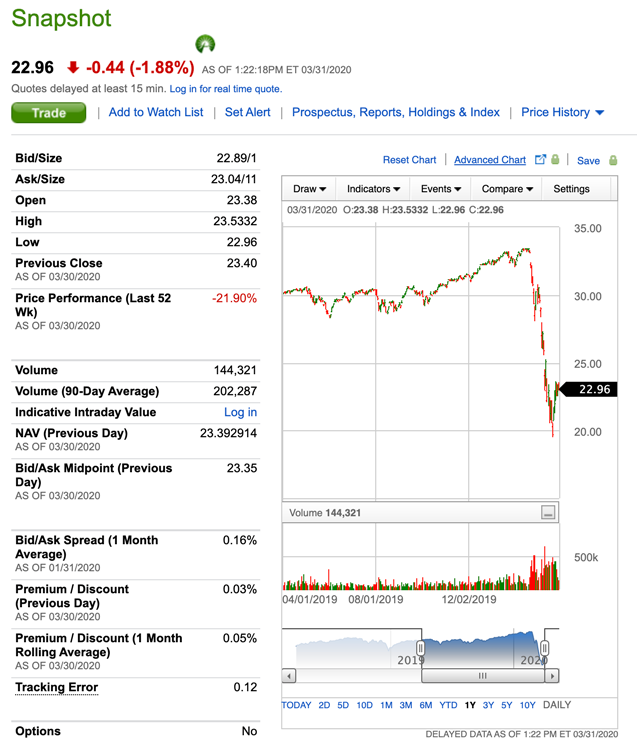

Fidelity Low Volatility Factor Etf Fdlo Stock Performance In 2020

Fidelity Low Volatility Factor Etf Fdlo Stock Performance In 2020

Counting On An Economic Recovery Or Low Volatility 2 Fidelity Etfs Cover That Investing Com

Counting On An Economic Recovery Or Low Volatility 2 Fidelity Etfs Cover That Investing Com

Seeking Shelter In Volatile Markets Fidelity

Seeking Shelter In Volatile Markets Fidelity

Counting On An Economic Recovery Or Low Volatility 2 Fidelity Etfs Cover That Investing Com

Counting On An Economic Recovery Or Low Volatility 2 Fidelity Etfs Cover That Investing Com

Using Low Volatility Etfs In Uncertain Markets

Comments

Post a Comment