Featured

Invest In Jd Or Alibaba

In 2020 JD went for a dual listing in Hong Kong a year after rival Alibaba went for a dual listing. JD Com Inc is currently generating about.

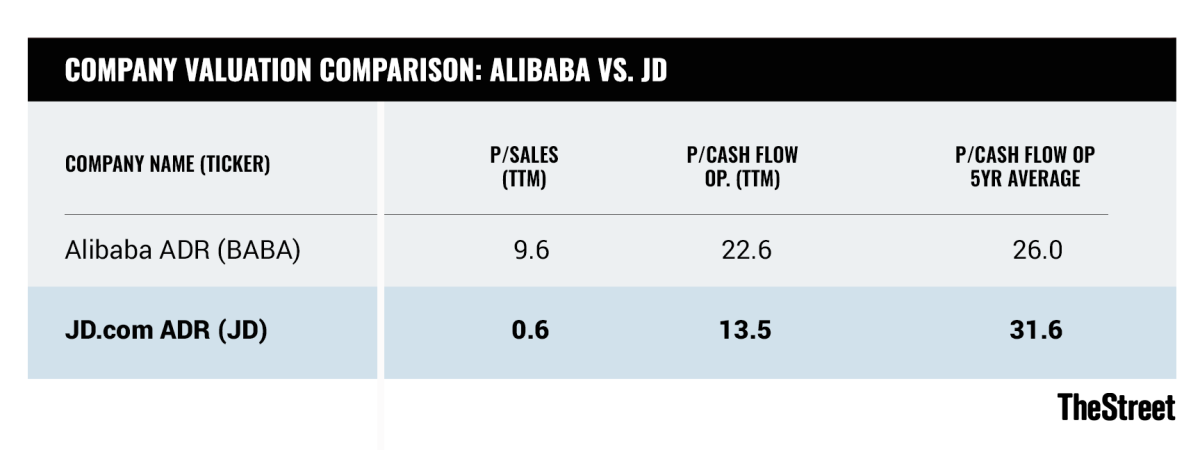

Alibaba S Stock Is A Significantly Better Deal Than Jd Com S Thestreet

Alibaba S Stock Is A Significantly Better Deal Than Jd Com S Thestreet

Given the investment horizon of 30 days Alibaba Group Holding is expected to generate 086 times more return on investment than JD.

Invest in jd or alibaba. Buying share in JD means that you expect the company to widen its profit margins over time. JDs business is simpler its years of investments in infrastructure and logistics are bearing fruit and boosting its margins and it will probably generate stronger earnings growth than Alibaba. It trades about -007 of its potential returns per unit of risk.

This phenomenon is not out of the norm looking at the historical trend. JD is finally getting on the board and I am surprised it took this long. Oh but Alibaba runs a cash machine on a whole.

JD has a return on asset ratio of 1170 757B 6469B while BABAs is 973 2438B 25051B. Both JD stock and BABA stock are up big in 2019. Given all of these points I recommend that investors choose JD over Alibaba at this point.

In addition its becoming a supply-chain technology and service provider. Is JD stock the better buy. JD stock price is up 50 year to date 20 percentage points better than Alibaba stock.

Alibaba was also planning to ditch US. Their economy is also expected to grow faster. A side from that Alibaba.

As of this writing the author did not hold a position in any of the aforementioned securities. Stock markets for the Ant Financial IPO which was. As a result investors may want to consider investing in Chinese companies as they dont have to handle the complications of the coronavirus.

For those with a more risk off mentality Alibaba is the better choice -- it has higher profit margins and a more diverse business. JD vs Alibaba Stock or Alibaba vs JD Stock which is the top Chinese Stock 2020. Thats where the money is.

Im sure some people would say buy both and a few might say buy neither given the run theyve been. Alibaba is primarily structured to take a fee from sellers via its online platform and as such has minimal need for tangible. An Alibaba investment is a more direct bet on continued top-line growth.

I am going to compare JD Stock with Alibaba Stock in different segments. However Alibaba Group Holding is 117 times less risky than JD. JDs free cash flows look a bit less predictable than Alibabas in the short term but both have doubled or tripled their cash profits in five years.

Thus the choice between Alibaba and JD is a difficult one.

Jd Com Could Double By 2023 Nasdaq Jd Seeking Alpha

Jd Com Could Double By 2023 Nasdaq Jd Seeking Alpha

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

What They Are Doing Alibaba And Jd Com Hacker Noon

What They Are Doing Alibaba And Jd Com Hacker Noon

Tencent Jd Com Invest 864 Million In Vipshop An Uphill E Commerce Battle Against Alibaba Walkthechat

Tencent Jd Com Invest 864 Million In Vipshop An Uphill E Commerce Battle Against Alibaba Walkthechat

Alibaba S Stock Is A Significantly Better Deal Than Jd Com S Thestreet

Alibaba S Stock Is A Significantly Better Deal Than Jd Com S Thestreet

Better Buy Jd Com Vs Alibaba The Motley Fool

Better Buy Jd Com Vs Alibaba The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Alibaba Rival Jd Com Plays The Long Game On Technology Investment Techcrunch

Alibaba Rival Jd Com Plays The Long Game On Technology Investment Techcrunch

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Tencent Jd Com Invest 864 Million In Vipshop An Uphill E Commerce Battle Against Alibaba Walkthechat

Tencent Jd Com Invest 864 Million In Vipshop An Uphill E Commerce Battle Against Alibaba Walkthechat

Better Buy Alibaba Vs Jd Com The Motley Fool

Better Buy Alibaba Vs Jd Com The Motley Fool

Alibaba And Jd Com Invest Billions In Drones And Robots Working To Global Delivery Under 72 Hours Nextbigfuture Com

Alibaba And Jd Com Invest Billions In Drones And Robots Working To Global Delivery Under 72 Hours Nextbigfuture Com

Jd Stock Vs Alibaba Which To Invest Youtube

Jd Stock Vs Alibaba Which To Invest Youtube

Comments

Post a Comment